*Originally published by Loi Luu

Pre Kyber .

My journey started in 2014, before crypto and Ethereum became worldwide phenomena. Along with my early academic collaborators, some of whom ultimately became my Kyber Network co-founders, we were impressed by how fundamentally different and game-changing this technology was. In particular, the ability to run an entire global technological and economic system without relying on any centralized party felt like an entire new world.

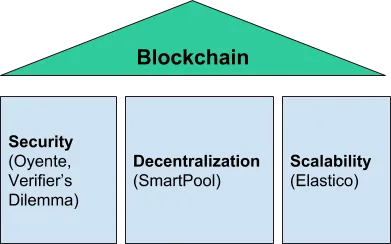

Being scientific problem solvers at heart, we were very motivated to improve the base technical layers — where we believed our work would have the most impact and where most of the contributions should be. As a result, our pre-Kyber work primarily centered around what I considered to be the 3 foundational pillars of the blockchain world, namely decentralization, scalability and security.

For each of these pillars, we contributed work that went on to become instrumental in the development of protocols widely recognized and adopted in the blockchain space. On security, we built Oyente, which was the first automated smart contract verification framework and one of the most used open-source auditing tools by security experts today (e.g. Melonport, Quantstamp). On decentralization, our work on Smartpool was focused on preventing over-centralization of mining pools, which made the underlying blockchain networks more secure and censorship-resistant. On scalability, our work on Elastico was the first proposed sharding solution for public blockchains and directly inspired the design of Zilliqa, currently one of the most promising scalable blockchain projects.

All these took several years of hard-work (amidst my PhD), but it was extremely rewarding and laid the strong technical foundations for Kyber to emerge. It was especially heartening to see how enthusiastic the entire community was to ideas that aimed to fundamentally change how incumbent economies worked. This enthusiasm was the key motivation to continue developing decentralized technology and solutions, despite the presence of major hurdles given the embryonic state of the technology.

While working on the base layer solutions gave us a lot of fun challenges and potentially allowed us to create significant impacts, we wanted to work on a platform that would allow us to bring the benefits of decentralized technologies to a much bigger audience, eventually to the non-crypto and non-technical users. As such, we made it a point to create a platform that can create direct impact and lay the foundation to unleash the potentials of decentralization to facilitate many other real-world use cases.

The key moment happened for us when a project approached us to discuss if it is possible to accept a different token in addition to Ethereum, with the intention to have common token-holders and community with the other token ecosystem. This would be beneficial for both sides, providing synergies while making the other token more useful as well. As we were working on it, we were surprised to see how hard this seemingly simple problem was.

Even for a single cross token transaction, there were a multitude of problems, ranging from incompatibility (token is different from Ether), finality of the payment (how to check if payment is confirmed), price feeds and so on. The challenge explodes if the contract wishes to accept more tokens among thousands of tokens out there, with the wide diversity of tokens, protocol standards and perceptions of value.

It turned out that no existing solution then addressed the problem or even talked about it, with the vast majority focused largely on the servings of professional traders and speculators. The more we worked on the problem, the more we realized the potential impact of solving it. Besides removing key hurdles that hinder the adoption of decentralized technologies, it would give equal access to services and platforms to token holders regardless of which token they hold.

Our goal, since that moment, was to facilitate seamless decentralized exchange between different projects, ecosystems. That we thought, might eventually lead to equalizing access to everyone, regardless of origin, location, power or background.

Kyber: The First Step

Kyber was hence constructed to be the first major step to achieve that goal, a decentralized platform for meaningful value exchange that is accessible to as many people as possible.

From the onset, the decision was made not to focus on the goals of supporting traditional trading techniques in the new crypto market, which count success based on artificial volume printout and could lead to unfair situations for end users. Instead, we strive to build a platform that could, over time, form the basis for a much more inclusive and transparent financial system.

After the initial token sale, our first step forward involved several key development phases.

- Building and shipping a well-tested token-conversion platform which is secure, publicly verifiable and supports a diverse pool of tokens.

- Delivering one of the most user-friendly interfaces for users in the decentralized space while proving the economic viability of our reserves model.

- Opening up the inter-token conversion platform to the most credible projects in the space, including MyEtherWallet, imToken, Request Network and many others.

All in all, more than 25,000 people participated in our token sale and used our platform across multiple interfaces. We are also incredibly lucky to have a global and diverse community that has always supported and believed in us through ups and downs since our inception. All these gave us the confidence and insights to open up the core platform so that it can be utilized in a much more expansive way.

In the last 9 months, the ecosystem blossomed as well. An incredible amount of innovation took place and a wide variety of projects were developed across the entire decentralized finance and commerce stack — ranging from mobile wallets, entirely new virtual goods economies, an ever-widening range of vendors who accept payments in crypto and decentralized hedge funds investing in crypto assets and so on. Tensions might arise at times between different parties due to competition and differences in philosophy, but everyone understood that ultimately, we were all working towards a different and, hopefully, much better global system. For us, our main focus was on how we can design Kyber to best enable them to reach their goals.

With both the platform and larger ecosystem ready, we were prepared to ship the broader strategy of Kyber. We first defined this strategy in our Kyber Network 2.0 event, followed by the release of our new website, developer portal and Kyber explainer. We will also be spending the months of July and August releasing more educational and communication material to articulate the broader strategy to the community, ecosystem and markets.

Kyber Awakens

The most obvious outcome of the current tokenized world would be the emergence of sheer number of tokens and protocols. Thousands of tokens, dozens of protocols are released each week, and most of these tokens are only accepted in their own ecosystem, or traded on exchanges. This obviously limits the usability and acceptability of tokens drastically. After all, what good is tokenizing assets if they cannot be used?

The next step of Kyber will be focused on connecting this fragmented tokenized world by enabling instant and seamless transactions between platforms, ecosystems and other use cases.

At the core of this is what we have been building since day one — an on-chain liquidity protocol that allows both open contribution of liquidity from token holders and open integration by any application to power their crucial liquidity and inter-token transaction needs.

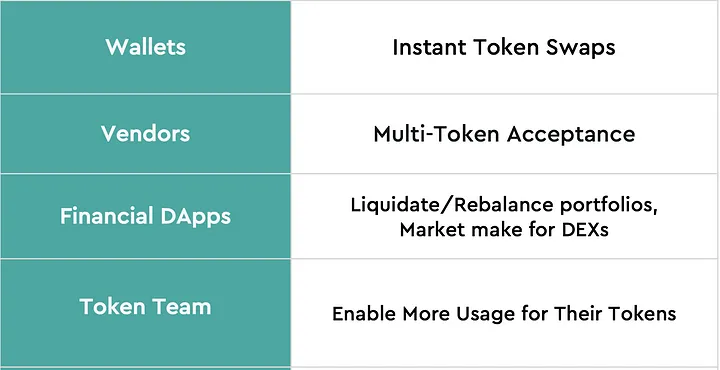

For example, wallets can have instant token conversions built in immediately, while vendors are able to accept payments in multiple tokens on their e-commerce platforms yet still receive in their preferred token. In addition, DApps can allow users who are not their token holders to utilize their platform and services with other tokens, and decentralized financial projects have the means to rebalance their portfolio instantly.

Liquidity is in turn facilitated through an open reserve architecture that allows anyone to contribute their idle token assets and earn from the spread in every transaction. These tokens become available for use across any platform that leverages our protocol, making them instantly more liquid and useful.

There are 3 key properties which anchor how we designed this open protocol:

- Inclusiveness: This protocol should allow as many parties, both big and small to contribute liquidity and tap into the protocol for their needs. This property of inclusiveness is also key to guaranteeing equal access to financial systems.

- Transparency: One of the most systemic reasons why decentralization leads to more robust systems is transparency, as most manipulations or financial crises happen due to information being obscured or not made available. This is why running all operations fully on-chain is a must in the liquidity protocol, allowing public verification and attestation to prevent potential frauds or disputes.

- Accessibility: To be widely adopted, the protocol must be platform-agnostic, allowing any application or protocol to tap into and leverage the liquidity pool, without limiting innovation and ecosystem diversity. Our key design focus is to be developer- and user-friendly to enable ease of integration and usage.

All these key principles go back to the idea of openness — namely, enabling any ecosystem player, big or small, to contribute to and tap into the contributed liquidity pool. In doing so, we can empower a whole new class of decentralized use cases to emerge — where the only limitation is the imagination of the ecosystem.

Kyber: Forward

Besides continuing to build out the platform, drive ecosystem adoption and articulate the broader strategy to the world, we are also preparing for the future by building our liquidity protocol to be more diverse, interoperable and scalable:

- Diversity: We will gradually open up reserves contribution to allow much larger token diversity. This will happen in 2 main steps, namely releasing the reserve documentation portal, and opening up the reserve protocol to allow anyone to freely contribute their available tokens into Kyber.

- Interoperability: We have been working with the ecosystem to enable greater integration with the entire crypto landscape, notably cross-chain support and seamless integration with popular protocols and DEXes.

- Scalability: We recently proposed Gormos, a new scaling solution that scales up on existing protocols by orders of magnitude, in addition to being cheaper and allowing faster settlement. Gormos will power applications that require a huge number of transactions without compromising on security or usability. This will be developed as an open source project by the entire ecosystem, and we will be using Gormos for Kyber as well to build a new infrastructure for a world with billions of active token pairs.

Kyber: Connecting The Tokenized World

Steve Jobs famously said in the commencement speech at Stanford that a lot of dots can only be connected backwards — and things make the most sense with the perspective of time. This was certainly the case for Kyber.

The core commitments to maintaining technical excellence, to making decentralized technologies accessible to as many people as possible and to making it easy for projects of all types to integrate with us — ended up being the technical and philosophical foundation upon which we are well-placed to connect what we believe will be the next phase of the tokenized world.

The first phase of the tokenized world arrived when Bitcoin created the first token as we know it. Ethereum dramatically accelerated the evolution when it made it easy to tokenize assets and created the first widely adopted token interoperability standard, ERC-20. We believe the next phase will be one where the majority of tokens become widely liquid, usable, and accepted for as many use cases as possible.

Scenarios that will be commonplace in the future will be ones where anyone who owns tokens, can easily and freely use these tokens in any context they wish. One can use gold-backed tokens to buy a T-shirt in a matter of seconds, invest in alternative funds in a completely different part of the world or use tokenized real estate to buy jewellery for a loved one.

That is the future that Kyber enables. Tokens in our protocol can be utilized across a wide variety of context and use cases, making them instantly more liquid and useful. Kyber therefore, aims to be the bridge between otherwise isolated token ecosystems and connecting the fragmented tokenized world.

Nothing significant in the decentralized space can be accomplished by any single entity alone, but rather require the collective efforts across a wide range of players. We are 100% committed to empowering and working alongside everyone who is working on the same mission — to create a more transparent, inclusive and accessible global financial system.

Together with the entire crypto ecosystem and our wonderful Kyber community, we look forward to enabling the next phase of the tokenized world together.