Build with Compound and Kyber to win up to $5000 in cDAI! (from a $42,000 prize pool)

Great to have Compound, a well-known project in the DeFi space, as our Hackathon Tech Partner!

Integrating Compound with Kyber Network for our #KyberDeFi Virtual Hackathon ? Compound is offering a total of $5000 in cDAI for their bounty rewards! (from a total hackathon prize pool of $42,000).

Compound Bounties — up to $5000 in cDAI

- Compound x Kyber Prize: $3,500

$3,500 in cDAI for the best project that uses/integrates both Compound and Kyber - Compound x Kyber (Runner-up): $1,500

$1,500 in cDAI for the Runner-up project that uses/integrates both Compound and Kyber

What is Compound?

Compound is an autonomous money market protocol, that lets users earn interest on and borrow Ethereum assets. The Compound protocol has over 100 million dollars worth of assets(source: defipulse.com) available to developers, today, that you can programatically access.

Inside the protocol, lending balances are tokenized; these are called cTokens. They represent the interest that a user is earning, and can be programmed, traded, and transferred. Users can frictionlessly borrow any supported asset from the protocol, using cTokens as collateral.

Compound has been getting more recognition in the space, receiving a $1million investment from Coinbase in the form of a “USDC Boostrap fund” to improve USDC liquidity on their platform.

Compound has also been audited by Trail of Bits and OpenZeppelin, and the protocol was formally verified in partnership with Certora.

How are interest rates on Compound set?

Interest rates are a function of the liquidity available in each market, and fluctuate in real-time based on supply and demand. When liquidity is plentiful, interest rates are low. As liquidity becomes scarce, interest rates increase, incentivizing new supply and the repayment of borrowing. You aren’t locked into an interest rate — expect it to change frequently.

How do I borrow an asset on Compound?

The Compound protocol relies on collateral to determine how much you can borrow — each of your balances in the protocol (cTokens) can be used as collateral to borrow assets.

Borrowing is instant, and borrowed assets are transferred from the protocol directly into your wallet.

How does collateral work, exactly?

Each supported asset has its own collateral factor, which represents the percent of the asset’s value that you can borrow. High quality, liquid assets have high collateral factors; smaller, or thinly traded assets have low collateral factors.

For more information, please read Compound FAQ.

What can you build with Compound? Hackathon Ideas

There are no wrong ideas! The Compound team is most excited about borrowing use-cases, and will help you build any conceivable application, but here are a few suggestions to get you thinking:

- Trade cTokens (representing balances inside Compound) on Kyber or a trading venue

- Margin trade using borrowed tokens on Kyber or a trading venue

- Create a “flash-lending” pool using Compound liquidity

- Create a system to allow users to easily repay their borrow balances using another asset (such as Ether), executed on Kyber or a trading venue

- Create a portable CDP-like system for Compound borrowing

- Help users prevent liquidation

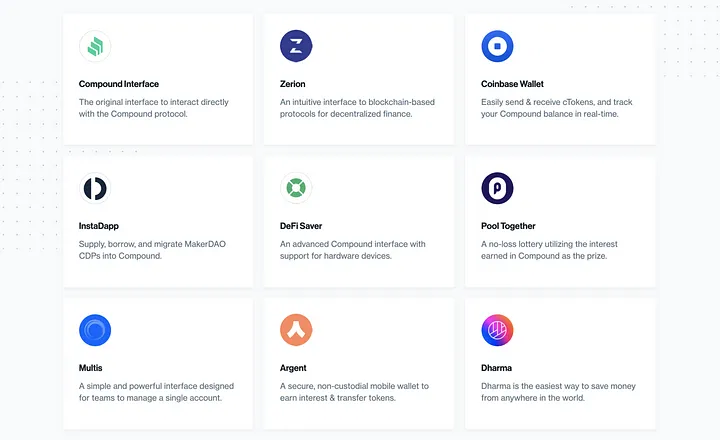

Community-built Interfaces on Compound

As a protocol, Compound is perfect for developers looking to build products that help users earn interest, or finance their ambitions. Here are some projects that have integrated Compound:

- Zerion is a portfolio monitoring & management tool for open finance, and allows users to seamlessly earn interest. Besides Compound, Zerion is going to integrate Kyber’s protocol as well.

- InstaDapp, which provides a convenient Supply and Borrowing interface to Compound, alongside CDP, Kyber Network and Uniswap support.

- Coinbase Wallet is the easiest way to interact with Ethereum applications, and has integrated cToken balances.

- Dharma is the easiest way to save money from anywhere in the world.

- Others include Compound Interface, DeFi Saver, Multis, Argent, Pool Together.

Compound Technical Resources

Compound Social Media

The team behind Compound

Robert Leshner is the Founder of Compound, and leads the team building the autonomous money market protocol. We’re glad to have Robert as one of our hackathon judges!

#KyberDeFi Virtual Hackathon — Build with Compound

Come join the #KyberDeFi Virtual Hackathon! Help us build the future of DeFi with bZx, Chainlink, Compound, Melon, Synthetix, WBTC, and other ecosystem builders.

💰Over $42,000 in prizes to be won!

Submission Period: 9 Sep-21 Oct

- Details: http://bit.ly/2m82RvL

- Register now: https://kyber.devpost.com/

- Join hackathon discord: https://discordapp.com/invite/nuWr2KF

Please contact Shane on Telegram for more information.