UPDATE: This is an old legacy system. Please visit KyberSwap.com for the latest Kyber pools.

In previous blog posts, we gave an overview of Kyber’s different reserve types, including how the Kyber Automated Price Reserve (APR) is useful for token teams and individuals, and how the Bridge Reserve pulls liquidity from other on-chain sources like Uniswap, Oasis, DutchX, and Bancor.

Today, we want to share about Fed Price Reserves (FPRs), which is uniquely designed to allow professional market makers (MMs) or advanced developers to effectively market-make and generate profits on-chain. Market makers running FPRs provide liquidity for about 70% — 80% of all trades happening on Kyber.

FPRs provide a strong set of advantages that make market making for a wide range of tokens profitable and feasible. These advantages include high capital/gas efficiency, immediate exposure to the widest set of takers in DeFi, exact control over pricing strategies and risk exposure, and a range of safety mechanisms.

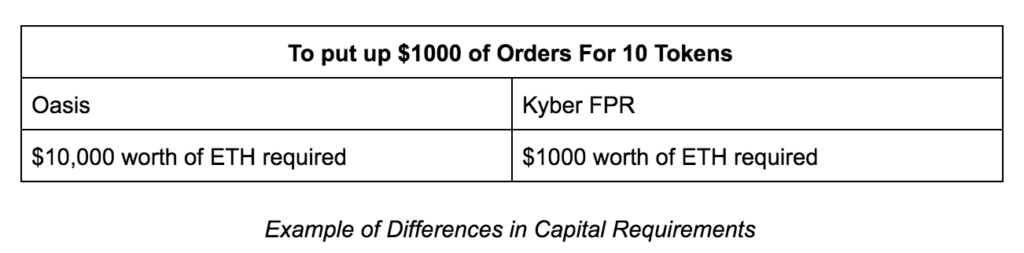

An example of how Kyber FPRs allow for a much higher capital efficiency compared to other on-chain systems: reserve operators can use the same quote currency inventory to market-make for up to 14 tokens. In contrast, for AMMs and orderbook systems, a separate quote currency inventory will need to be set aside for every different token or order.

We believe bringing professional market makers on-chain will greatly improve the liquidity in DeFi for the space, and drive innovation forward. Kyber FPR is our technical platform for professional market makers, and we are fully committed to helping them get started.

Opportunities In Market Making On-Chain

Market making on-chain is different from operating on centralized exchanges or in hybrid platforms, with a different set of opportunities and trade-offs. Namely, many DeFi apps and use cases can only take liquidity from fully on-chain protocols.

Since smart contracts only talk to smart contracts, decentralized dapps can only use on-chain liquidity to perform innovative smart contract-enabled DeFi functions such as flash loans, on-chain liquidation, and portfolio rebalancing. As such, market makers who want to cater to these use cases, can only do so by provisioning liquidity on fully on-chain protocols.

Also, despite the strong growth of DeFi over the last year, market making on-chain remains relatively untapped compared to market making on centralized exchanges.

For example, most market making strategies on centralized exchanges that are based on a high turnover could struggle to average 1bp (basis point) of profit per volume. This is due to a large number of liquidity providers and takers deploying a wide variety of different strategies, and also because orders placements and cancellation can be as fast as 1 millisecond and without cost.

In contrast, market making on-chain has far less competition. Professional MMs can very often generate profits of around 20-35bps on their volume. For example, Kyber’s FPR averaged about 35bps of profits per volume traded in 2019 (about 1.2M ETH). Learn more about the benefits of on-chain market making here.

Kyber FPR For Professional Market Makers

Kyber’s Fed Price Reserve (FPR) is a unique product that allows professional market makers (MMs) to effectively market-make and generate profits on-chain. In FPRs, prices are fed on-chain by market makers using highly capital and gas efficient mechanisms to make rapid market making for a wide range of tokens feasible.

The FPR architecture allows professional MMs to either manually or build bots to operate their own unique algorithms, customize their trading strategy, and adjust their desired risk exposure.

