Hello fellow Kyberians,

Welcome to another packed ecosystem update as we continue our monthly tradition of bringing you the latest progress and news updates from Kyber world. May was a month of new milestones for Kyber as it reached its highest number of unique and new user addresses while also surpassing $1 billion cumulative trades since launch. We also introduced new KyberDAO staking partners who join to serve stakers and pool masters with new tools and UIs and we can’t wait to launch Katalyst. And of course we continue to have a great cohort of new projects integrate Kyber and for us, seeing this constant inflow of new teams working on Etheruem is the clearest signal we are on the right and healthy path towards mainstream adoption.

Kyber Network Stats

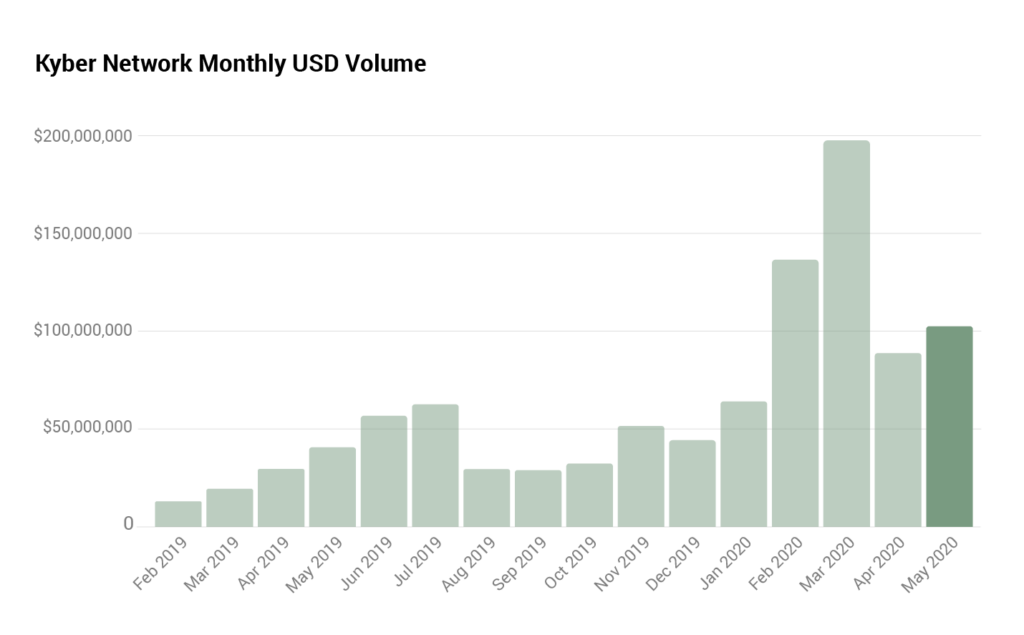

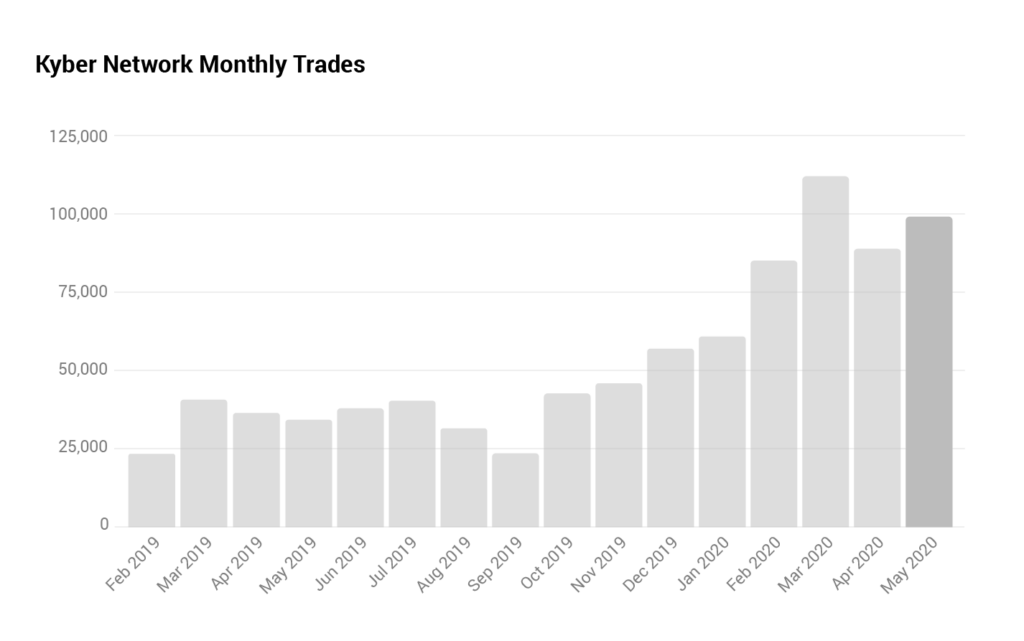

We did it! 1 billion USD volume since mainnet launch! $70M volume in 2018, $388M in 2019, and $609M in the first 5 months of this year and here we are. This volume was carried out over one million transactions signed by 84k unique addresses and 5.8 million ETH equaling roughly 5% of the total ETH supply. Bring on the next billion 😎

