As a way to kickstart value exchange within their own token ecosystem, many teams (such as Arbitrum, Optimism, ENS, etc.) have employed airdrops whereby newly minted tokens are directly sent to a user’s wallet address. In doing so, token teams are able to get their tokens into the hands of multiple users all at once and price discovery will happen naturally as users trade or use the tokens themselves. In other words, airdrops maximizes the reach of a token’s initial distribution which ultimately aids in protocol decentralization.

In contrast to traditional distribution mechanisms (IPOs, ICOs, etc.) where users have to proactively commit funds during a presale process, airdrops do not require the exchange of funds (which also eliminates the need to trust the issuer) but instead implement a set of qualification criterias. In order to be eligible for the token airdrop, users will need to pass the qualification criteria which usually consists of logging some form of on-chain activity with their personal wallets before the snapshot date. As such, airdrops indirectly reward the most active community members by distributing newly minted tokens directly to their wallets.

Given that the majority of airdrops do not require any upfront capital from the user, airdrop participants face minimal financial downside in exchange for rewards that scale with the overall token ecosystem adoption. The biggest unknown for airdrop hunters is therefore the airdrop qualification criteria which is usually kept private by the token teams in order to minimize token distribution abuse. A recent study by X-explore indicates that a standard airdrop hunter can, on average, expect to reap up to $9,384 in airdrop rewards from more established projects.

With minimal financial downside and the biggest investment being that of time, airdrops have become a lucrative strategy for many airdrop hunters who prefer to invest their time rather than money. Moreover, there now exists various services whose core purpose is to help discover upcoming airdrops and their corresponding qualification criterias so that users can benefit from such airdrops. Following the growth of the airdrop market, this article is meant as a blueprint for users starting out their journey as an airdrop hunter.

Qualifying For An Airdrop

Airdrop eligibility is highly dependent on the token team and can therefore vary greatly from one airdrop to the next. Moreover, the airdrop criteria is supposed to help the token team scale their ecosystem in the long-term and is therefore also case-specific. Lastly and most critically, the qualification criteria for an airdrop is rarely published prior to the snapshot date which means that airdrop hunters can only take a best guess approach based on project familiarity as well as guidelines from previously completed airdrops.

In order to generalize the airdrop requirements, this article analyzes some of the most high-profile airdrops to date and compares each team’s approach to their token airdrop.

Arbitrum – $ARB

Arbitrum is a layer 2 EVM optimistic rollup solution designed to scale Ethereum. By enabling transactions to be processed on its own Arbitrum One network but ultimately settled against Ethereum, Arbitrum significantly increases the transaction throughput and settlement times.

$ARB is an ERC-20 governance token native to the Arbitrum One rollup chain. Following the successful launch of the Arbitrum One chain, $ARB was distributed based on a snapshot of block 58642080 (6th Feb 2023) on the Arbitrum One chain.

Optimism – $OP

OP Mainnet is a layer 2 EVM optimistic rollup solution designed to be fast, simple, and scalable. Built as a minimal extension to existing Ethereum software, OP Mainnet’s EVM-equivalent architecture scales Ethereum apps at a fraction of the cost.

$OP is an ERC-20 governance token native to the OP Mainnet rollup chain. Following the successful launch of the OP Mainnet, $OP was distributed based on a snapshot taken at 25 Mar 2022 on both OP Mainnet and Ethereum Mainnet.

Uniswap – $UNI

Uniswap is a DEX that facilitates peer-to-peer market making and swapping of ERC-20 tokens via smart contracts. Uniswap initially deployed their V2 protocol on Ethereum in May 2020 but has since expanded across multiple chains and launched their V3 protocol.

$UNI is an ERC-20 governance token native to the Ethereum Mainnet. Following the successful launch of UniV2, $UNI was distributed based on a snapshot ending 1 Sep 2020 at 12:00AM UTC on the Ethereum Mainnet.

Blur – $BLUR

Blur is a NFT marketplace that enables its users to sweep and list across marketplaces, snipe reveals, and manage their NFT portfolio.

$BLUR is an ERC-20 governance token which is native to the Ethereum Mainnet. $BLUR can be claimed by users with care packages which were distributed across 3 waves:

- Wave1: NFT traders on competitor marketplaces 6 months prior to Blur launch (19 Oct 2022)

- Wave 2: NFT traders who actively listed on Blur (Currently active)

- Wave 3: NFT traders who place bids on Blur (Planned)

ENS – $ENS

The Ethereum Name Service (ENS) is a distributed, open, and extensible naming system based on the Ethereum blockchain. ENS’s job is to map human-readable names like ‘alice.eth’ to machine-readable identifiers such as Ethereum addresses, other cryptocurrency addresses, content hashes, and metadata.