Comparison With AMMs and On-Chain Orderbooks

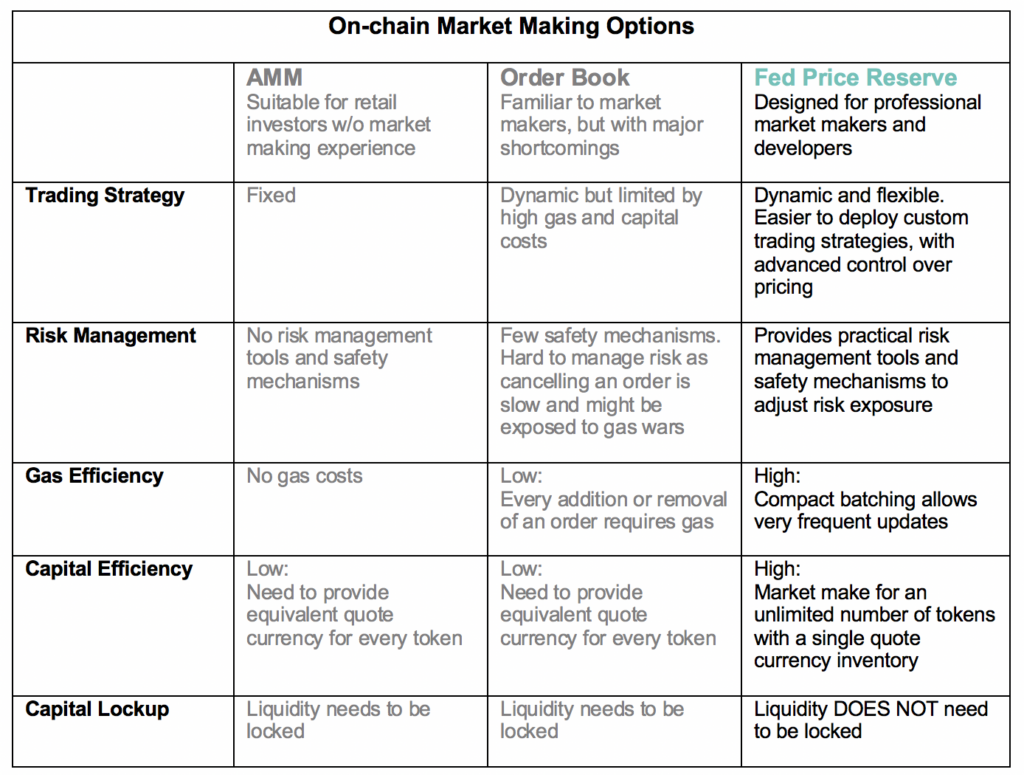

Automated market makers (AMMs) and on-chain orderbook systems sufficient for retail investors, but have major shortfalls for professional market makers, due to a lack of capital efficiency and control over pricing strategies.

AMMs use an algorithm that automatically provides a tradable price, but offer no control over trading strategies, limited protection against impermanent losses, and only provide sufficient liquidity for token pairs that are already sufficiently liquid. In addition, AMMs require a relatively high amount of token inventory ‘locked up’ to provide liquidity.

On-chain order books on the other hand, are too gas and capital inefficient to be used for market making, particularly if the goal is to market make for a large number of tokens. We shall explain these points in the coming sections.