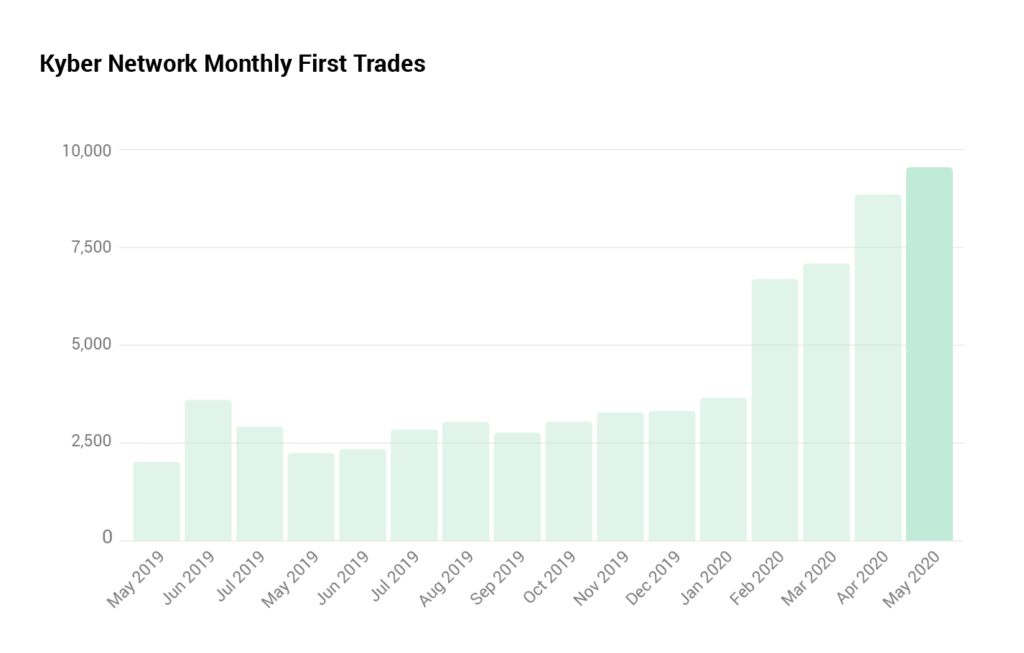

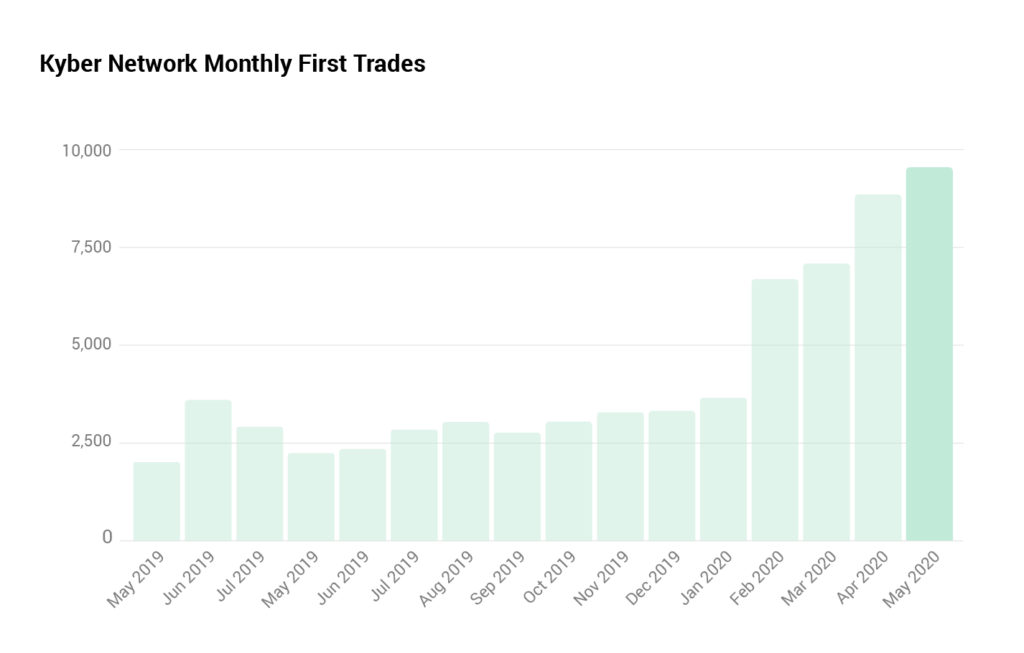

May’s total volume at $103M was our third highest monthly volume and although it wasn’t as high as the bonanza we saw back in March with $196M, we’ve ended up with a month that sees new addresses and unique addresses reach all time highs and we continue a growth trend that stretches all the way back to launch.

