The world of decentralized finance (DeFi) is constantly evolving, and with new innovation comes new opportunities for ETH holders and liquidity providers to maximize their earnings.

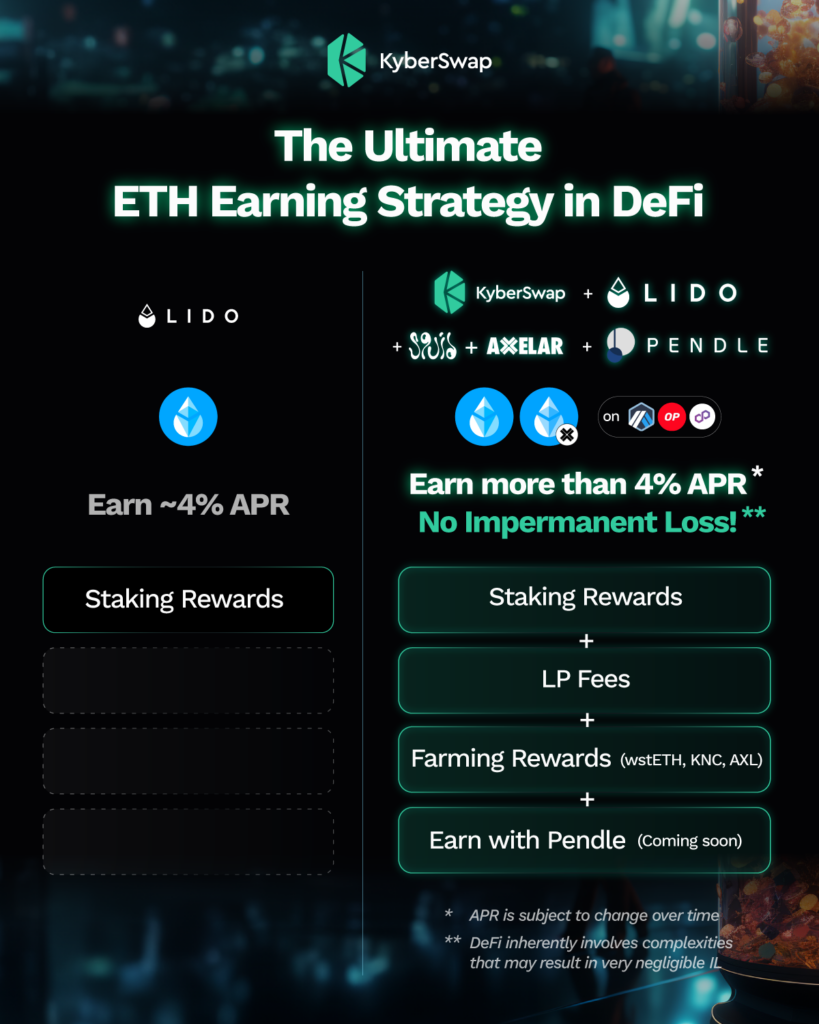

Today, we’re thrilled to introduce possibly the ultimate ETH earning strategy in DeFi in collaboration with Lido Finance, Axelar, Squid and Pendle!

For this, we have launched a total of 6 farms on Arbitrum, Optimism & Polygon POS on KyberSwap Elastic, including wstETH/axl.wstETH static farms and wstETH/ETH dynamic farms.

Read on to learn how you can earn more incentives, more farming rewards, and get this… no impermanent loss*, with no need for position maintenance!

Safe, Sustainable & Attractive Earnings for ETH & wstETH Holders

Why is this possibly the best ETH earning strategy in DeFI?

KyberSwap’s wstETH/axl.wstETH and wstETH/ETH liquidity pools are designed to handle substantial ETH and wstETH bridging demand via Axelar’s cross-chain swaps and Squid routing, thus supporting significant volume and providing liquidity providers in these pools significant incentives from LP fees.

On top of ETH staking rewards via Lido wstETH, which is usually around 4%, wstETH holders can also earn additional incentives by participating in wstETH/axl.wstETH and wstETH/ETH pools to earn the LP fees. On top of that, LPs can stake to earn farming rewards! This means multiple streams of earnings on ETH, creating a robust earning strategy that can outshine other alternatives.