FPR Design Advantages

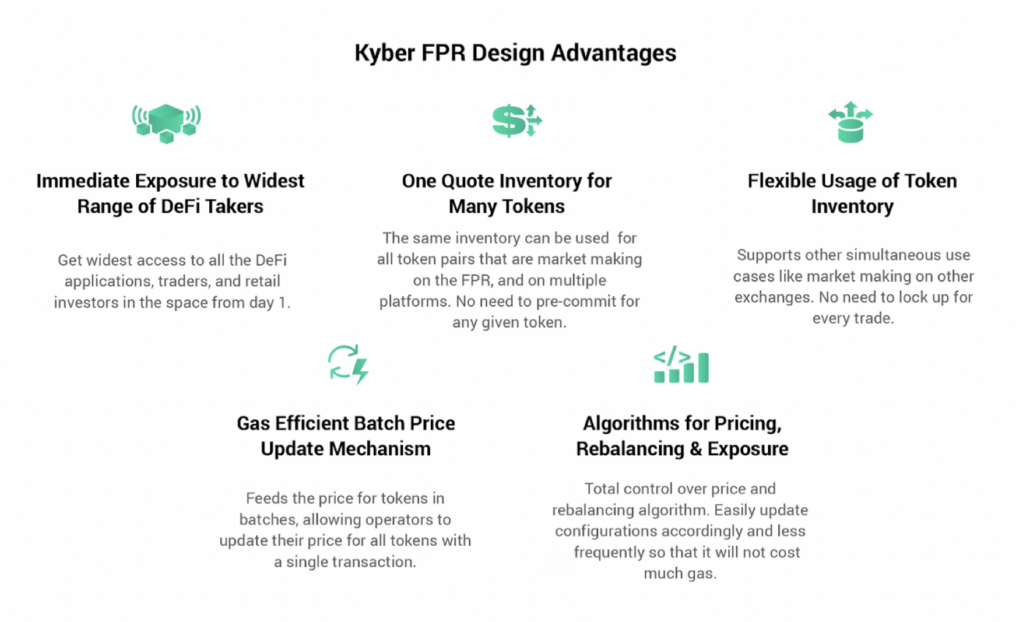

1. Immediate Exposure To The Widest Range Of DeFi Takers

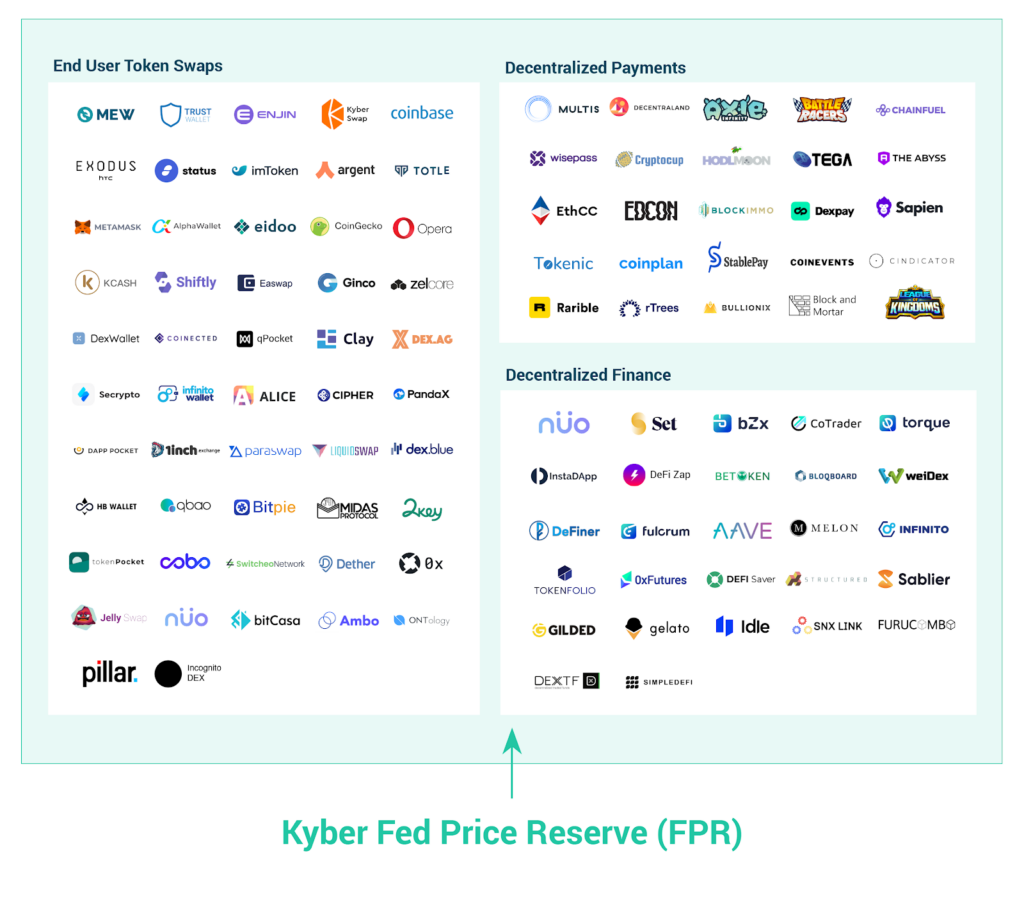

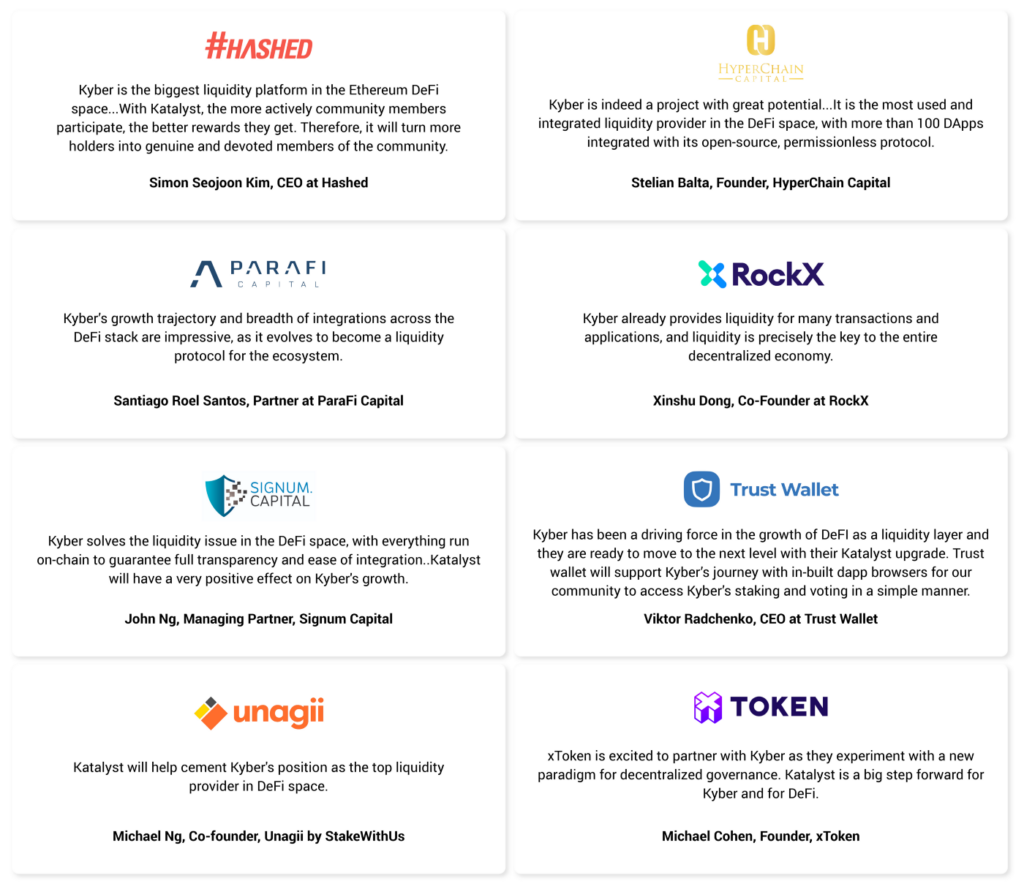

Market makers require a robust pool of takers to absorb the liquidity they provide. Kyber is the most used and most integrated token swapping endpoint for wallets, DApps and aggregators in the entire DeFi space, with over 100 integrations, US$1Billion in total trading volume, and 1 million transactions since launch. FPRs are integrated into this network as soon as they are deployed.

This allows market makers who set up Kyber FPRs to get the widest access to all the DeFi applications, traders, and retail investors in the space from Day 1.

2. One Quote Inventory For Many Tokens

Kyber FPR is designed to allow the ETH balance to be used for all the tokens that the MM is pricing, without it being pre-committed for any given token. This is a major advantage of Kyber’s FPR.

Usually, for on-chain orderbook platforms such as Oasis Trade, the token and ETH amount in the order has to ‘exist’ and be locked up by the liquidity provider immediately with the placed order. For example, on Oasis Trade, for 100 ETH of orders, you need to commit 100 ETH, and for 5 different token pairs, you might need 500 ETH worth. The liquidity provider will subsequently need to wait for the order to be filled.

In comparison, MMs on Kyber only commit inventory as needed. The FPR on Kyber allows much more efficient use of token inventory since ETH committed to the FPR can be used for all the tokens that are MM on this Kyber reserve. For example, 100 ETH committed to Kyber can be used for all the different token pairs.

In addition, even if ETH is pooled to cater to all tokens on Kyber, ERC20 tokens (e.g. DAI, USDC) can reside on another address to allow liquidity providers to market make on multiple platforms at the same time.

3. Flexible Utilisation Of Token Inventory

Besides being able to use ‘one quote’ inventory for many tokens to market make for many pairs on Kyber, the token inventory can also be used on many other use cases simultaneously, including being used to market make on other exchanges or other advantages of the inventory (like interests, voting power, staking etc.).

This is a major advantage over other on-chain systems like Oasis or Uniswap where quote tokens need to lock up for every trade and cannot be used for any other purposes.

4. Gas-Efficient Batch Price Update Mechanism

Gas efficiency is a major factor to operate profitably in terms of market making on-chain. For example, if an operator wants to market make for 30 tokens, they will typically need to place 30 orders for each token, as well as add/remove a large number of orders every day given the high volatility of prices in the crypto space.

Every order being added or removed is an individual gas event, making maintaining smaller orders or a larger number of pairs highly inefficient. This makes the traditional order-book unfeasible for professional market making on-chain, particularly for many tokens.

FPR provides a mechanism that feeds the price for tokens in batches, allowing operators to update their price for all tokens with a single transaction. This quoting mechanism allows for price changes to be pushed frequently for a large number of tokens, enabling MMs to always maintain current prices on-chain.

