Telegram: DeFi’s Messaging Platform Of Choice

Browse through the wealth of dapps and you would quickly see that Telegram has become one of the messaging platforms of choice for DeFi users. Telegram’s programmability allows users to conveniently access a whole suite of features and functions directly from a mobile app:

- Stay up-to-date with the latest DeFi happenings by subscribing to news channels (e.g. Coin Bureau Insider, Cointelegraph)

Subscribe to specialized channels which provide trading insights based on the latest market trends (e.g. 100eyes Crypto Scanner, ICO Analytics)

Get notified of any significant on-chain events through automated bots (e.g. Whale Alert)

Enable notifications from your favourite DeFi services to be delivered via Telegram (e.g. hal, Allnodes)

Keep track of a project’s latest releases by joining the team’s Telegram channel (e.g. Kyber Network Official)

Engage with the team and like-minded users through the team’s Telegram group (e.g. Kyber Network Official)

In addition to the above, the Telegram team conducted an offering for their native The Open Network (previously Telegram Open Network) token in 2018 which set the foundation for the TON blockchain to be launched. With continued support for crypto-specific features such as Telegram Bot Wallets, Telegram has cemented itself as a mainstay in a DeFi user’s toolbox.

The Rapid Rise Of Telegram Trading Bots

As Telegram innovation kept pace with the DeFi space, the introduction of Telegram Bots in 2015 paved the way for users to conveniently execute pre-programmed functions through a simple chat command. Telegram Trading Bots started to gain traction towards the second half of 2022 as developers merged crypto wallet functions with the convenience of bots.

These functions could range from simple queries regarding the status of a wallet or even executing multiple complex trading strategies with a single command. Some examples of the more popular strategies implemented by Telegram trading bots are:

- Instant Trades: Simple user-initiated trades where bots execute the trade immediately upon the trader providing the parameters in the chat.

Sniping: Front-run market movers by detecting actions from specific wallet addresses and executing profit making strategies that take advantage of how public transactions are ordered.

Copy Trading: Monitor specific addresses and have the bot automatically replicate the trades done by the addresses being tracked.

Scam Checking: Check the contract of the token being traded for any instances of fraud such as rug-pull or honeypot logic.

This synergy between developers, who were able to pre-program any form of computer logic, and traders, who were looking for easier ways to trade, kickstarted a wave of trading via the Telegram app.

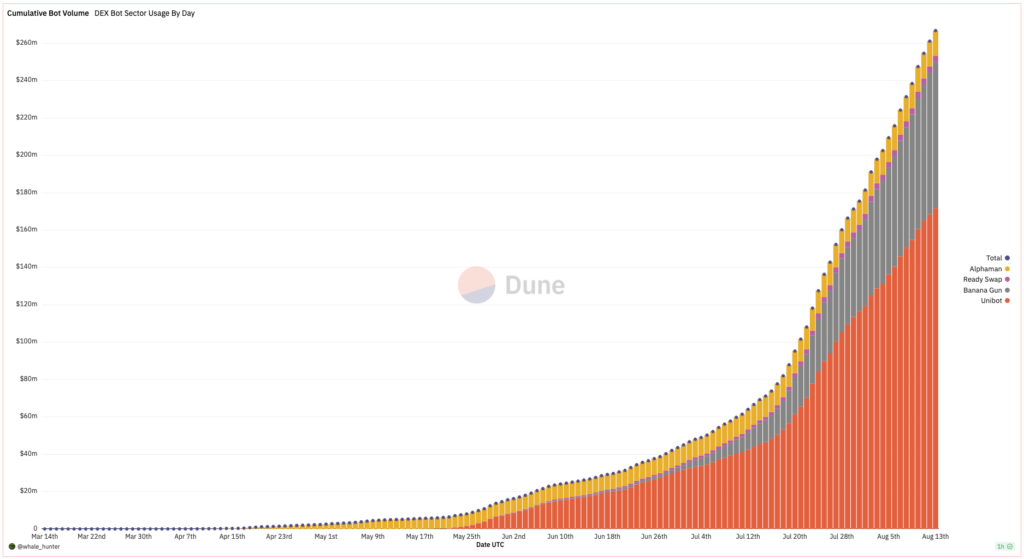

With such flexibility and convenience afforded to traders, Telegram trading bots exploded in popularity as cumulative bot volume ballooned to >USD250M in less than 5 months. Underlying this massive shift were thousands of traders demanding a quicker and more convenient trading journey.

By providing Telegram bots access to trade tokens directly from their linked or pre-funded wallet, traders could delegate all the complexities of completing a DeFi transaction to the bot. This means no longer having to sign individual transactions and even the ability to chain complex multi-step trading strategies. All the trader needed to do was to provide the trading bot the trading parameters and it would take care of the rest.

