Our BENQI pools on KyberSwap have proven so popular that we have decided to keep the good times going! Liquidity mining with BENQI continues on KyberSwap. Keep reading for the full details below!

To recap, since launching on the Avalanche Network, Kyber Network has been collaborating with popular ecosystem projects in joint initiatives to bootstrap liquidity and increase adoption.

As part of these joint initiatives, KyberSwap was proud (and still is!) to partner with BENQI to bring our traders and liquidity providers the best rates and optimized returns.

Why Add Liquidity on KyberSwap?

KyberSwap allows LPs to maximize the use of capital via:

- Amplified Liquidity Pools with extremely high capital efficiency; less tokens required to achieve better liquidity and rates compared to AMMs.

- Dynamic Fees that react to market conditions and optimize returns for LPs.

- Better Reliability & Security: Audited by ChainSecurity and insured up to $20M by Unslashed Finance.

By popular demand after a successful run of BENQI’s liquidity mining on KyberSwap, we’ve decided to launch a second phase, extending a couple by popular demand and introducing new pools!

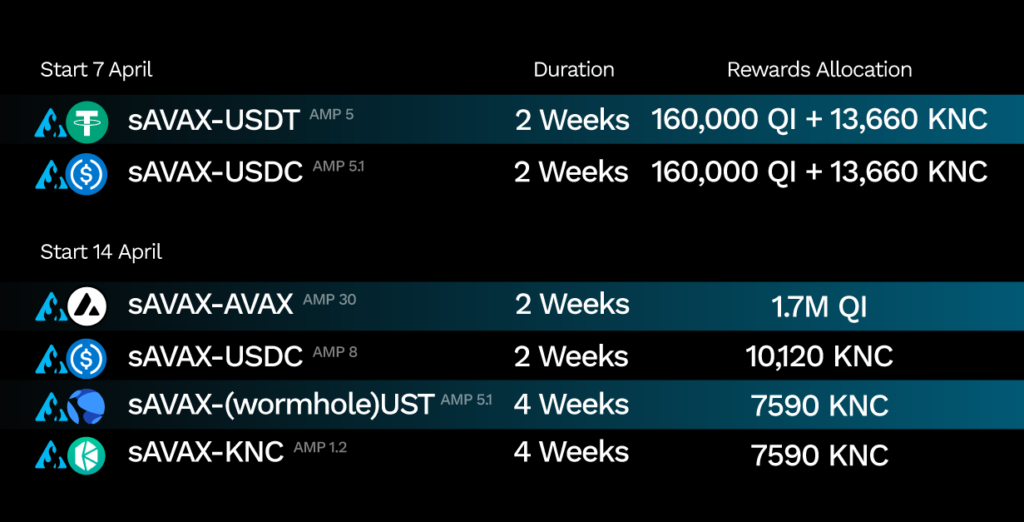

From ~7th April SGT, liquidity providers can add any amount of liquidity to the eligible sAVAX-USDt and sAVAX-USDC pools to unlock their share of QI and KNC liquidity mining rewards.

In addition, 4 new farming pools sAVAX-AVAX, sAVAX-USDC, sAVAX-(wormhole)UST and sAVAX-KNC launched on ~14th Apr SGT, bringing the total rewards to ~1.7M in QI and KNC!

PS: There is no need to unstake and restake your assets if you have previously staked in the sAVAX-AVAX and sAVAX-KNC pools.

The QI token is a native asset on Avalanche and oversees the entire ecosystem of the BENQI protocol including future iterations of the protocol. QI is required to vote and decide on the outcome of proposals through BENQI Improvement Proposals (BIPs).

UST is a stablecoin on the Terra blockchain. (Wormhole)UST refers to UST that has been wrapped using the Wormhole Bridge. Other than WBTC, it is a cross-chain asset available on KyberSwap. For more information and to learn how to use the bridge, please refer to this guide by the Wormhole team.

You can also borrow (wormhole)UST on Anchor Protocol using sAVAX as collateral. Learn how here.

BENQI Liquid Staked AVAX (sAVAX) is the token that users receive when staking their AVAX on BLS. It is the tokenized version of staked AVAX and accrues interest through Avalanche staking rewards. Users are able to exchange sAVAX for AVAX + staking rewards through the Unstake. AVAX holders can get $sAVAX by staking $AVAX on BENQI here.

Important Details:

1st Batch

Start: 7th April

Duration:

- sAVAX-USDt (AMP5): 2 weeks

- sAVAX-USDC (AMP5.1): 2 weeks

2nd Batch

Start: 14th April (SGT)

- sAVAX-AVAX (AMP30): 2 weeks

- sAVAX-USDC (AMP8): 2 weeks

- sAVAX-(wormhole)UST (AMP5.1): 4 weeks

- sAVAX-KNC (AMP1.2): 4 weeks

Vesting: No Vesting

Token Contracts (Please verify this yourself before trading):

- QI: 0x8729438EB15e2C8B576fCc6AeCdA6A148776C0F5

- KNC (Avalanche):0x39fC9e94Caeacb435842FADeDeCB783589F50f5f

- (Wormhole)UST: 0xb599c3590F42f8F995ECfa0f85D2980B76862fc1

How to Farm $QI and $KNC

- Visit Kyberswap.com

- Make sure you are on the Avalanche network and have some AVAX tokens for gas transaction fees on Avalanche.

- Visit the Pools page and add liquidity into the eligible pools. Eligible Rainmaker pools are identifiable by a raindrop 💧 icon. You will receive Liquidity Provider (LP) tokens representing your pool share after you add liquidity.

- Next, go to the Farm page and click Approve on the farm you wish to add liquidity to. Once approved, stake your LP tokens on the farm and you will start receiving QI and KNC rewards, which can be harvested anytime.

- Harvest your rewards whenever you want. There is no vesting period.

- Go to the Vesting tab to claim rewards once they are unlocked. Unlocked rewards can be claimed anytime.

- To remove liquidity, first, unstake your LP tokens on the Farm page, then go to the My Pools page to view and remove your liquidity position. For more details, read this guide on how to remove liquidity.

Watch our Tutorial Video for detailed instructions on Yield Farming! This video example is on Ethereum, but the steps are similar on Avalanche Network.

About BENQI

BENQI is a decentralized non-custodial liquidity market and liquid staking protocol built on Avalanche.

The lending protocol, which has over $2B in TVL, allows users to lend, borrow, or earn interest using their digital assets.

The liquid staking protocol, which currently has over $100M in staked, tokenizes staked AVAX and allows users to freely use it within Decentralized Finance dApps such as Automated Market Makers (AMMs), Lending & Borrowing Protocols, Yield Aggregators, etc. Additional information on BENQI’s products can be found here.

Website | Whitepaper | Twitter | Discord | Telegram

About Kyber Network

Kyber Network is building a world where any token is usable anywhere. KyberSwap.com, our flagship Decentralized Exchange (DEX), provides the best rates for traders in DeFi and maximizes returns for liquidity providers.

KyberSwap powers 100+ integrated projects and has facilitated over US$7 billion worth of transactions for thousands of users since its inception. Currently deployed across 10 chains including Ethereum, BNB Chain, Polygon, Avalanche, Fantom, Cronos, Arbitrum, Velas, Aurora and Oasis

KyberSwap | Discord | Website | Twitter | Forum | Blog | Reddit | Facebook |Developer Portal | Github |KyberSwap| KyberSwap Docs