5. Algorithms For Pricing, Rebalancing, and Exposure

FPR Operators have total control over their pricing algorithm because they determine the price off-chain and feed them to the contract. They also have total control over their algorithm to rebalance their inventory. For example, operators can easily withdraw excess inventory, sell them elsewhere, and buy a different set of inventory to deposit to the contract.

There are several variables to allow the operators to set important parameters for liquidity exposure, including step functions to adjust the price for larger volume (emulating the quantity slippage in an orderbook), max volume per block, and max imbalance volume per block.

When operators decide to change their liquidity exposure or the market of the tokens they are quoting changes, they can easily update those configurations accordingly. These configurations are meant to be updated less frequently, once a day or even once in a few days, and will not cost much gas.

Amongst other functionalities, they can:

- Fine-tune the price change that is caused by the net traded amount

- Simulate an orderbook-like quotation to help develop their market making strategy

- Perform just one low gas cost transaction to update the price for a batch of multiple token pairs

- Have sanity-check rate mechanisms to filter out bad quotes to protect reserves during massive price swings

- Control duration of quotes and the max quantities that can be traded without price updates to help ensure fund safety.

- Configure their whitelisted addresses (eg. their Binance deposit addresses) to easily and safely withdraw their inventory.

Such flexibility and advanced control over pricing is not available on other on-chain models such as AMMs.

Katalyst: Fee Simplifications and Native Rebates

In Katalyst, there will be a set of major upgrades to make it easier for professional market makers to set up FPRs in Kyber. Some of these updates have been discussed in prior posts, but we will reiterate them here with a focus on FPRs.

- The network fee will become part of the trade, so reserve operators do not need to worry about holding KNC for fees and changes in KNC value.

- Network fees will now be divided between DAO rewards, KNC burning and rebates for reserves. This provides predictability of fees/revenue and streamlines operations for MMs.

- Initially, these reserve rebates will be allocated exclusively for FPRs based on their portion of trades facilitated in order to compensate for their dedication and contribution to the Kyber ecosystem.

- The network fees and proportion of rebates will be decided by the KyberDAO. MMs can easily vote and participate in governance to produce the optimal outcome.

- Top performing FPRs that facilitate the largest amount of trade volume may also receive additional rebates/grants beyond the native Katalyst rebates.

- Reserve routing will be introduced as part of Katalyst, allowing developers to route any single trade across any number of preferred reserves. This will likely spread out liquidity between reserves, allowing new reserves to gain a share of the trades if they offer competitive rates, providing better overall liquidity for takers in the process.

Getting Started: On-Chain Market Making

For professional market makers and developers who are motivated to provide liquidity for DeFi using Kyber’s Fed Price Reserve (FPR), we want to collaborate with you, understand what you need and work with you to make your project successful. Please get in touch here.

Apart from optimising the FPR reserve type, we are committed to providing the necessary knowledge, advice, and tools required for professional market makers to leverage Kyber to effectively and profitably market make on-chain.

To better understand the needs of professional market makers, Kyber has officially joined the Chicago DeFi Alliance, working alongside 0x, CMT Digital, Compound, Cumberland, DV Trading, dYdx, IDEX, Jump Capital, Opyn, Set Protocol, Synthetix, TDAmeritrade, Volt Capital and others to drive the DeFi space forward.

After Katalyst, we will be rolling out many more initiatives to accelerate professional on-chain market making, so join our discord and stay tuned!

Together with our Automated Price Reserve (APR), Bridge Reserve, and other market making tools, these steps will further propel Kyber towards being able to provide takers and DApps with the single endpoint for their on-chain liquidity needs, ensuring they receive the best possible price (quote) for each trade, without needing to integrate multiple systems.

About Kyber Network

Kyber Network is delivering a sustainable liquidity infrastructure for DeFi. As a liquidity hub, Kyber connects liquidity from various protocols and sources to provide the best token rates to Dapps, aggregators, DeFi platforms, and traders.

Through Kyber, anyone can provide or access liquidity, and developers can build innovative applications, including token swap services, decentralized payments, and financial Dapps — helping to build a world where any token is usable anywhere. Kyber is powering more than 100 integrated projects and has facilitated over US$7 billion worth of transactions for thousands of users since its inception.

KyberSwap, the latest protocol in the liquidity hub, provides the best rates for traders and maximizes returns for liquidity providers.

Discord | Website | Twitter | Telegram | Forum | Blog | Reddit | Facebook | Github | KyberSwap | KyberSwap Docs