Crucially, with all the complexities of the trade being abstracted away, Telegram trading bots provided traders with a key competitive advantage: speed. Traders could more effectively respond to real-time market events as pre-programmed trading strategies could be executed while on-the-go. No more having to toggle between different dApp or program interfaces. Just send the trading instructions to the bot and the bot will immediately carry out the trade, no questions asked.

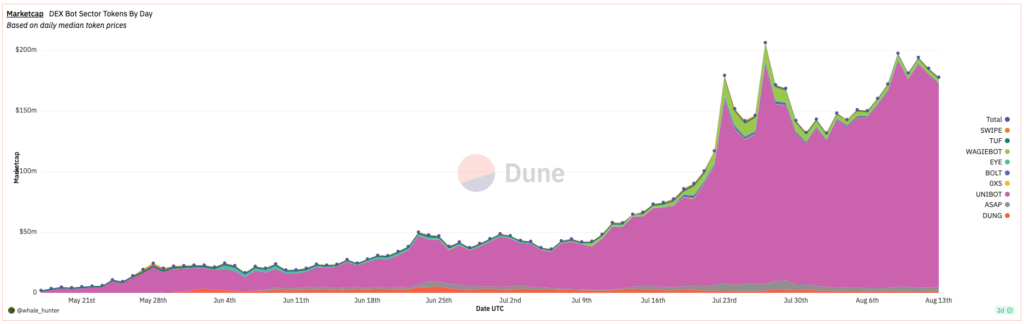

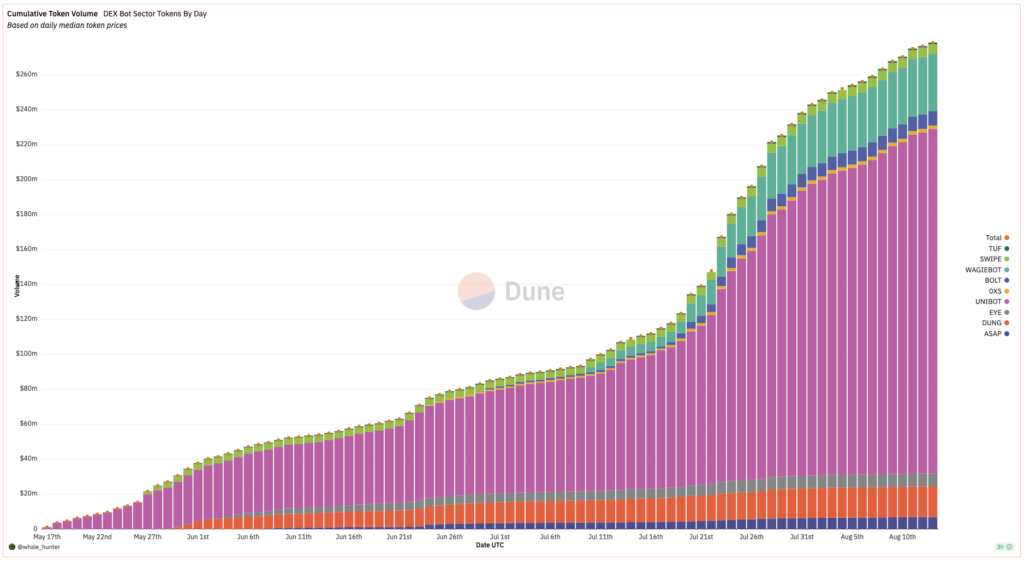

Accompanying this rapid rise in volume was the equally explosive growth of token valuations linked to various Telegram Trading Bot projects. Within the span of 4 months, the cumulative token volume for such projects grew from USD1M to >USD275M as teams embellished their projects with various token mechanics. These mechanics range from tiered benefit programs (lower fees, call limits, etc.) to revenue sharing mechanisms based on token holdings. While Telegram bot tokens have managed to capture much of the value underlying the hype, it remains to be seen whether this will continue given the maturity of this space.

Extreme Convenience At The Expense Of Safety

To achieve the level of convenience and speed demanded by its users, Telegram trading bots needed to be able to sign transactions on behalf of the trader. Consequently, traders are required to share their private keys with the Telegram bot on wallet setup. This can be done through importing their private keys or pre-funding a wallet that was created by the bot.

While the above setup enables bots to easily execute any manner of trades, it also means that the bot can transfer the trader’s funds at its own discretion. In other words, users have to trust that the bots do not misuse their funds. This is a tall order given that the majority of Telegram trading bots do not provide audit reports nor access to an open-sourced codebase or sufficiently detailed documentation. As such, it is also not possible to verify claims from Telegram trading bot teams that private keys are only used for setup and thereafter permanently deleted.

In addition to requiring a trusted setup, the flip side of quicker trades is that this speed might come at the expense of better rates. Unlike aggregators which query multiple liquidity sources for more optimal rates, a swap that prioritizes speed will likely reduce the number of liquidity sources to minimize route discovery time. Consequently, market depth is constrained especially where exotic tokens are concerned.