It is also worth noting that wstETH/axl.wstETH pools, in particular, have no impermanent loss*, and there is less need for liquidity position maintenance, since static farm ranges don’t change. Alternatively, wstETH holders can also opt to add liquidity to wstETH/ETH and stake in the corresponding dynamic farms.

To top it off, Pendle will also start supporting the wstETH/axl.wstETH pools on Arbitrum and Optimism, adding yet another earning stream. Users will be able to speculate, trade and hedge the pools’ APR, while at the same time, earning more rewards on top. Pendle support is expected to launch on September 27th.

Farming Rewards

Liquidity providers will benefit from farming incentives provided by Lido, KyberSwap and Axelar in the form of $wstETH, $KNC and $AXL tokens. These incentives are aimed at bootstrapping liquidity within the pools. Farms will be reviewed towards the end of each month to determine continuation and incentives adjustments for following months.

For the first month, farms will receive the following allocations:

wstETH/axl.wstETH farms on Polygon PoS, Arbitrum and Optimism:

1.755 wstETH

6,323 KNC

9,638 AXL

wstETH/ETH farms on Polygon PoS, Arbitrum and Optimism:

5.26 wstETH

6,323 KNC

What is wrapped stETH (wstETH)?

Users can stake any amount of ETH with Lido Finance and receive a receipt token called stETH, which is a rebaseable ERC-20 token that represents ether staked with Lido and the validator rewards it earns. It can be used on other platforms to earn additional rewards/incentives. wstETH is a wrapped version of stETH for use on DeFi applications that don’t support rebasing tokens.

Learn more about wstETH here.

What is Axelar wrapped stETH (axl.wstETH)?

axl-wstETH is a 1:1 tokenized representation of wstETH by Axelar/Squid to facilitate seamless, fast and cost-efficient bridging of wstETH and ETH cross-chain. More about this coming up in our next article, so stay tuned!

How to get wstETH on Ethereum?

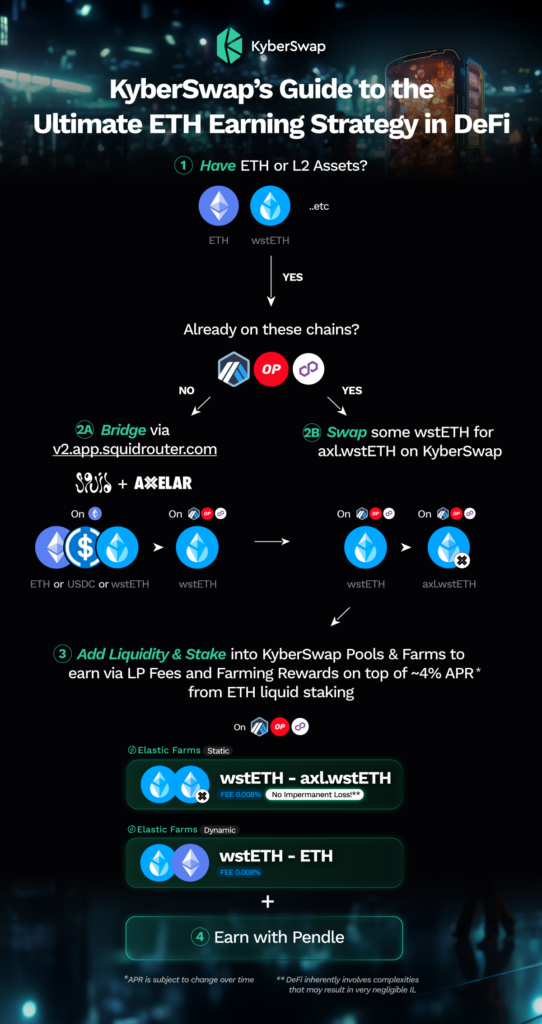

How to get wstETH on L2s?

- Swap any token for wstETH on KyberSwap here.

- Learn how you can bridge your wstETH to Arbitrum, Optimism and Polygon POS here.

- Go to app.squidrouter.com and use the V2 beta toggle to bridge USDC/wstETH to wstETH on the destination chain.

- Soon, you will also be able to bridge wstETH using cross-chain swaps powered by Axelar/Squid here.

In doing so, you can benefit from lower gas fees and exciting DeFi opportunities such as KyberSwap’s Ultimate ETH Earning Strategy!

How to get axl.wstETH on L2s?

There are various ways you can do this:

- Go to app.squidrouter.com and use the V2 beta toggle to bridge USDC/wstETH to axl.wstETH on the destination chain.

- Swap any token for axl.wstETH on its native chain on KyberSwap

a. Swap on Arbitrum

b. Swap on Optimism

c. Swap on Polygon PoS

You can also refer to the infographic below on how to get started:

So, whether you’re new to DeFi or a seasoned pro, this strategy offers a straightforward way to maximize your ETH holdings and reap the rewards.

For more detailed instructions on farming with Elastic pools, please visit: https://docs.kyberswap.com/guides/how-to-farm

How to Maximise your Earnings with Pendle

Pendle is a permissionless yield-trading protocol where users can execute various yield-management strategies.

For more information on Pendle and their protocols, please visit: https://docs.pendle.finance/Home

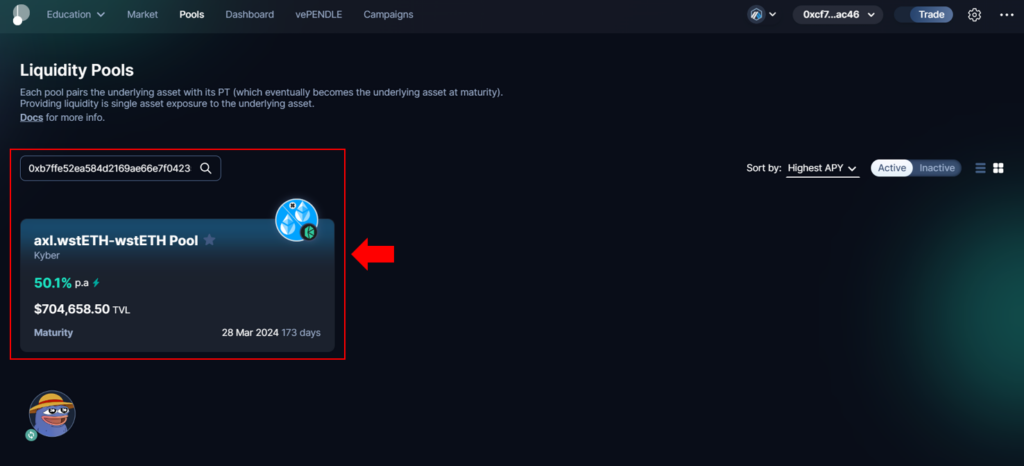

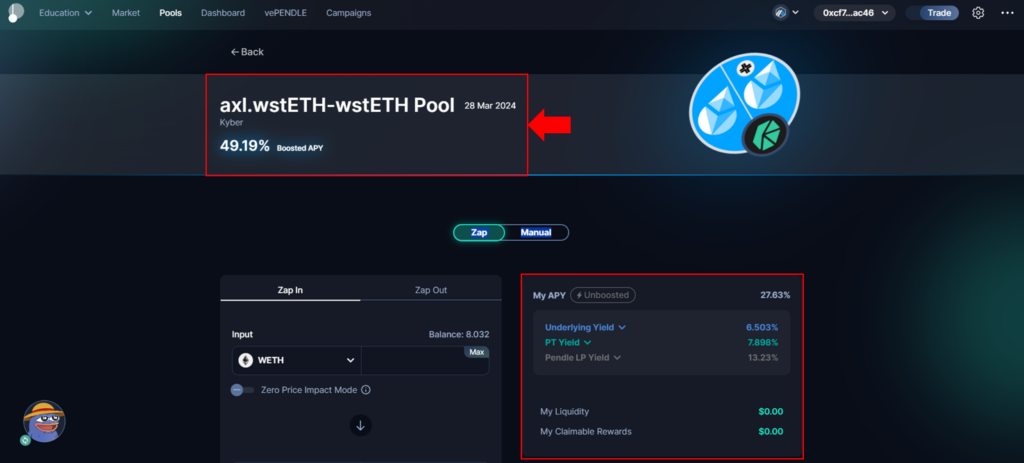

1. Head to the “Pools” tab on Pendle. Ensure you’re on the Arbitrum network.

2. Search for KyberSwap’s axl.wstETH-wstETH pool. You may do so by copying the pool’s address into the search bar.

Pool Address: 0xb7ffe52ea584d2169ae66e7f0423574a5e15056

3. On this page, you’ll be able to see an overview of the pool, including its name, maturity, and maximum boosted APY at the top.

On the right, you can see the breakdown of the yield for this pool (which can be expanded further), including the minimum base APY that you can earn from providing liquidity.

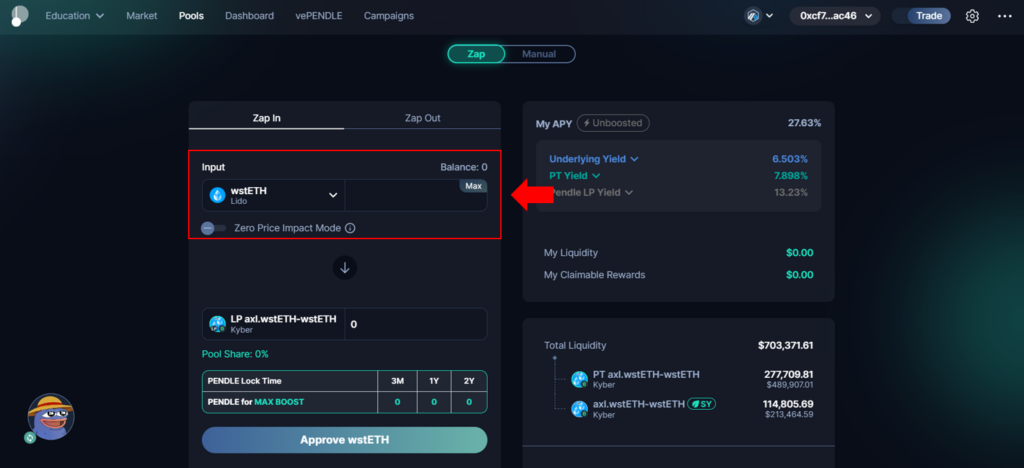

4. Next, select your desired asset and input amount. Pendle will automatically help you zap and convert your assets into the LP token directly.

(Optional) Toggle on Zero Price Impact to provide liquidity without affecting the price. This is especially useful in the initial stages when the pool still has low liquidity, which may lead to high price impact. You can read more about Zero Price Impact mode here.

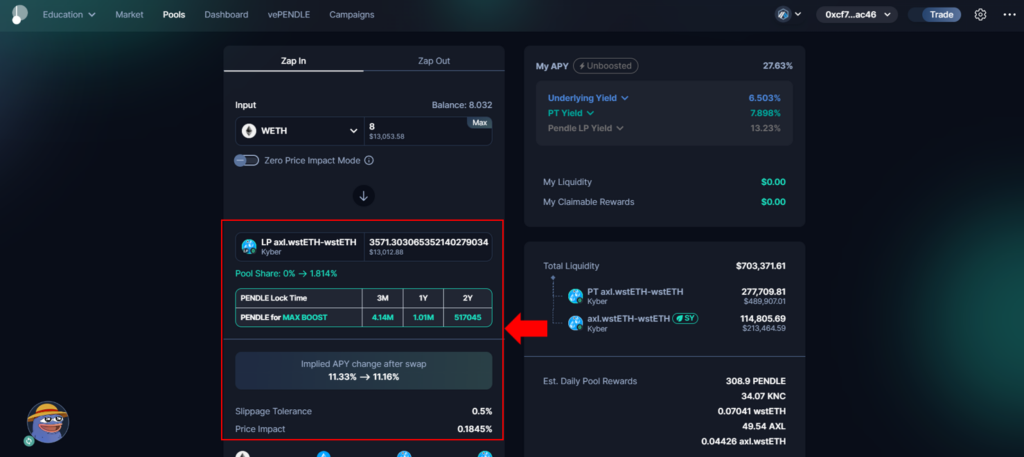

5. A summary of the LP transaction will appear once you’ve keyed in the input, including the Slippage Tolerance and Price Impact.