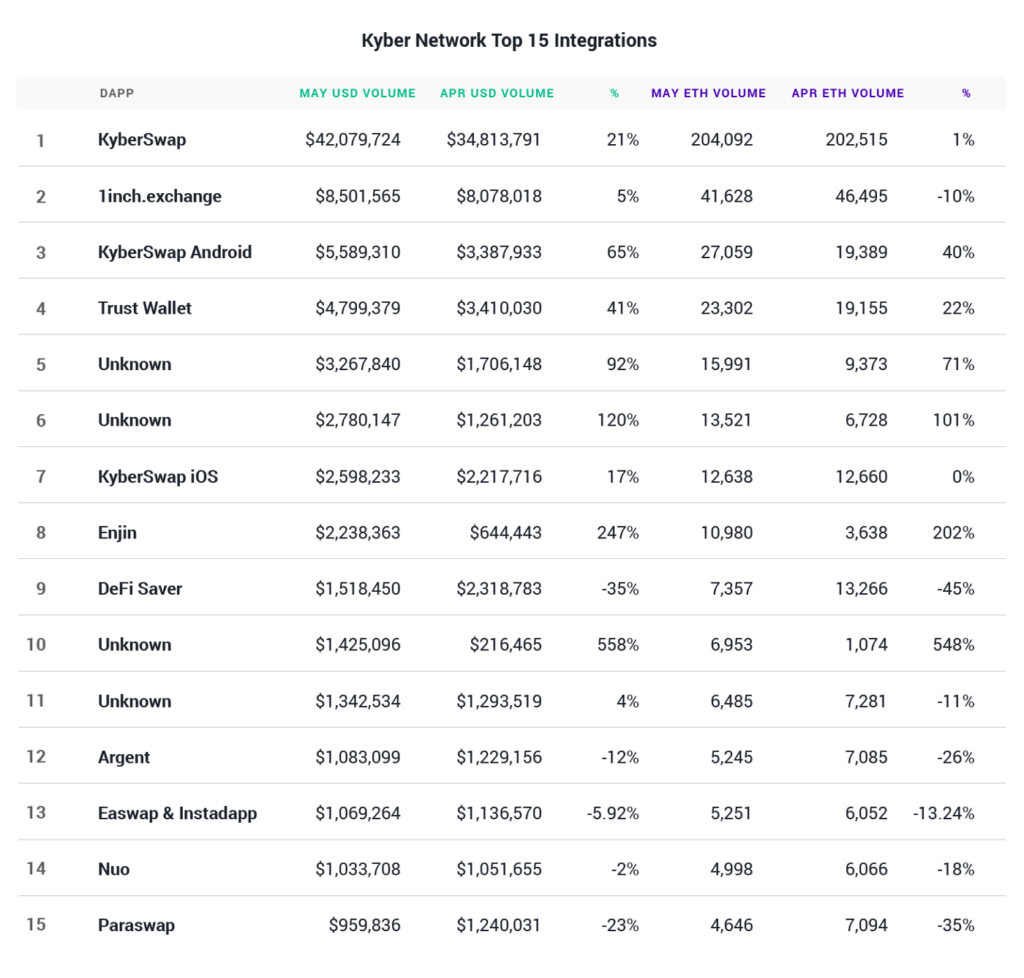

The top Kyber integrations continue to be the usual DeFi dapps, large wallets, and KyberSwap’s own offerings across web and mobile platforms. Standouts for May include KyberSwap’s Android app which saw $5.6M volume, and 1inch.exchange which continues its own impressive growth with $8.5M volume. Overall though most Kyber integrations have grown noticeably over the year and while twelve months ago only one integration apart from KyberSwap managed to crack the $1M mark, today more than a dozen dapps routinely do so on a monthly basis.

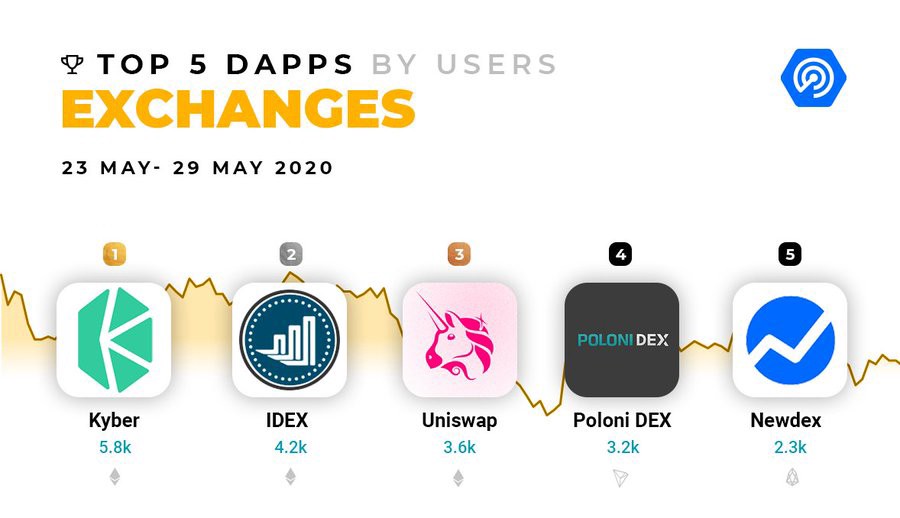

Within the Ethereum liquidity protocol landscape itself Kyber continues to perform strongly and has established itself as one of the most used set of smart contracts on Ethereum today.

