A few months ago we announced our plans for the Katalyst protocol upgrade and the launch of the KyberDAO — a community platform for the decentralized governance of Kyber Network. This was followed by an overview of KyberDAO’s key design principles and the general staking, voting, claiming, and delegation process.

Since then, we have started picking up pace towards the KyberDAO launch! We updated our staking documentation, further developed our default KyberDAO UI, and started working with other projects to prepare multiple convenient options for KNC holders to stake their tokens, delegate voting power, and claim rewards. A key player in this delegated voting system is the KyberDAO pool operator.

Pool Operators

KNC holders who are willing to stake their tokens but do not have the resources to regularly participate in voting in every epoch (about 2 weeks), have the ability to delegate their voting power to another Ethereum address or a ‘pool’ to vote on their behalf. Projects or developers that set up and manage this voting pool are called ‘pool operators’.

Kyber will provide a variety of technical options for pool operators, depending on their preference and inclination. This will help to ensure there is a wide range of voting interests being represented. This will, in turn, allow KNC holders to easily stake their tokens and get rewards by choosing a pool operator that aligns with their needs.

This blog post outlines the options that pool operators can use to run KyberDAO voting pools, describes the mechanisms behind each option, and highlights the differences in terms of deployment and reward distribution.

For all these options, pool operators need to be responsible for understanding the DAO and manually voting for all the campaigns in every epoch. They can determine their own fee structure for their services, and will be incentivized to vote regularly since the rewards (and their fees) are directly proportionate to voting regularly.

Below we present the list of options for running a voting pool, from the perspective of a pool operator.

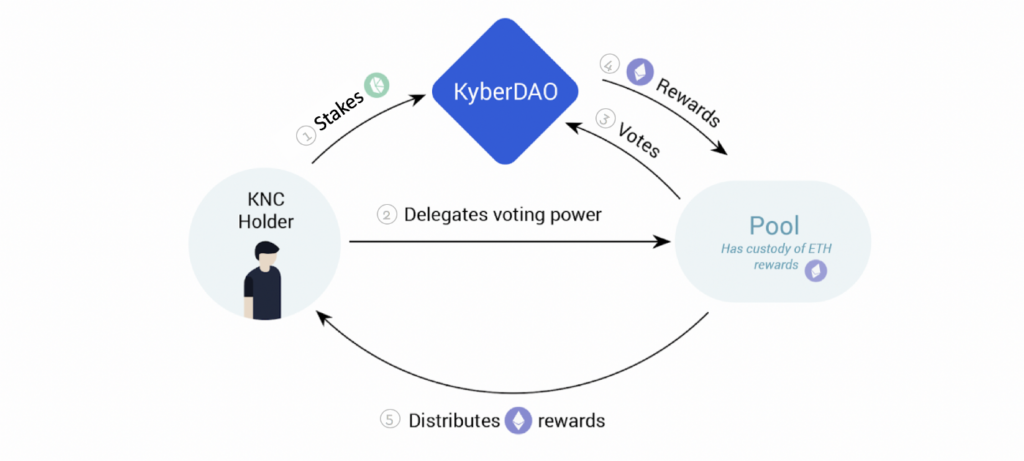

1. Use The Default KyberDAO Pool Delegation

Pool operators can simply use the default pool delegation built into the KyberDAO to run their pool. This is the simplest option, since the pool operator does not need to deploy any smart contracts, hold the rewards or build a UI (members can just delegate from the default Kyber.org interface).

However, operators will have to develop their own mechanism for distributing the rewards to the members, since this is not covered by the base KyberDAO.

How it works

- KNC holders can delegate their KNC to your pool using the default Kyber.org interface or through your own custom interface.

- You are the pool operator and they will become your pool members.

- The KNC delegated to you will be non-custodial, i.e. you can vote on the behalf of your pool members with their KNC staking power but you have no control over the KNC delegated to you.

- You will have to claim and hold the ETH rewards, and develop your own mechanisms for tracking your pool rewards and distributing them to your pool members.

- ETH rewards distribution from the KyberDAO to your pool can be tracked on-chain.

See here for details on how the default KyberDAO pool delegation works. Progress on the Kyber.org interface is going well and it is expected to go live together with the Katalyst launch at the end of Q2, 2020.