$ENS is an ERC-20 governance token native to the Ethereum mainnet. $ENS was distributed based on the total time of an address’s past and future registration with the snapshot being taken on 13 Oct 2021 on the Ethereum Mainnet.

Airdrop Qualifying Criteria Compared

| Arbitrum | Optimism | Uniswap | Blur | ENS | |

| Project Type | L2 | L2 | DEX | NFT Marketplace | Identity |

| Distribution Mechanism | Points | Categories | Interact | Points, Loyalty | Ownership |

| Snapshot Date | 06/02/23 | 25/03/22 | 01/09/20 | 19/10/22 | 13/10/21 |

| Snapshot Chain | Arbitrum One | OP Mainnet, Ethereum | Ethereum | Ethereum | Ethereum |

| Bridge Funds | ✓ | ✓ | |||

| Bridge Volume | ✓ | ||||

| Transaction Count | ✓ | ✓ | |||

| Transaction Volume | ✓ | ||||

| Taker Action (Swap, Order, Bid) | ✓ | ✓ | ✓ | ✓ | |

| Maker Action (Liquidity Provision, Farming, Listing) | ✓ | ✓ | ✓ | ||

| NFT/Token Ownership | ✓ | ✓ | ✓ | ||

| DAO Participation | ✓ | ||||

| Social Promotion | ✓ | ||||

| Competitor Interaction | ✓ | ✓ |

As can be seen from the above comparison, the qualifying criteria for an airdrop is highly specific to the product. Consequently, the best strategy to become eligible for an airdrop is to interact with the product as intended. Given that the ultimate goal of airdrops is to grow the ecosystem, token teams will also want to distribute tokens to the most active users as this significantly increases the likelihood of organic and sustainable growth.

Airdrop Hunting

Having covered the basics of airdrop hunting above, we can now try to hunt for some of the most promising projects that might conduct airdrops: Linea, zkSync, Scroll…

Linea

One project that might conduct an airdrop in the near future is Linea, a type 2 zkEVM that replicates an Ethereum environment by leveraging rollups. Linea was developed by Consensys, the same team behind MetaMask, which further bolsters the potential rewards if an airdrop is conducted.

KyberSwap has recently expanded onto the Linea Testnet allowing users to easily experiment with the Linea ecosystem and maybe even qualify for an airdrop. The steps below outline the journey of an airdrop hunter using the Linea Testnet as an example.

1. Connect To The Linea Testnet

You can connect to the Linea Testnet using the chain selector helper on https://kyberswap.com/.

2. Fund Your Wallet With Linea Goerli ETH

In order to start transacting on the Linea Testnet, you will first need to source some Goerli test ETH to pay the gas fees for the transaction. You can refer to Linea’s official Docs for a guide on how to achieve this.