A mini table also shows you the length and amount of PENDLE that is needed to be locked for you to get the maximum boosted APY for this pool.

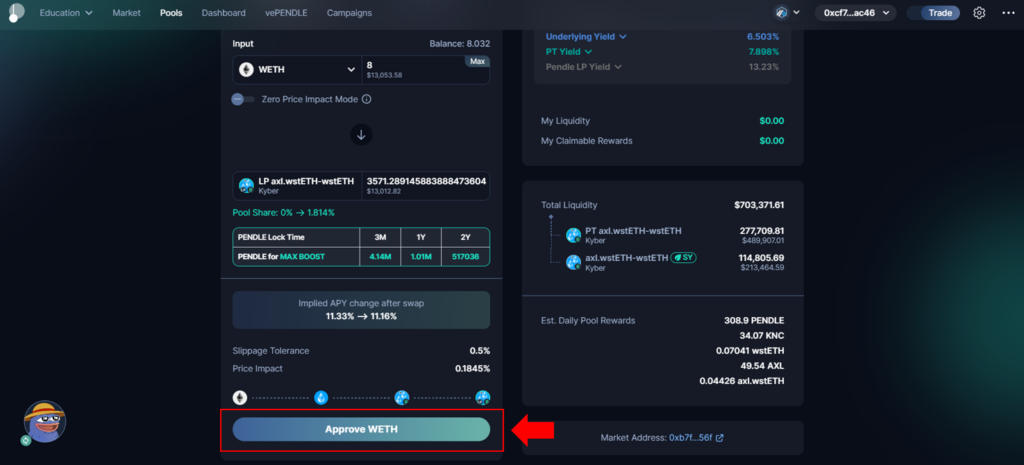

6. Once you’re ready, simply approve and confirm the transaction in your wallet.

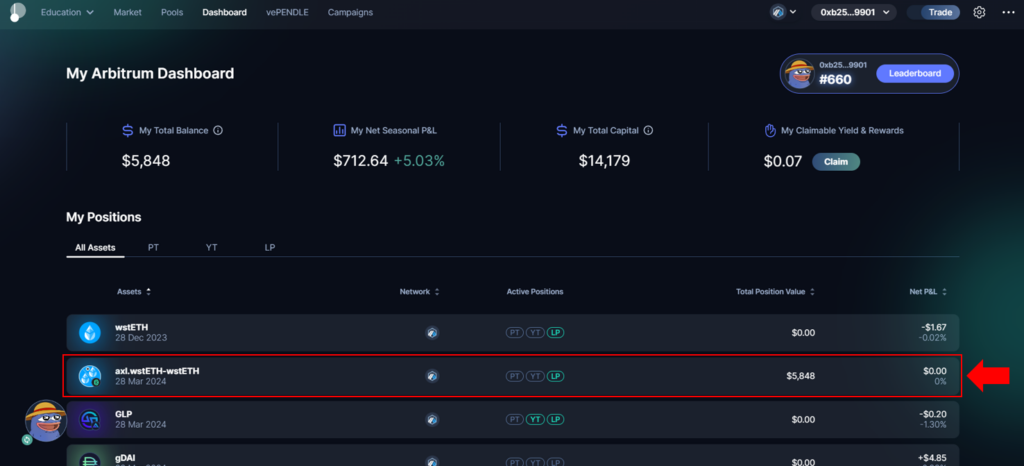

7. As a Pendle user, you can monitor and manage all of your Pendle positions on our Dashboard, including adding/removing liquidity, claiming all your hard-earned yield and rewards

Note: Pendle positions can be exited anytime even before maturity. Any yield and rewards that have been earned can still be claimed after exiting.

For more information about Pendle and their tokenisation protocols, please visit: https://app.pendle.finance/trade/education/learn

*DeFi inherently involves complexities that may result in very negligible IL. Learn more about Impermanent Loss here.