Build with bZx and Kyber to win up to $3000 in DAI! (from a $42,000 prize pool)

Today we shine the spotlight on our first Hackathon Tech Partner: bZx! Learn about bZx and integrate them for our #KyberDeFi Virtual Hackathon! bZx is offering a total of $3000 in DAI in bZx-specific bounty rewards! (from a total hackathon prize pool of $42,000)

bZx bounties — up to $3000 in DAI

- bZx x Kyber Prize: $1,500

$1,500 in DAI for the best project that uses/integrates both bZx and Kyber - bZx — Best Use Case: $1,500

$1,500 in DAI

What is bZx?

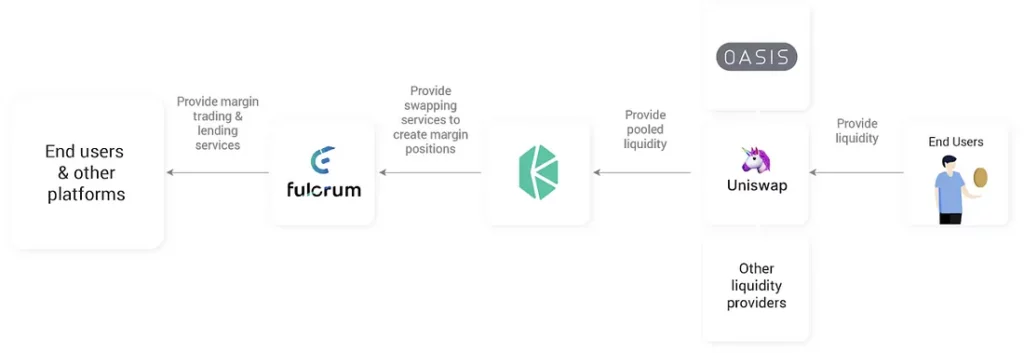

bZx is an open protocol for shorting, leveraging, lending, and borrowing, powered by Kyber & 0x, and built on the Ethereum blockchain .

What is Fulcrum?

Fulcrum aims to be the most simple and powerful way to lend and margin trade. It is a completely trustless platform for margin; it does not use centralized price feeds or centrally administered margin calls. It is permissionless and rent free; there are no fees and no accounts. Fulcrum is built on the bZx protocol and extends the protocol by allowing both loans and margin positions to be tokenized. The bZx base protocol was successfully audited by ZK Labs.

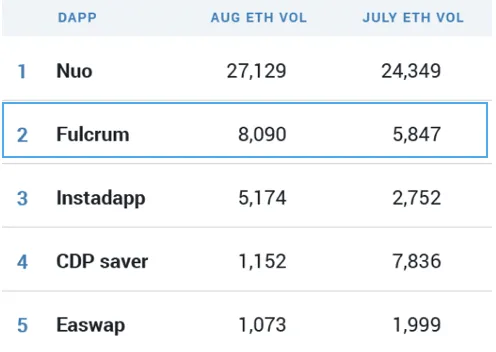

Fulcrum is integrated with Kyber and is one the fastest growing DeFi applications in terms of trading volume through Kyber!

The Kyber team also interviewed the bZx team in our ‘Any Token, Anywhere’ series explaining how Fulcrum works.

In addition, bZx is launching Torque on September 14th, a borrowing platform with indefinite-term loans and fixed interest rates. No accounts needed, and with universal wallet access. Using Torque, getting a DAI loan using ETH is as simple as sending that ETH to dai.tokenloan.eth. Read more here.

What can you build with bZx? Hackathon Ideas

1. iDAI is a powerful Money Lego that allows you to build a wide variety of applications

- No loss lotteries

- No loss donations

- No loss DAICOs

- Interest earning DAI integrated with Nexus Mutual to automatically hedge the smart contract risk

- Interest earning DAI integrated with GSN (see: gDAI)

- SwaniDAI, a DAI that hedges the risk of DAI depegging in addition to smart contract risk and liquidation risk.. Implemented by simply using iDAI instead of DAI in the current swanDAI implementation.

- A combination of features, e.g., gDAI that is integrated with Nexus Mutual coverage

& much more…

2. Inverse & Leveraged ETFs

In the traditional financial system ETFs are popular among actors seeking diversified exposure through a single instrument. By placing a variety of popular existing ERC20s together in a basket, a variety of ETFs could be constructed with Melon or Set Protocol. However, up until now, those baskets could only provide long exposure without leverage. Fulcrum’s tokenized short and leveraged tokens allows the construction of Inverse ETFs composed of short tokens or Leveraged ETFs composed of leverage long tokens. These sorts of token baskets could be useful for individuals as a simple directional trading strategy or to hedge existing exposure for tax purposes.

3. Structured Products

A structured product is a combination of two or more instruments that comprise a single asset. Structured products allow the creation of highly customized assets for any type of risk-return objectives, traditionally with the use of derivatives — and can range from simple to highly complex.

For example, an Ethereum enthusiast may want a structured product with long exposure to Ether and short exposure to Bitcoin. With wrapped Bitcoin, Fulcrum’s short tokens, and Melon or Set Protocol, an Ethereum enthusiast basket can be created which is made up of Ether and short Bitcoin. With Ethereum-base structured products, it becomes significantly easier for someone to get exposure to products that meet their specific needs.

4. Interest Bearing Strategy Sets

Using Fulcrum’s iTokens you could create a basket using Melon or Set that increases and decreases exposure to an asset based on moving average crossovers that also earns significant interest while the set is being held in a unit of account such as USDC.

bZx Technical Resources

bZx Social Media

The team behind bZx

bZx and Fulcrum are helmed by co-founders Tom Bean and Kyle Kistner. Kyle recently wrote an article titled “How Decentralized is DeFi? A Framework for Classifying Lending Protocols”

We’re glad to have Tom and Kyle as judges for our #KyberDeFi Hackathon!

#KyberDeFi Virtual Hackathon! — Build with bZx

Come join the #KyberDeFi Virtual Hackathon! Help us build the future of DeFi with bZx, Chainlink, Compound, Melon, Synthetix, WBTC, and other ecosystem builders.

💰Over $42,000 USD in prizes to be won!

Submission Period: 9 Sep-21 Oct

- Details: http://bit.ly/2m82RvL

- Register now: https://kyber.devpost.com/

- Join hackathon discord: https://discordapp.com/invite/nuWr2KF

Please contact Shane on Telegram for more information.

Launch Video: