FairFlow by KyberSwap – Where LPs get back arbitrage value.

Let’s begin!

What is FairFlow?

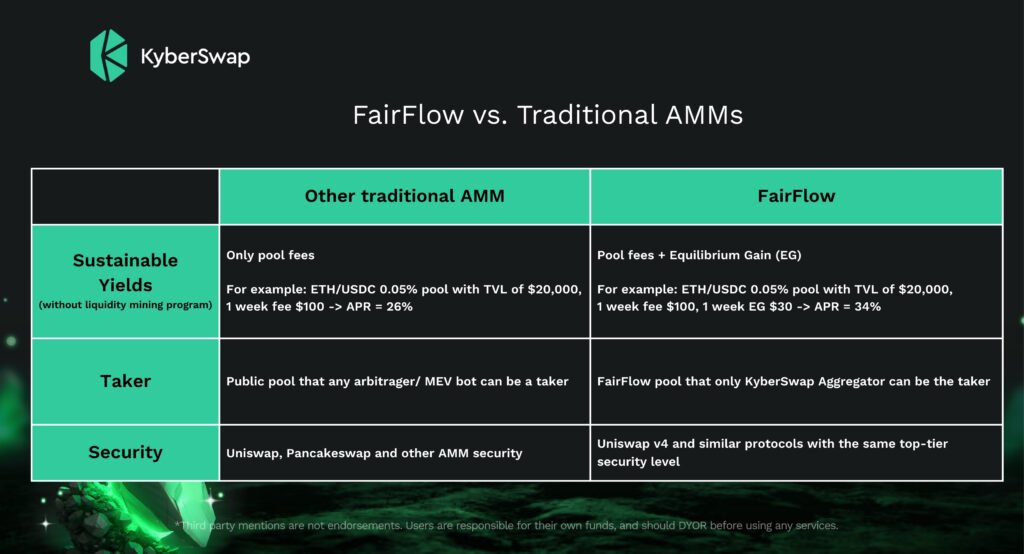

FairFlow is a swap hook that enhances liquidity pools, built on Uniswap V4 and similar protocols. It is designed to help LPs earn additional yields from arbitrage value besides LP fees – while maintaining top-tier security.

The arbitrage value, which would typically be captured by external MEV bots, is now redistributed back to LPs through our Equilibrium Gain (EG) Sharing Program, funded by the FairFlow hook. Furthermore, FairFlow doesn’t require LP token staking to earn EG Sharing. So, LPs can use them in other DeFi protocols to unlock additional yield opportunities and utility.

The Problem with Traditional LP Models

In traditional AMM models, LPs provide liquidity to earn LP fees (gain side) as compensation for Impermanent Loss (loss side). When prices revert to their original level to make Impermanent Loss equal zero, it may appear that LPs haven’t lost anything. However, in reality, LPs still incur Opportunity Value Loss, which is captured by arbitrage activity.

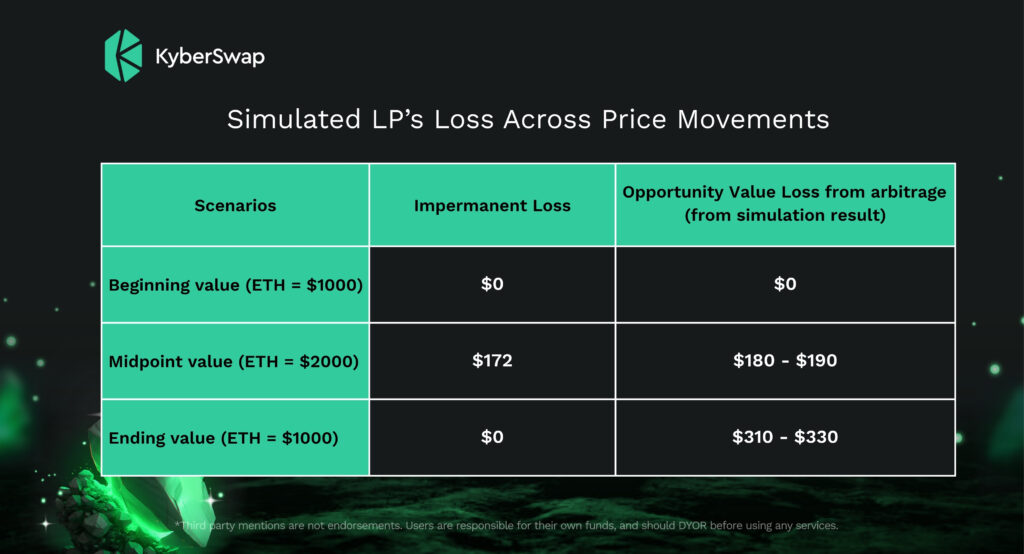

To simplify the concept, we have a basic example here (some technical details have been omitted for the sake of simplicity): Imagine you provide full-range liquidity with 1 ETH + 1,000 USDC when ETH is priced at $1,000.

- When ETH price increases to $2,000, your LP position rebalances to ~0.707 ETH and 1,414 USDC which is equivalent to selling ~0.293 ETH for 414 USDC. However, if you kept your ETH and sold it now, you would have received 586 USDC.

- The $172 difference (586 USDC – 414 USDC) represents Impermanent Loss. It also reflects the Opportunity Value Loss from arbitrage in a simple case where the pool doesn’t rebalance automatically, the LP can withdraw 0.293 ETH by adding 414 USDC (to rebalance the pool) and sell these ETH elsewhere for 586 USDC.

- Later, when ETH returns to $1,000, your LP position reverts to 1 ETH and 1,000 USDC. Following the same logic, it’s as if you used 414 USDC to buy back ~0.293 ETH. However, you could have repurchased ~0.293 ETH for just 293 USDC. This results in an additional Opportunity Value Loss of $121.

- At the endpoint (when ETH returns to $1,000), the LP incurs an $293 ($172+$121) in Opportunity Value Loss* from arbitrage activity in a simple case – even though the Impermanent Loss is zero.

*In reality, the Opportunity Value Loss from arbitrage can be greater than in the simplified example, because prices typically do not move directly from $1,000 to $2,000 and back. Instead, they fluctuate intensively in between, creating more opportunities for arbitrage activities.

Note: This simplified example is for conceptual illustration only. The figures are not based on any simulation. Refer to the table below for actual simulation results.

How FairFlow Solves It

Return Opportunity Value Loss From Arbitrage To LPs

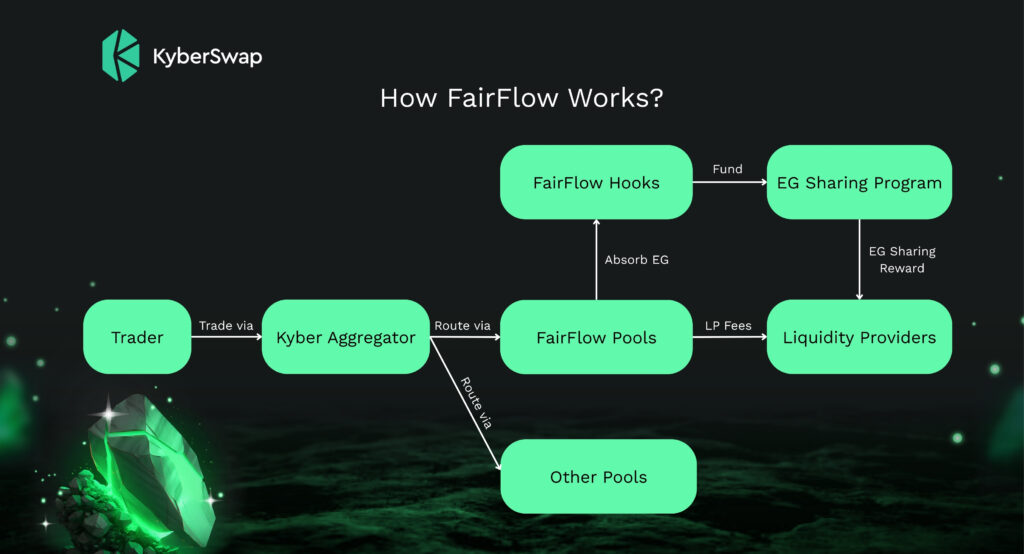

Instead of allowing arbitrage profits to be fully captured by external arbitrageurs, FairFlow redirects these profits back to LPs – known as Equilibrium Gain (EG) – through EG Sharing Program.

This is made possible because the KyberSwap Aggregator is the only taker for FairFlow pools, blocking external arbitrageurs from fully extracting value. As a result, the majority of arbitrage profits generated within FairFlow pools are captured by the FairFlow hook and then redistributed to LPs.

Here’s a simple explanation and example to help you understand how FairFlow works:

A user wants to trade 10,000 USDC for ETH via KyberSwap Aggregator.

Behind the scenes, the KyberSwap Aggregator checks prices across various pools and FairFlow pools to determine that the fair market output should be 2.88 ETH.

If the FairFlow pools offer better output compared to the fair market output, KyberSwap Aggregator will ask FairFlow pools signer for a signature of the fair market price. Then KyberSwap Aggregator will return to the taker the signature and a trading route that partially goes through the FairFlow pools.

If part of the trade is routed through the FairFlow pools – say 1,000 USDC – and that portion returns more than expected based on the signed reference (e.g. 0.30 ETH instead of 0.288 ETH), the difference (0.012 ETH) is recognized as Equilibrium Gain (EG).

Note: From the beginning, the taker received a quote that includes the fair market output so 0.288 is what they expected

In this case, KyberSwap Aggregator is the only taker for FairFlow pool so this Equilibrium Gain (EG) is absorbed by FairFlow hook, rather than going to external arbitragers, and later redistributed to LPs via EG Sharing Program.

How is Equilibrium Gain (EG) actually distributed back to LPs?

The total EG is split into two parts:

- EG Sharing Program (70%): Distributed to each position proportionally to its EG contribution.

- Platform (30%): Allocated to the platform, which may distribute it to Partners (Token teams & Platforms), KyberSwap, KyberDAO or reserve it for LM program and other future rewards.

Positions earn an EG Sharing based on their contributed EG. EG Sharing Program directly distributes rewards in the two tokens of the token pair, and the cycle for EG distribution is on a weekly basis.

Note: The EG Sharing Program structure may be revised in the future.

Earn EG Rewards Without Sacrificing Other Utilities

Since EG Sharing Program (also LM Program) doesn’t require LPs to stake their LP tokens in a farming contract to receive EG Sharing (and also LM reward), they can freely use those LP tokens in other DeFi protocols to earn additional yield.

For example:

- An LP holds a USDC/ETH LP token: 0x2AC03BF434db503f6f5F85C3954773731Fc3F056.

- They can claim their EG Sharing on KyberSwap in both tokens of the pair, without needing to stake the LP token.

- At the same time, the LP token can be used elsewhere – such as lending or staking platforms – for further yield opportunities and utility.

This flexibility is made possible by FairFlow’s off-chain reward mechanism. Unlike traditional AMMs where rewards are calculated via on-chain farming contracts, FairFlow tracks LP participation off-chain and distributes EG Sharing to LP token holders. This design also helps reduce staking-related risks for LPs, as no staking is needed.

Dive into FairFlow’s Equilibrium Gain and Liquidity Mining

Once you grasp FairFlow’s concept, let’s dive deeper into how EG is calculated, distributed, and the LM formula.

How EG is calculated

Off-chain

Whenever the aggregator algorithm produces a route for a user’s request that includes FF pools, a fair price calculation is triggered through collaboration between the aggregator and the FF backend.

The additional value contributed by the FF pools is determined as the difference between:

- The best route including FF pools, and

- The best alternative route excluding FF pools.

A portion of this additional value is recognized as potential EG. The remaining value stays embedded in the route to ensure the taker still gets a competitive rate.

Based on the calculated potential EG, the FF backend computes a fair price and generates a signature for it. This signed fair price is then included in the user’s transaction.

On-chain

When the transaction reaches the blockchain, the hook checks the signed fair price against the actual on-chain outputof the FF pools.

If the actual result from the FF pools is better than or equal to the signed fair price:

- The pools deliver the fair price result to the taker.

- The pools absorb the difference internally (the EG).

If the actual result is worse than the fair price:

- The pools instead deliver the actual on-chain result to the taker.

- No EG is absorbed in this case.

How EG sharing is distributed

EG sharing for each position will be calculated and be displayed in near real-time, with approximately a 5-minute delay after blockchain confirmation. These rewards will accumulate over a fixed cycle, currently set to 7 days. At the end of each cycle, a new cycle will begin immediately.

The rewards from the completed cycle will enter a validation period of 48 hours (currently). Once validated, our internal system will transfer the accumulated EG sharing funds to the distribution smart contract.

The accumulated EG sharing will be split between the LP Pool and Kyber (as the hook owner), with 70% allocated to the LP Pool and 30% to Kyber (This ratio is subject to change based on prevailing policies or governance decisions).

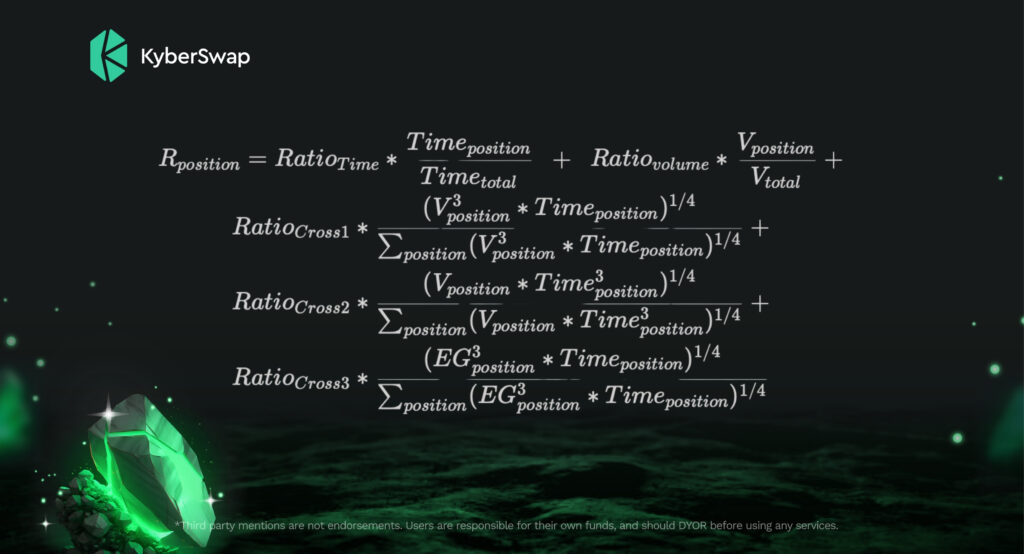

Liquidity Mining Formula

The liquidity‐mining reward for any given position is calculated based on three components:

EG generated by the position

How much EG, the position actually produces over time: EG_position

Volume and fees supported

The trading volume routed through the position and the fees it earns: V_position

Active time

The position’s proportion of the pool’s active liquidity (analogous to “seconds per liquidity” in a tick‐based AMM): Time_position.

Putting it all together, a position that generates lots of EG, attracts high volume (and thus fees), and represents a sizable slice of the pool’s liquidity will earn a high LM rewards.

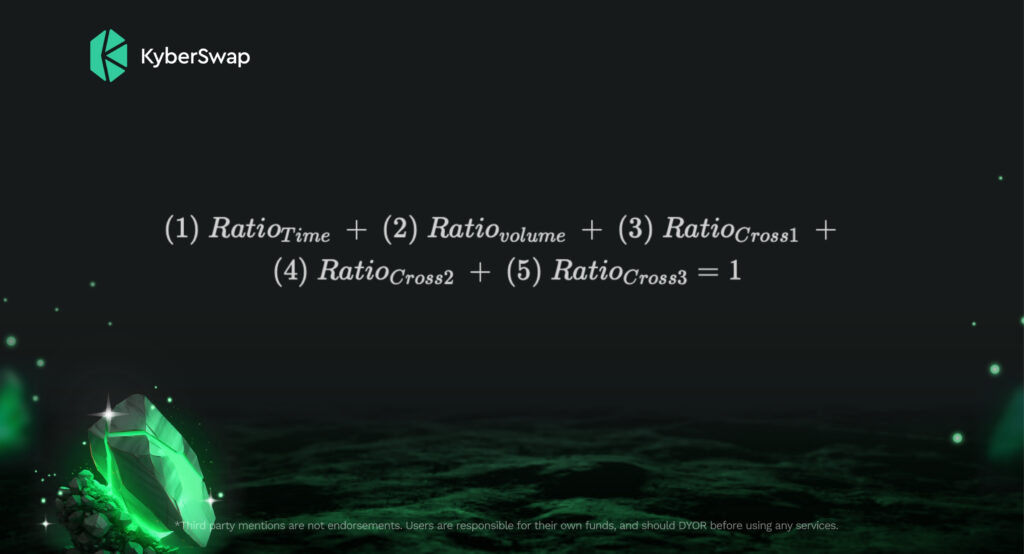

The LM reward sharing of a position is calculated as following:

Where the allocations for each factors/ cross-factors are pre-determined by the LM campaign creator:

How Does FairFlow Perform Compared To Traditional Pools? A Data Comparison

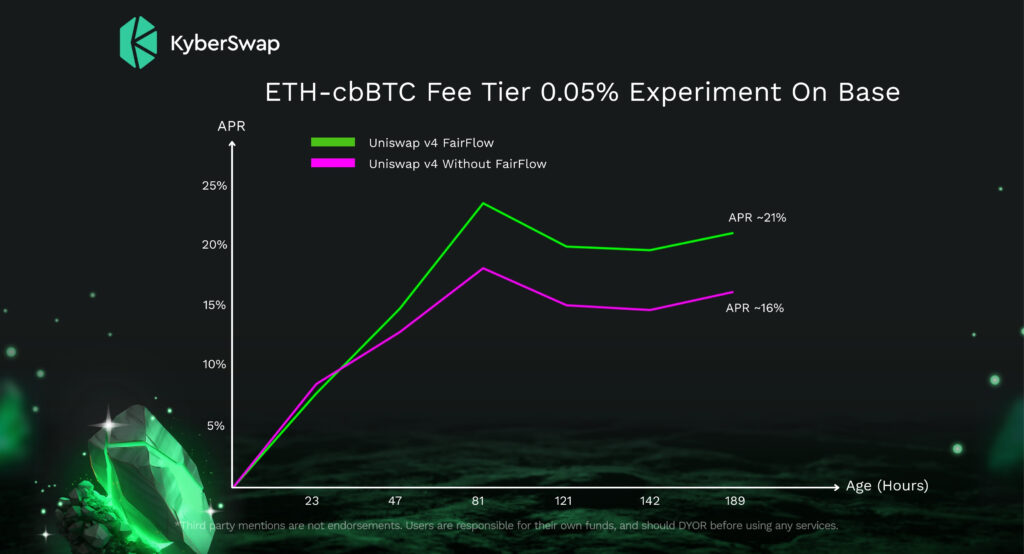

The KyberSwap team conducted multiple experiments to evaluate the effectiveness of FairFlow. In this case, we will give LPs the example of ETH/cbBTC 0.05% pool on Base.

The results show that Uniswap v4 FairFlow consistently delivers a higher APR for LPs compared to a standard Uniswap v4 pool across most timeframes. After 189 hours of experiment, Uniswap v4 FairFlow 0.05% pool delivered an APR of nearly 21%, while the standard pool only reached 16%.

Getting Started With FairFlow

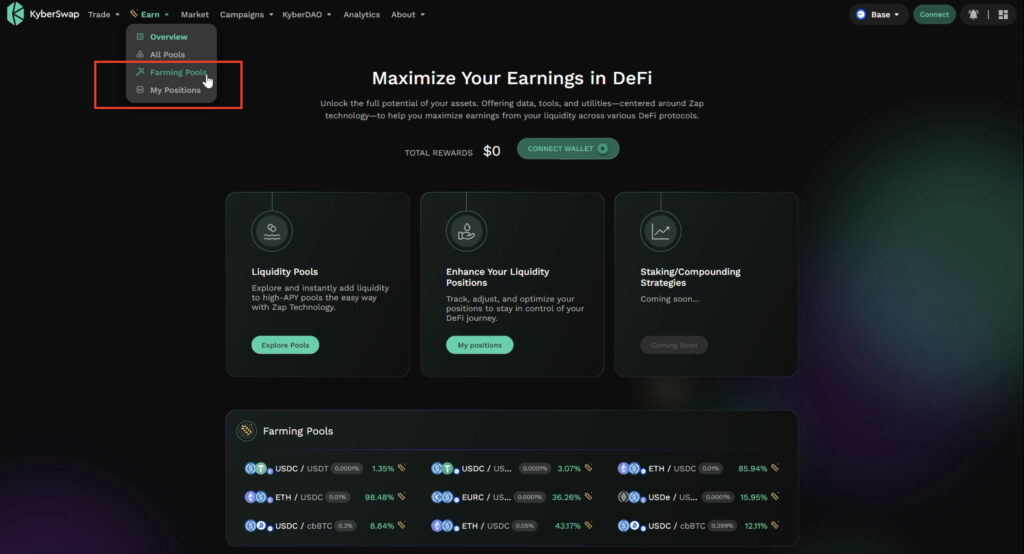

Step 1: Go to “Earn” and select “Farming Pools”

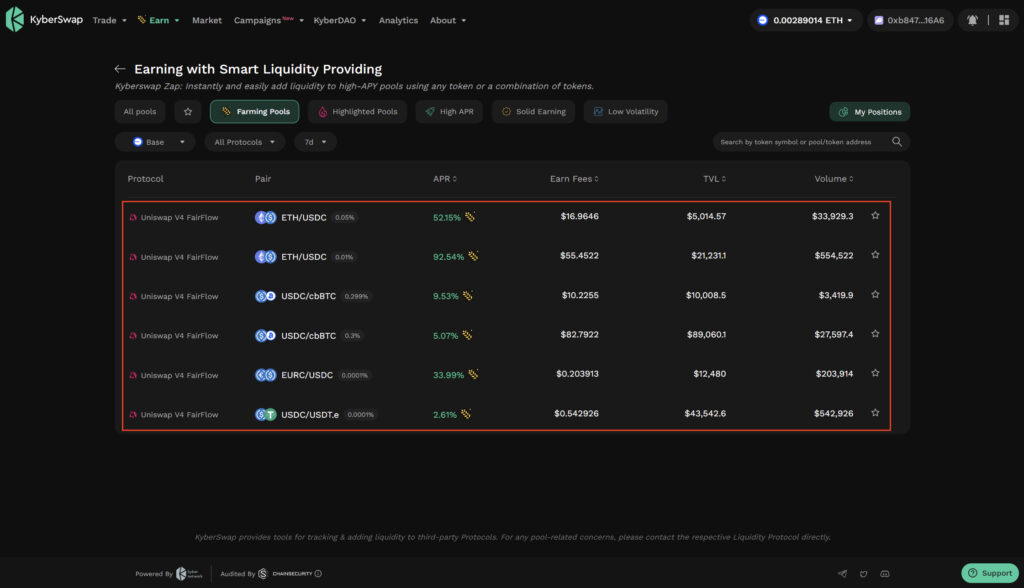

Step 2: Select the pools where you want to add liquidity.

FAQ

1/ Is FairFlow safe? Who holds the funds?

Funds are held directly in Uniswap V4’s and similar protocols’ pools, not by KyberSwap, FairFlow only adds a swap hook layer to control taker access and absorb EG, which does not add any security issues to LPs. You can refer to this document for reference: https://docs.uniswap.org/contracts/v4/quickstart/hooks/swap

FairFlow hook smart contract is audited by Omniscia. Audit result: https://github.com/KyberNetwork/kyber-exclusive-amm-sc/tree/main/audits

2/ How can I claim my EG Sharing?

To claim EG Sharing, your wallet must hold the LP token at the time of claiming. If staked elsewhere, please unstake it first.

3/ Is FairFlow only applicable on Uniswap v4?

No. FairFlow initially launched on Uniswap V4 pools, but we plan to expand support to other similar protocols in the future.

4/ Can the EG Sharing Program change over time?

Yes. The EG Sharing Program, funded by the FairFlow hook, is subjected to constant evaluation and re-adjustment.

5/ How is the EG Sharing Program different from a Liquidity Mining Program?

Yes, they are different. The EG Sharing Program is funded by actual arbitrage opportunity (real cash flow), while traditional Liquidity Mining programs mainly rely on short-term token incentives provided by the project.

6/ Can Liquidity Mining Program be run alongside the EG Sharing Program?

Yes, Liquidity Mining Program can be run alongside the EG Sharing Program. Our objective is to maximize value for Liquidity Providers (LPs). KyberSwap will continuously evaluate high-potential pools and, when feasible, launch supplementary Liquidity Mining campaigns. We may also engage with strategic partners to co-fund these initiatives and further enhance LP yields.

7/ How does the KyberSwap Aggregator ensure the best rate for takers while Equilibrium Gain (EG) is absorbed?

A FairFlow pool is included in the routing only when it offers a better rate than existing liquidity sources and adds value to the quoted rate. The FairFlow hook captures only a portion of this added value as Equilibrium Gain (EG), ensuring that takers still receive a superior output compared to routes that don’t include FairFlow.

8/ Does limiting FairFlow access to the KyberSwap Aggregator restrict takers from interacting with it?

No, it does not. Even though only KyberSwap Aggregator is allowed to swap with FairFlow, the KyberSwap Aggregator is available for all takers and currently one of the top aggregators with good market share, and have been integrated into major platforms/wallets/solvers/fillers, etc.