Kyber Katalyst Updates

It’s almost time! The excitement is building up and we’re starting to get the butterflies as we come onto the final straight of our Katalyst launch. It’s been six months of tireless work but we believe it will have been worth every sweat and tear to deliver what will be the engine to the next phase of Kyber’s growth. The next few months will certainly pass by in a blur as we deploy our new smart contracts, unveil our staking portal, announce new staking partners and finally bring the KyberDAO to life so we want to take this opportunity to thank you all again for your unending support.

This month we had the pleasure of announcing that Protofire, a highly experienced blockchain dev company (having worked with the likes of MakerDAO, 0x and Aragon), has built a set of proxy smart contracts to help KyberDAO pool operators manage their pools.

Their trustless smart contract proxy can be deployed by any party wishing to provide staking services as a KyberDAO pool master and allows stakers delegating their KNC to the pool master to claim their rewards whenever they want as opposed to having to wait for the pool master to manually calculate and distribute the rewards.

We’re encouraging and supporting all KyberDAO Pool Master initiatives so get in touch with us if you’d like more info and you can also find a breakdown of the various pool master deployment options here.

One of the first pool masters to deploy Protofire’s pool master proxy contract is our latest KyberDAO partner, Stake Capital and their StakeDAO. Stake Capital have been pioneering work within the revenue-sharing self-governed DAO space for a while and their StakeDAO token provides holders with continuous staking rewards from various DeFi services. We’re excited they’ll be participating in KyberDAO and as one DAO to another, we have a lot to learn from each other and grow together. Announcement

Teaser

You heard it hear first folks, DeFi_Dude and a few highly skilled members of the Ethereum community are working on a KyberDAO Community Pool Operator that will be using Protofire’s proxy pool master smart contracts. This community pool operator will act and operate on behalf of the Kyber community’s interests by collecting their feedback, building consensus, and allowing anyone who doesn’t have the time or resources to actively vote every epoch to delegate their KNC vote to the Community Pool.

More details will be announced by DeFi_Dude soon!

Katalyst Episode 3

And to wrap up our Katalyst updates for the month, we present you with the 3rd episode of our Katalyst video series. This episode provides a high level overview of some of the changes coming with Katalyst including custom spreads for DApps and reserve routing:

Kyber DeFi Updates

Kyber Joins the Chicago DeFi Alliance

In May we announced that Kyber had joined the recently launched Chicago DeFi Alliance (CDA). Backed by high profile companies including online broker giants TD Ameritrade, the alliance is aiming to bootstrap liquidity by matching DeFi companies with professional market makers, giving teams strategic guidance on regulatory best practices, and providing mentorship, and we will be making the most of this opportunity to learn from these companies. Article

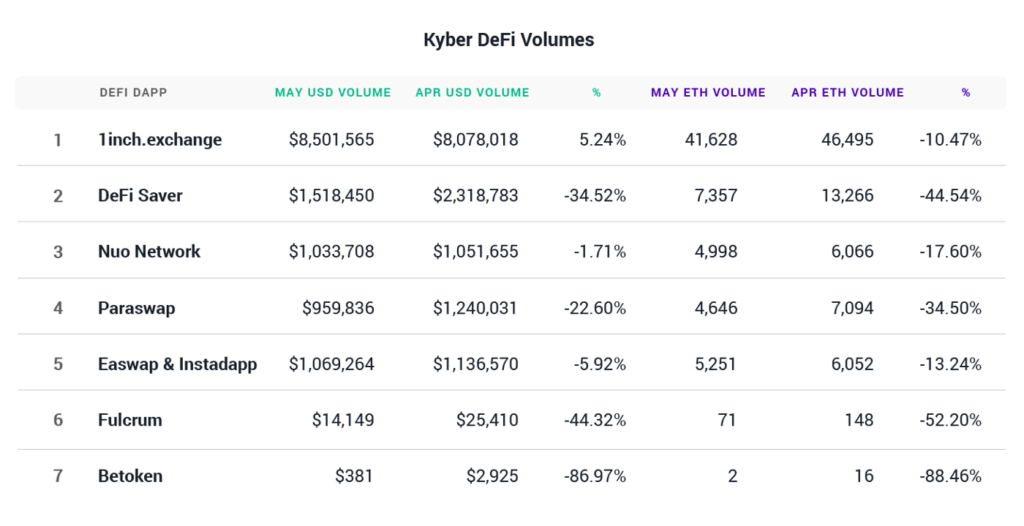

DeFi Volumes

May was a mixed bag of results for DeFi projects with 1inch increasing its USD volumes while others saw dips of varying sizes. This can partly be attributable to a slight decrease in market volatility (and therefore less CDPs to save by DeFi Saver for example)

May also saw the mainnet launch of Ren Protocol (so expect more flavours of BTC, BCH and Zcash on Etherem coming soon) and Argent’s v1 release of their popular crypto wallet and we wanted to wish both these projects all the best with their new releases.

New Kyber DApp Integrations

BiLira

BiLira is a company working on bringing decentralized financial service to Turkish citizens. Their Turkish Lira stablecoin (TRYB) sits at the core of this mission and they are well placed to execute on this given that Turkey is at the forefront of crypto adoption around the world (more on this in our Kyber Turkey section below). Listing TRYB on Kyber allows this Turkish Lira-backed asset to be available to the thousands of users using wallets, DeFi dapps and merchant services integrated with Kyber and we look forward to BiLira’s continuing growth! Announcement

League of Kingdoms

League of Kingdoms is a popular NFT-based MMO strategy game where players have the opportunity to monetize their in-game assets by earning rewards from growing their virtual kingdoms. The value generated accrues in their LAND tokens and with the second LAND presale currently underway, users can purchase LAND in any ERC20 token through the Kyber integration. Announcement

DEXTF

DEXTF is a non-custodial asset management protocol that helps professionals and institutions manage their funds. Users synthesize, subscribe and redeem to and from their favourite portfolio ideas through an ETF-like mechanism and the Kyber integration allows subscription to a fund through a single transaction instead of having to separately and manually provide all the different assets within the fund. Announcement

Reserve and Token Metrics

Reserve volumes were up 12% (note: total reserve volume is always equal to total Kyber Network volume) with a number of reserves including the Bancor Bridge Reserve and REN, BNT, RSR, ANT automated reserves seeing triple digit volume increase.

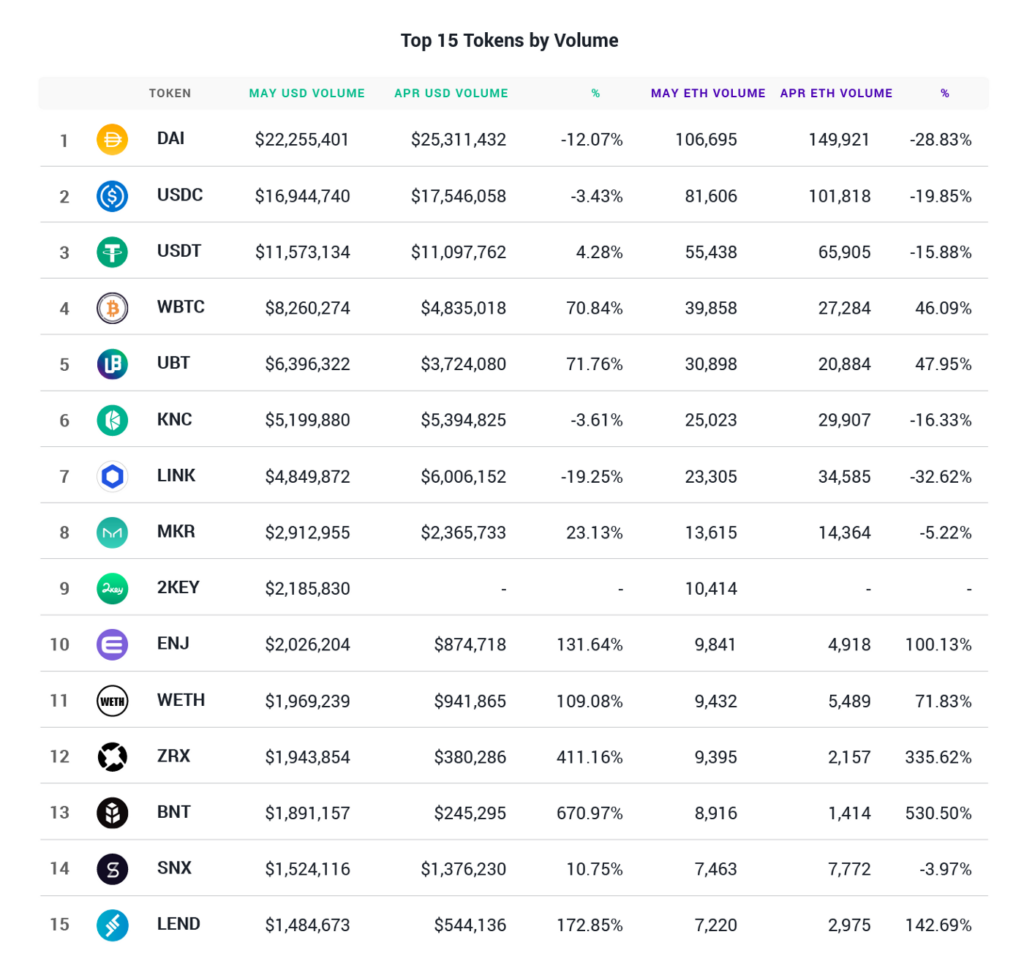

Token Volumes

With 2Key’s $2.3M volume in May we’re seeing the continuation of a trend where new tokens perform strongly within their first few weeks and months (with UBT debuting at $4M and BAND $1M in previous months)

Apart from token volumes, it’s also worth noting WBTC’s 300% increase in total supply (to 4k BTC worth $38M) as various entities have been minting large amounts to lock up in Maker CDPs as collateral to mint DAI. With this increase in demand for WBTC, its volume on Kyber has also increased from $4.8M to $8.3M.

New Tokens on Kyber

Binance USD [BUSD] — BUSD is a 1:1 USD-backed stablecoin approved by the New York State Department of Financial Services and issued in partnership with Paxos. Link

BiLira [TRYB] — TRYB is a 1:1 Turkish Lira-backed stablecoin issued by the Bilira team. Fiat on-ramps to TRYB include large Turkish banks. Link

Pillar [PLR] — Pillar is a smart wallet that allows for the secure transfer of value through both Ethereum and the Pillar Payment Network. Users are also able to swap tokens through a direct Kyber integration. Link

2Key [2KEY] — 2Key is an Ethereum layer 2 blockchain referral solution. Link

Global Human Trust [GHT] — GHT is a payment token used within the NextgHRM system to access Digital IDs, payroll applications and other services from the DTS group. Link

KNC

MCD Application

For those closely tracking KNC developments, you’ll know we’re in the middle of our Multi Collateral DAI on-boarding process application for KNC. As of the end of May, we’ve ticked two more items off the checklist towards this goal and the Risk Domain team concluded its risk evaluation process and proposed the below parameters for KNC:

Risk Premium: 4%

Liquidation Ratio: 175%

Liquidation Penalty: 13%

Full list of risk parameters as well as a detailed breakdown of their evaluation can be found here.

In parallel, the MakerDAO Oracle Team concluded that should the community decide to green light Kyber’s application, there were no blockers to creating a secure KNC oracle. We can’t wait to see KNC being locked up to issue DAI in the near future!

Kyber World

Crypto’s popularity has exploded in Turkey over the last few years and it is now regarded as one of the countries on the forefront of crypto adoption(1 2 3). We’ve personally been observing increased Turkish interest in the DeFi space for some time now and we thought what better time to open our horizons to Turkey than now.