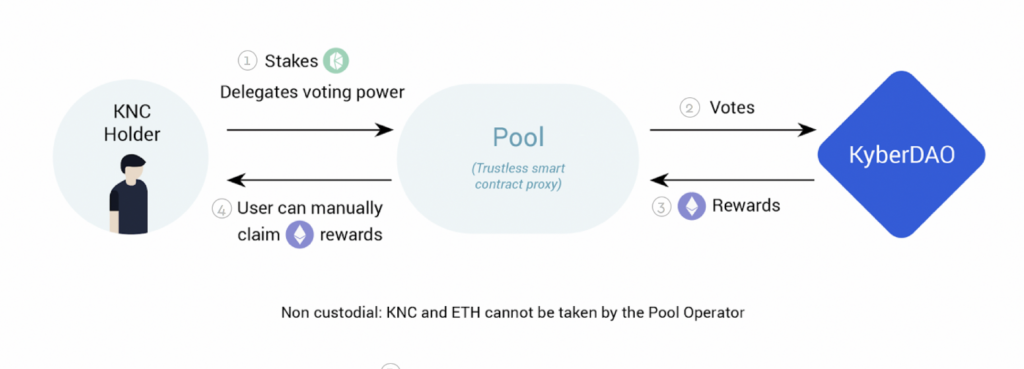

2. Deploy a Trustless Pool Operator Proxy Contract

For pool operators who prefer a trustless mechanism for reward distribution, they can choose to deploy a smart contract proxy that will store the rewards in the proxy contract and allow their pool members to claim the rewards directly from the proxy contract.

How it works

- If you deploy this smart contract proxy, KNC holders can delegate their KNC voting power to you, the pool operator.

- You can vote on the behalf of pool members, but you will have no control over their KNC or ETH rewards.

- After you vote, the subsequent ETH rewards are stored trustlessly in a smart contract and pool members can claim it themselves anytime.

- Rewards can be tracked on-chain.

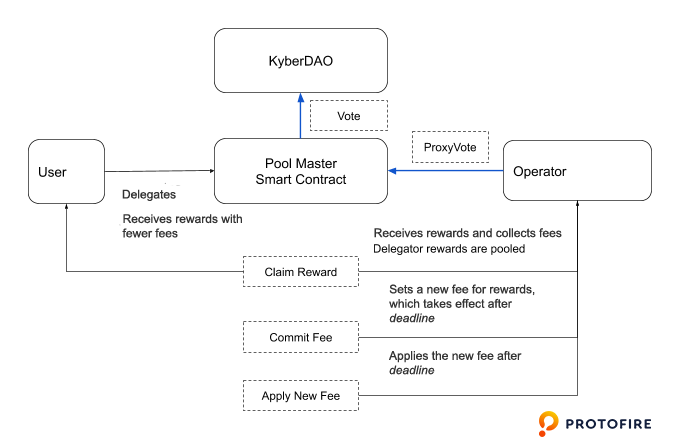

StakeWith.Us Partnership

The development of this trustless smart contract proxy is supported through atechnical partnership between Kyber and StakeWith.Us, a popular blockchain infrastructure firm that validates for proven blockchain projects, and is the first and only staking infrastructure provider backed by a government deep tech fund — SGInnovate, and LuneX Ventures, Golden Gate Ventures’ blockchain arm. StakeWith.Us will also be a pool operator, providing a convenient way to stake KNC and claim ETH rewards, while taking part in all KyberDAO votes on behalf of their delegators. The smart contract proxy itself is being developed by the team from Protofire. Protofire’s trustless smart contract proxy documentation can be found here.

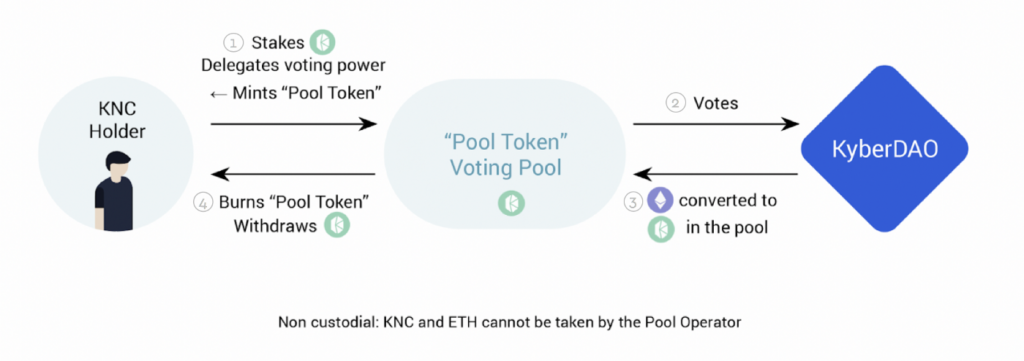

3. Deploy Your Own Unique KyberDAO Pool Token

The second trustless mechanism with automated rewards will be to deploy a unique ERC-20 KyberDAO “Pool Token”. The KNC in this pool will be used to vote by the pool operator, and the rewards will be used to purchase more KNC and added to the pool.

Therefore, the rewards for the pool members will be indirectly received via the value accrual of the Pool Token, which they can “claim” by converting the Pool Token back into KNC (and burning the Pool Token).

Pool operators will need to provide a front end interface to allow your pool members to burn their Pool Tokens to unlock their KNC. Pool Tokens are ERC20, and pool members are also free to sell them in other liquid markets. We’re currently working with a startup to develop this KyberDAO Pool Token technology, and more details will be provided soon.