Shallower market depth significantly increases the likelihood that the trade will be executed at suboptimal rates hence the extremely high default slippage tolerance recommended by such bots. Critically, with slippage configured anywhere starting from 5%, such trades are themselves also vulnerable to front-running attacks.

Lastly, while the simplicity of the chatbot interface makes it easy to execute a trade, it also hides critical trade information as well as any safeguards which might have prevented unintended trades. From the perspective of a trader swapping via the bot, they are effectively submitting a blind market order with no confirmation prompts or actions. Given the speed of the trade, any errors made while creating the trade would be immediately realized as a loss.

Telegram Trading Bots And The Future Of DeFi

While Telegram trading bots introduce significant safety and security risks, its rapid rise provides undeniable proof that there are plenty of traders willing to overlook such shortfalls in exchange for the conveniences which they enable. The presence of Telegram trading bots implies that there is a user experience gap which native DeFi applications are still unable to address. As such, what can the benefits of Telegram trading bots teach us about the future of DeFi?

Ease of trading

There is significant pent-up demand for a simple trading interface where swaps can be immediately executed. With an average trade size hovering around USD600, it is unlikely that traders who use such trading bots trade exclusively via Telegram. The shift towards Telegram trading bots therefore implies that the current dApp experience is probably unsuited for conducting immediate swaps while on-the-go. This could be due to the lack of native mobile support or the lack of options to select a basic trade interface.

Trading automation

In addition to just simple trades, the pervasiveness of complex trading strategies (e.g. sniping, copy trading, etc.) across various implementations indicate a demand for pre-programmed trading solutions that can be automated. While some of the current implementations contribute to toxic order flow, the ability to implement pre-programmed trading strategies that can be safely and easily configured by the average user would likely bring significant user experience improvements into the space.

Platform familiarity

The pervasiveness of Telegram as a platform likely also contributed to the success of the trading bots built on their platform. Given the relationship between Telegram and DeFi, many trading bot users would likely have been existing Telegram users who are already familiar with the application. This significantly lowered the barriers to adoption and hints to the importance of converting users through novel solutions with familiar experiences.

Telegram’s bot programmability is also a significant factor as many teams leveraged its open platform to enable new channels for value to flow. While Telegram as a platform is not decentralized, this composability of features is a key attribute which DeFi dApps should continue to follow as network value is amplified with each subsequent integration.

The user experience and security dilemma

Time and time again, user behavior has shown that safety concerns take a backseat to profit opportunities until the time that something goes wrong. This is important to put in the context of DeFi’s narrative of not your keys, not your crypto. Telegram trading bots tend to be centrally run and do not have sufficient visibility into their code but this has not stopped the industry from expanding.

Short of being able to code your own trading bot, there will always exist this technical limitation which requires some form of trust in the program developers. Even if the code can be easily read and audits are publicly available, there is a strong social element when it comes to adoption and this can only be bridged via education. Not all trusted solutions are inherently bad but as early adopters, we must be cautious of how such solutions are portrayed as not acknowledging the tradeoffs might set the industry back due to potential loss of monetary value.

Taking a step back, the need to constantly sign every transaction also introduces additional friction and has been recognized as a significant barrier to mass adoption of crypto in general. Up until the point where a user’s funds can be managed externally through non-trusted setups and permissions revoked at any time, an element of trust is still required to bridge this experience gap.

While foundational solutions such as zero-knowledge proofs and account abstraction are being developed, dApp teams must continue to iterate on the user experience. This means taking into account the diversity of trading situations where the same trader might prioritize different aspects of an on-chain trade such as convenience, pricing, security, etc. Additionally, to reach mainstream users, the complexities of such features must be abstracted away and packaged into experiences which still feel comfortably familiar to users; all while maintaining strong safety and security guarantees.

Telegram trading bots currently solves a major pain point for traders looking for extreme convenience but their security tradeoffs are too significant to overlook. As such, there are two possible futures for Telegram trading bots. If dApp interfaces are able to provide the same level of convenience with stronger safety guarantees, the need for Telegram trading bots might be eliminated completely. Alternatively, if advances in cryptography enable such bots to be set up without the sharing of private keys, Telegram trading bots might become another mode of trade that contributes to onboarding the next billion DeFi users.

At KyberSwap, we are first and foremost guided by our commitment to user safety. This entails being a trustless platform where users always maintain full control over their assets. While this currently necessitates more manual management on the part of our users, we are constantly working hand-in-hand with our community to identify areas for improvement as well as opportunities for personalization of trading journeys on KyberSwap. Moreover, products like KyberAI were built with the intention of democratizing data and consequently making DeFi more approachable. Instead of blindly trusting KyberSwap, users can continue to swap at superior rates and earn upsized yields by verifying our code bases and audits.