Optimism is Chain number 12 to be integrated with KyberSwap!

As part of KyberSwap’s commitment to enhancing DeFi infrastructure and altogether making DeFi accessible to all, we are thrilled to announce that the KyberSwap ecosystem has now expanded to the Optimism network, a Layer-2 scaling solution that provides near-instant transaction finality and cheaper transaction fees without sacrificing security.

This integration means KyberSwap users will have another low-cost and lightning-fast place to swap tokens at the best-optimized rates!

Optimism traders can now swap at the best rates and liquidity providers earn higher fee returns on KyberSwap. All in one user-friendly, and secure interface!

What is Optimism?

Optimism is an Ethereum L2 blockchain that can support all of Ethereum’s DApps. Thanks to optimistic rollups, Optimism takes advantage of the Ethereum Mainnet’s security to scale the Ethereum ecosystem. In other words, transactions are recorded on Optimism in a trustless manner but ultimately secured on Ethereum.

Instead of running all computation and data on the Ethereum network, Optimism puts all transaction data on-chain and runs computation off-chain, increasing Ethereum’s transactions per second and decreasing transaction fees.

Bringing cheaper and faster trades to KyberSwap with Optimism

How do I switch to Optimism Network on KyberSwap?

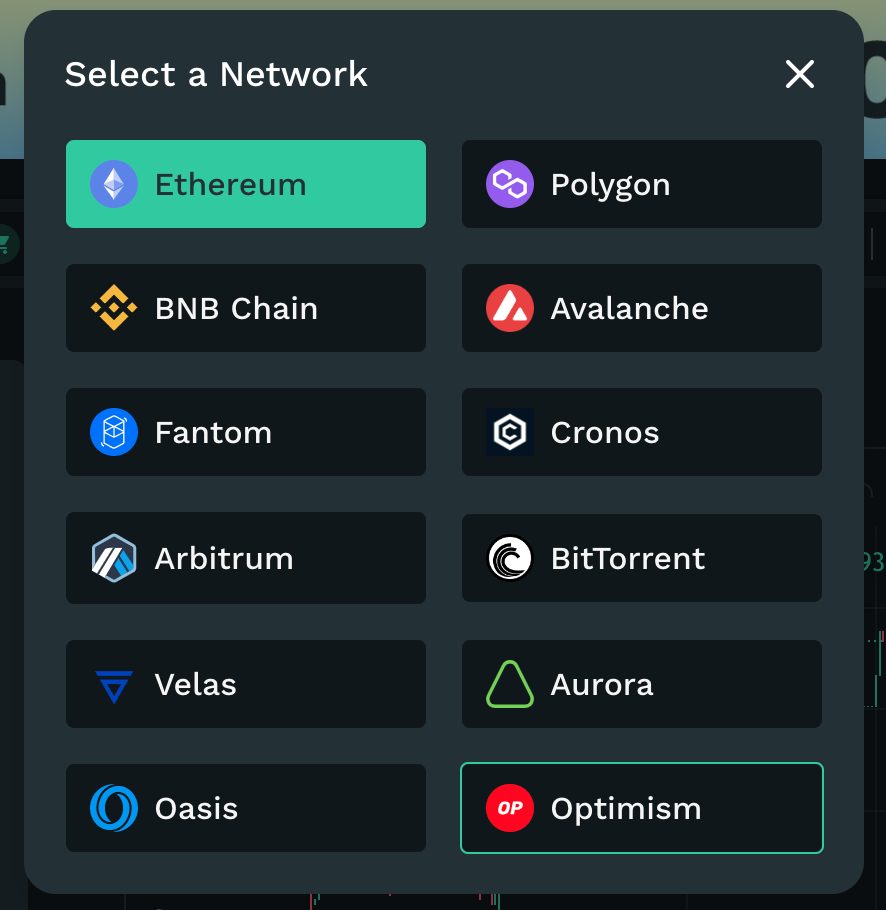

On KyberSwap, simply click on the Ethereum button at the top to switch your network to Optimism or change your network via your Metamask Wallet extension directly.

How do I bridge assets between the Ethereum and Optimism networks?

To move ETH or ERC20 token assets from Ethereum to Optimism, simply use Optimism Bridge.

When you are on the Optimism network on KyberSwap, click the ‘Bridge Assets’ button at the top of the page to access the bridge. Note that this button is not displayed if you are on the Ethereum network; change your network to ‘Optimism’ on your Metamask first.

The entire process is fast and simple. Check out this FAQ from the Optimism Team to learn more!

How to Create a New Pool on Optimism Network with KyberSwap Elastic?

Creating Pool on KyberSwap Elastic (BNB)

*Do take note this tutorial video is on BNB chain but the steps are similar on Optimism.

Step 1: Ensure you are on the Optimism network on KyberSwap Elastic.

Step 2: Click on the “Create Pool” tab on the right side of the page. An “Add Liquidity” popup will be displayed in which your first step is to select the pair of tokens you want to provide liquidity for and select the fee tier. You can choose between 4 fee tiers below:

- Option 1–0.008% fee tier (Best for very stable pairs)

The 0.008% fee tier is ideal for token pairs that typically trade at a fixed or extremely high correlated rate, such as pairs of stablecoins (e.g. DAI-USDC). Liquidity providers take on minimal price risk in these pools, and traders expect to pay minimal fees. - Option 2–0.01% fee tier: Best for very stable pairs

The 0.01% fee tier is ideal for token pairs that typically trade at a fixed or extremely high correlated rate, such as pairs of stablecoins (e.g. DAI-USDC). Liquidity providers take on minimal price risk in these pools, and traders expect to pay minimal fees. - Option 3–0.04% fee tier: Best for stable pairs

The 0.04% fee tier is ideal for token pairs that typically trade at a fixed or highly correlated rate, such as pairs of stablecoins (e.g. DAI-USDC). Liquidity providers take on minimal price risk in these pools, and traders expect to pay minimal fees. - Option 4–0.3% fee tier: Best for most pairs

The 0.30% fee tier is best suited for less correlated token pairs such as the ETH-DAI token pair, which are subject to significant price movements to either upside or downside. This higher fee is more likely to compensate liquidity providers for the greater price risk that they take on relative to stablecoin LPs. - Option 5–1% fee tier: Best for exotic pairs

The 1% fee tier is best suited for even less correlated token pairs such as the ETH-KNC token pair, which are subject to significant price movements to either upside or downside. This higher fee is more likely to compensate liquidity providers for the greater price risk that they take on relative to stablecoin liquidity providers.

Step 3: To start this pool, you will need to select a starting price. Set your custom price range in which you would like to provide liquidity by indicating the min price and the max price of that range. Be advised that the min price and max price you select will automatically be modified by the system to the nearest lower values which are called lower and upper “ticks” that are used in our new mechanism to prevent high gas costs resulting from the scenario where multiple price ranges are crossed during a trade.

*The price range you’ve selected should represent the degree to which you think the current price will fluctuate in the future. The liquidity you provide will be evenly distributed over this price range. You will get a fee for any swap to be processed at a specific price (or in other words, at a specific active tick) in your selected range, proportional to the liquidity you provide at that price (or at that active tick). Therefore, a full price range may bring you less fees than a concentrated price range due to the liquidity allocation on inactive ticks.

Step 4: Next, indicate the amount of tokens you’d like to provide liquidity for into the ‘Deposit Amounts’ section on the bottom left. If you change the amount of one token to be deposited, the amount of other token to be deposited will be updated automatically. If the amount of any token is more than what you have in your connected wallet, “Supply” button will be disabled.

Click on the “Supply” button on the bottom of the left screen to allow KyberSwap to access your wallet and make transactions.

*For the very first time you create a pool/provide liquidity to any specific token, you have an additional step of approving the tokens.

Step 5: Confirm your pool creation & addition of liquidity. After hitting “Supply”, a popup will be displayed for your review. This popup will summarize all information about your liquidity, current price and price range that you’ve chosen. Click on “Add” button at the end of the popup to create the pool and add liquidity.

Wait for the transaction to be confirmed. Once confirmed, you can visit the “My Pools” page and see the pool you have just created with your desired liquidity.

How to Add Liquidity to an existing pool on Optimism

Step 1: Ensure you are on the Optimism network (same as above)

Step 2: Click on “Pools” tab on the left upper main menu. Select the token pair in which you want to provide liquidity.

Step 3: Select pool to participate in. If there is a pool for the pair of tokens you’ve selected in the 1st step, your next step is to click on the “+” button at the end of the row for that pool. If there is no existing pool, you may wish to create a new pool.

*You should consider the specific fee tier the pool has already been set up with. Please refer to above for the fee options.

Step 4: Input your custom price range in which you would like to provide liquidity by indicating the min price and the max price of that range. Be advised that the min price and max price you select will automatically be modified by the system to the nearest lower values which are called lower and upper “ticks” that are used in our new mechanism to prevent high gas costs resulting from the scenario where multiple price ranges are crossed during a trade.

*The price range you’ve selected represents the degree to which you think the current price will fluctuate in the future. The liquidity you provide will be evenly distributed over this price range. You will get a fee for any swap to be processed at a specific price (or in other words, at a specific active tick) in your selected range, proportional to the liquidity you provide at that price (or at that active tick). Therefore, a full price range may bring you less fees than a concentrated price range due to the liquidity allocation on inactive ticks.

Step 5: Indicate the amount of tokens you’d like to provide liquidity for into the ‘Deposit Amounts’ section on the bottom left. If you change the amount of one token to be deposited, the amount of the other token to be deposited will be updated automatically. If the amount of any token is more than what you have in your connected wallet, “Supply” button will be disabled.

Step 6: Click on “Supply” button on the bottom of the left screen to allow KyberSwap to access your wallet and make transactions. Note that for the very first time you create a pool/provide liquidity to any specific token, you have an additional step of approving the tokens.

After hitting “Supply”, a popup will be displayed for your review. This popup will summarize all information about your liquidity, current price and price range that you’ve chosen.

Step 7: Click on “Add” button at the end of the popup to add liquidity into the pool. Wait for the transaction to be confirmed. Once confirmed, you can visit the “My Pools” page and see the pool you’ve added liquidity to.

Start Trading on KyberSwap using Optimism Now

With Optimism integration, KyberSwappers can make faster and cheaper transactions while getting the best rates on KyberSwap.com possible while being assured of top-notch security.

Swap at the BEST rates and Add Liquidity to earn OPTIMIZED fees on KyberSwap now!