How it works

- KNC holders can become your pool members by locking up KNC tokens in your pool and minting new Pool Tokens (name and initial exchange rate determined by you).

- As a pool operator, you are responsible for voting in every epoch to claim the full ETH rewards, which will then be automatically converted to KNC and restaked (you can take some ETH as pool operator fees depending on your business model).

- Over time, if there are more ETH rewards converted to KNC, the amount of KNC locked in your pool will increase, and each Pool Token will be worth more KNC than before.

- Minting and burning of the Pool Token, delegation of voting power, and distribution of ETH rewards to the pool operator can be tracked on-chain.

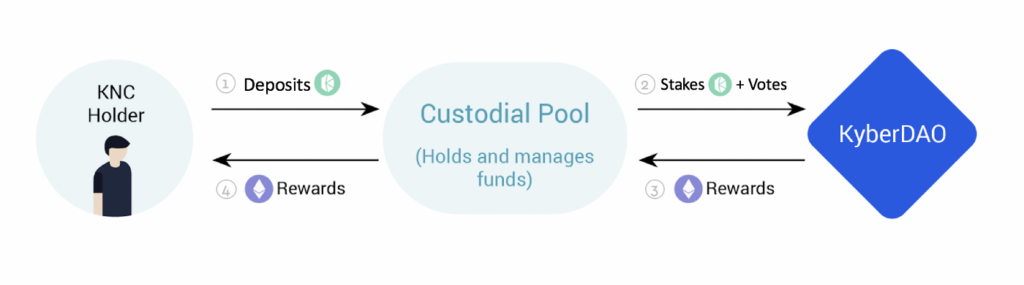

4. Operate a Custodial Pool

For pool operators who are comfortable with holding the tokens of the pool members, for example centralized exchanges or custody services, they can operate a voting pool by allowing KNC holders to deposit their tokens, while voting on their behalf.

No smart contracts need to be deployed for this method, but a portal for allowing users to deposit KNC, and withdraw KNC and rewards is needed.

How it works

- KNC holders can deposit their tokens into your staking service platform for you, the custodial pool operator, to hold and manage.

- You will be in full control of their KNC as well as their subsequent ETH rewards after you vote on their behalf.

- You are responsible for voting in every epoch to claim the full rewards and for distributing the ETH rewards back to your pool members.

- You can vote via the default kyber.org interface, without the need for smart contracts.

- You will have to develop your own mechanisms for reward tracking and distribution. Rewards claiming and distribution are not tracked on-chain.

5. Build And Deploy Your Own Smart Contracts

Motivated pool operators can also develop their own set of smart contracts to interact with the KyberDAO system.

How it works

Be a KyberDAO Pool Operator!

We hope this blog post has given you a good picture of the options available to potential pool operators. We welcome developers, community members, and blockchain projects to use these options to run voting pools or participate in governance. Projects like RockXMiner, HyperBlocks, StakeWith.Us, imToken, Trust Wallet, Signum Capital, and #Hashed have already expressed support for the launch of the KyberDAO. Several community members have also reached out to see if they can operate a community pool together!

By participating in Kyber’s governance, you will play a part in determining its incentive system and other important protocol decisions, thereby helping to shape the future of decentralized liquidity and DeFi.

Documentation on Katalyst and KyberDAO can be found on Github here. For more details about the KyberDAO, read our overview and these Staking, Voting, and Withdrawing examples. For governance-related updates, join us in our official Discord server and follow our KyberDAO twitter account!

#KatalystIsComing

Related information

- Pre-DAO Poll: Deciding Kyber’s Initial Protocol Parameters

- KyberDAO: Staking and Voting Overview

- KyberDAO: Options for Pool Operators

- Protofire Trustless Smart Contract Proxy for the KyberDAO

- Protofire Trustless Smart Contract Proxy Github Documentation

- KyberDAO Partner: StakeWithUs

- KyberDAO Partner: Stake Capital

- KyberDAO Partner: ParaFi Capital Invests in KNC to Participate in Governance

- Kyber Community Pool by DeFi Dude and other community members

- Follow KyberDAO on Twitter

About Kyber Network

Kyber Network is delivering a sustainable liquidity infrastructure for DeFi. As a liquidity hub, Kyber connects liquidity from various protocols and sources to provide the best token rates to Dapps, aggregators, DeFi platforms, and traders.

Through Kyber, anyone can provide or access liquidity, and developers can build innovative applications, including token swap services, decentralized payments, and financial Dapps — helping to build a world where any token is usable anywhere. Kyber is powering more than 100 integrated projects and has facilitated over US$7 billion worth of transactions for thousands of users since its inception.

KyberSwap, the latest protocol in the liquidity hub, provides the best rates for traders and maximizes returns for liquidity providers.

Discord | Website | Twitter | Telegram | Forum | Blog | Reddit | Facebook | Github | KyberSwap | KyberSwap Docs