With that in mind, we’d like to introduce you to Ece Belgin who will be leading our efforts in Turkey by organizing local meetups, participating in AMAs (you can already watch her first one with the BiLira team here), expanding our Turkish community, and running our new Turkish Telegram, Twitter, and Discord channels.

Ece has been involved in crypto for a while now and is the creator of ETHIstanbul, is an Ethereum Foundation Devcon V Scholar, and has highly popular crypto youtube and instagram channels. We look forward to working with her 💪

Kyber Around the (Virtual) World

With the coronavirus’ ongoing impact on world travel it’s no surprise that in-person conferences continue to be put on hold for the foreseeable future. This has been a boon for virtual conferences and we’ve enjoyed being able to connect and exchange ideas with other projects from the comfort of our living rooms.

Loi was recently on a panel with the founders of 0x and Uniswap to discuss all things liquidity at the Mainnet conference while I had the opportunity to debate interoperability within DeFi with Ren and Thorchain at Reimagine2020.

Our Marketing Manager Shane participated in a DeFi Italy AMA while in Japan Taisuke co-organized an online meetup with MakerDAO to dive deep into TVL, Kyber v Uniswap, and all things DeFi. And over in China, Jeff, our Chinese community representative, gave a highly popular presentation on Kyber to over 20k viewers.

In The Media

As usual, there was plenty of media mentions for Katalyst, Kyber&DeFi, KNC, and all other things Kyber and we’ve picked some out for you:

Coindesk — Why Kyber Network Tokens Tripled to $100M Despite Recession

Decentralised.co — The Numbers Behind Kyber Network

Blockonomi — Kyber Crosses 1 Billion Trading Volume Mark

Fitzner Consulting — Token Pick: Kyber Network Crystal

TheStreet — Kyber Gets Boost From Growth in Decentralized Finance

The Defiant — Arthur: DeFi Will Eat Traditional Finance

Other Articles: AltcoinBuzz, DappRadar, CryptoBriefing, CryptoTicker, BitcoinWiki, BitcoinExchangeGuide, Formal Verification, Saturn , Santiment Insights, Our Network, The Ancient Babylonians, The Daily Chain

Foreign Language Articles: French, Italian, German, Japanese, Russian, Spanish, Turkish, Turkish

Hashed Reports

We’d also like to give special mention to two reports published by Hashed, a VC who have believed and backed Kyber’s vision since day 1 and who apply rigorous fundamental analysis to their valuations:

Report 2: The Proper Value of KNC after Katalyst

Report 1: What Changes Katalyst Will Bring to the Value of Kyber Network Crystal

Conclusion

It’s been another busy month for our ecosystem but then again, these past 15 ecosystem updates have shown that this is the case every month! For us as a team it’s been very rewarding building and delivering something that’s shaped up into one of the leading liquidity providers of its space, and with a major protocol upgrade and DAO on the way, we’re more excited about our future than ever. Our community has been an integral part of our growth and we thank you for being part of this Kyber story.

About Kyber Network

Kyber Network is delivering a sustainable liquidity infrastructure for DeFi. As a liquidity hub, Kyber connects liquidity from various protocols and sources to provide the best token rates to Dapps, aggregators, DeFi platforms, and traders.

Through Kyber, anyone can provide or access liquidity, and developers can build innovative applications, including token swap services, decentralized payments, and financial Dapps — helping to build a world where any token is usable anywhere. Kyber is powering more than 100 integrated projects and has facilitated over US$7 billion worth of transactions for thousands of users since its inception.

KyberSwap, the latest protocol in the liquidity hub, provides the best rates for traders and maximizes returns for liquidity providers.

Discord | Website | Twitter | Telegram | Forum | Blog | Reddit | Facebook | Github | KyberSwap | KyberSwap Docs