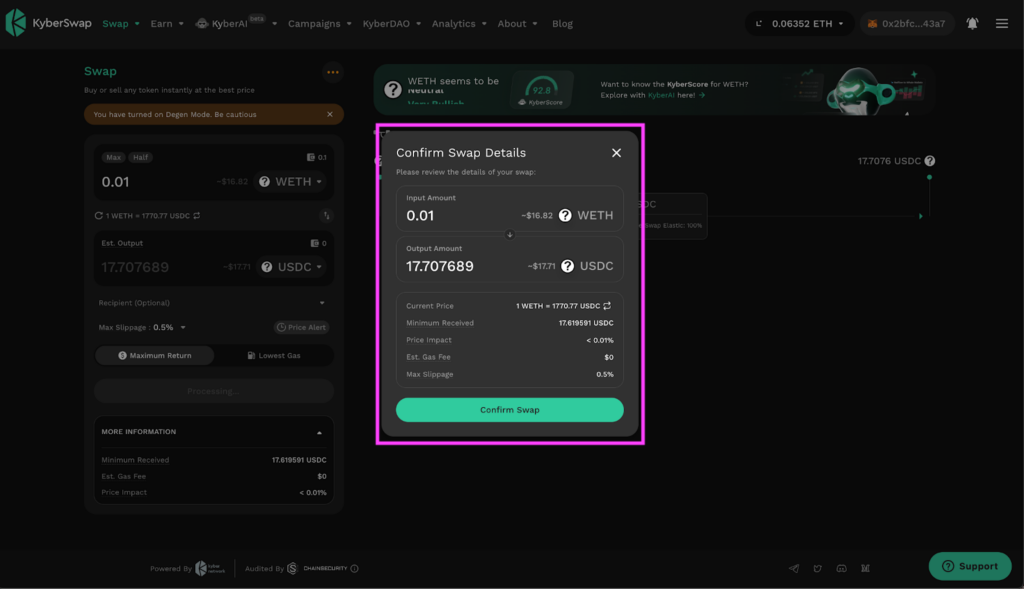

3. Conduct A Swap

Once you have acquired some test ETH, you can swap it for various tokens via the KyberSwap Aggregator. Specific to the Linea Testnet, swaps via the KyberSwap Aggregator will be routed via KyberSwap pools. The number of liquidity sources is expected to increase significantly once the Linea Mainnet is launched thereby ensuring superior rates for traders.

By conducting a swap, you are not only exchanging tokens but also adding to your wallet’s transaction count, smart contract interactions, and transaction volume (less of a factor on testnets). Note that as this is a testnet swap, the values of the tokens are not reflective of actual value but instead mock values for a test asset.

You can view a complete guide on how to swap on Linea Testnet here.

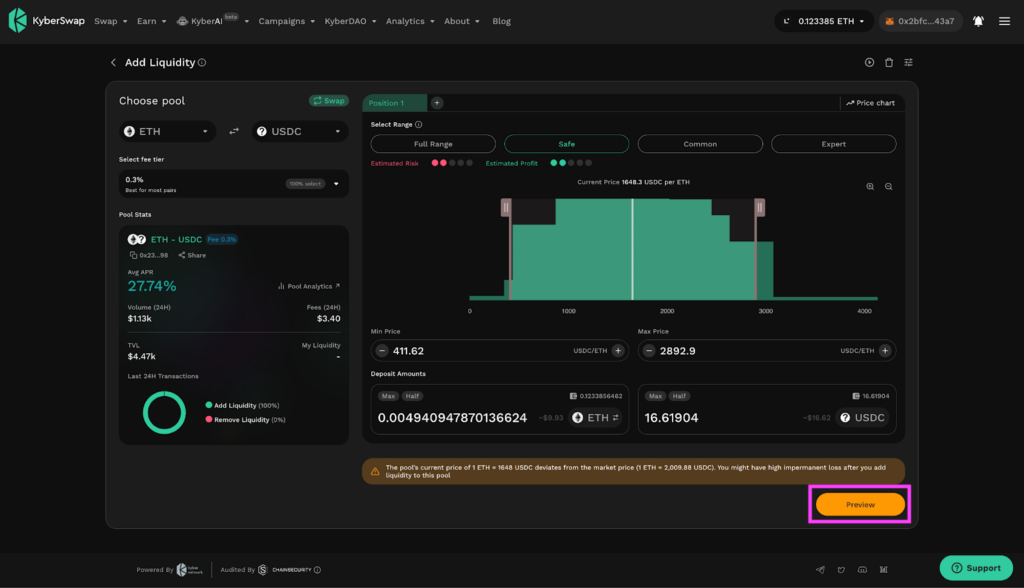

4. Contribute Liquidity To A Pool

Another action that can be performed is the adding of liquidity to a liquidity pool. KyberSwap enables test tokens to be added to multiple Elastic and Classic pools. By adding liquidity to various pools, you are also allowing other testnet users to experiment with swaps on the testnet while also increasing your smart contract interaction count.

You can view a complete guide on how to contribute liquidity on Linea Testnet here.

5. Interact With Other Dapps On Linea Testnet

Increasing your activity across all other protocols deployed on Linea Testnet is a good way to signal that you are an active user. You can view the full list of available dapps as well as their corresponding guides on the Linea Docs.

6. Complete Linea Campaigns

To fully test the reliability and security of the network, Linea is also hosting campaigns on Galxe whereby users can complete a set of tasks in order to claim special rewards. Completion of such campaigns is usually a positive indicator that you would be eligible for an airdrop, if applicable.

You can view their DeFi Week campaign here.

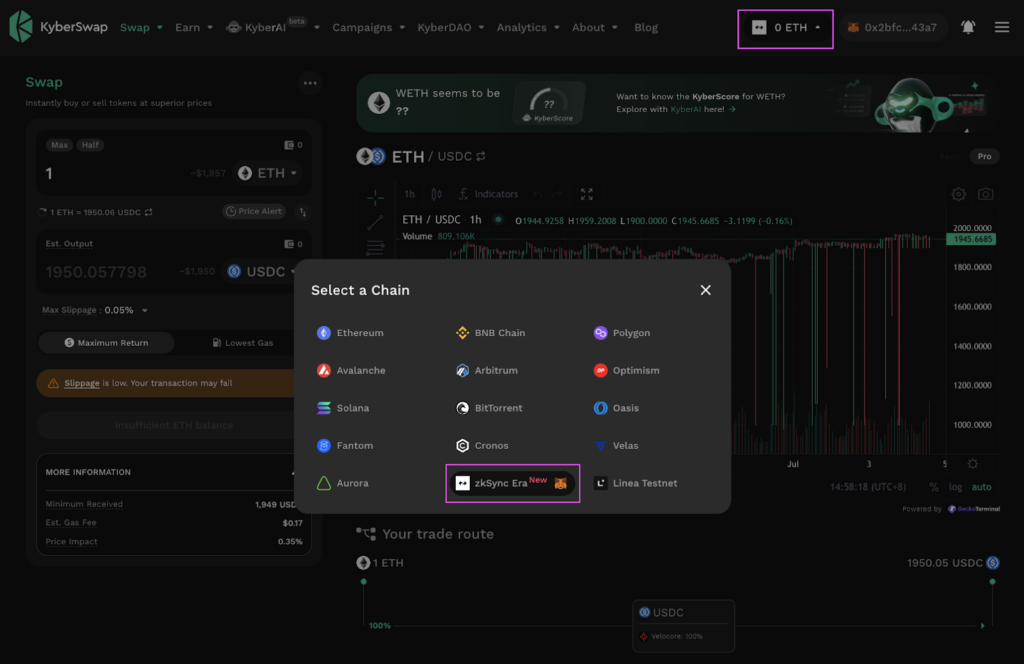

zkSync

zkSync is another promising project which has managed to gain significant traction within the DeFi space. zkSync Era was the first L2 zkEVM to be launched on the mainnet and currently supports many of the most popular dapps across multiple categories such as DeFi, decentralized identity, gaming, etc.

KyberSwap has recently expanded onto zkSync Era allowing users to trade at superior rates and earn supercharged yields while possibly even qualifying for an airdrop. The steps below outline the journey of an airdrop hunter using the zkSync Era mainnet as an example.

1. Connect To The zkSync Era Mainnet

You can connect to zkSync Era using the chain selector helper on https://kyberswap.com/.

2. Fund Your Wallet With zkSync ETH

In order to start transacting on the zkSync Mainnet, you will first need to source some zkSync ETH to pay the gas fees for the transaction. You can bridge ETH from Ethereum Mainnet using the zkSync bridge.

3. Conduct A Swap

Once you have acquired some ETH, you can swap it for various tokens via the KyberSwap Aggregator. Swaps via the KyberSwap Aggregator will be routed across multiple liquidity sources across zkSync Era to ensure superior rates for your swap. By conducting a swap, you are not only exchanging tokens but also adding to your wallet’s transaction count, smart contract interactions, and transaction volume.

You can refer to our user guide for a step-by-step walkthrough on how you can get superior rates for your market order.

4. Contribute Liquidity To A Pool

Another action that can be performed is the adding of liquidity to a liquidity pool. KyberSwap enables users to create new Classic pools or add liquidity to existing pools. Apart from contributing more liquidity to the zkSync DeFi ecosystem, liquidity providers can also earn amplified yields on KyberSwap Classic.

You can refer to our user guides for a comprehensive walkthrough of creating or adding liquidity to Classic pools.

5. Interact With Other Dapps On zkSync Era

Increasing your activity across all other protocols deployed on zkSync Era is a good way to signal that you are an active user. You can view the full list of available dapps on the zkSync ecosystem page.

Final Thoughts

Airdrops have quickly proven to be an effective way for teams to launch their tokens as it introduces the following benefits:

- Minimal trust assumptions: As no funds are exchanged, users do not have to worry about issuers disappearing with their presale funds. Moreover, issuer incentives are aligned with ecosystem growth as they do not have an initial pool of alternative funds to rely on. Distribution is also more transparent as it is based on on-chain transactions.

- Organic price discovery: The absence of an indicative price allows token price discovery to be more organic as token valuation will be directly dependent on actual token trades and usage upon launch.

- Activity based distribution: Airdrop eligibility focuses on the most active ecosystem users which ensures that there is a wider distribution of tokens.

In an effort to bring DeFi to the masses, the KyberSwap product suite will be deployed across upcoming chains with the most potential to drive DeFi adoption. In doing so, KyberSwap users can conveniently access the newest chains and also have the opportunity to receive potential airdrops just by interacting with the KyberSwap dapp.

With multiple chains slated to be launched in the near future, do keep a lookout for our announcements as the KyberSwap ecosystem continues to expand across more chains.