Farm with $ETH, $USDC, $MAI, $AAVE, $DAI, $LDO $USDT, $stMATIC, $WTBC and unlock your share of over $130,000 in incentives!

Concentrated liquidity mining on KyberSwap Elastic continues with 12 more farms to bring higher capital efficiency and optimized earnings for liquidity providers on Polygon!

This first phase of this initiative is set to bring liquidity providers over 120,000 KNC in liquidity mining rewards, with more incentives to come in the near future!

Polygon is a decentralized Ethereum scaling platform that enables developers to build scalable user-friendly dApps with low transaction fees without ever sacrificing security. Its core component is Polygon SDK, a modular, flexible framework that supports building multiple types of applications.

Polygon provides a wide variety of modules developers can use to easily deploy and configure their own custom blockchain. These include consensus and governance modules, as well as a variety of execution environments and virtual machine implementations.

Liquidity Mining with KyberSwap Elastic on Polygon

From 22 September, liquidity providers can choose from 12 eligible pools on KyberSwap Elastic to deepen liquidity on Polygon and earn KNC incentives!

Don’t forget, LPs can enjoy the advantages of concentrated liquidity, auto-compounding, multiple fee tiers and JIT protection all on KyberSwap Elastic!

Learn more about KyberSwap Elastic here.

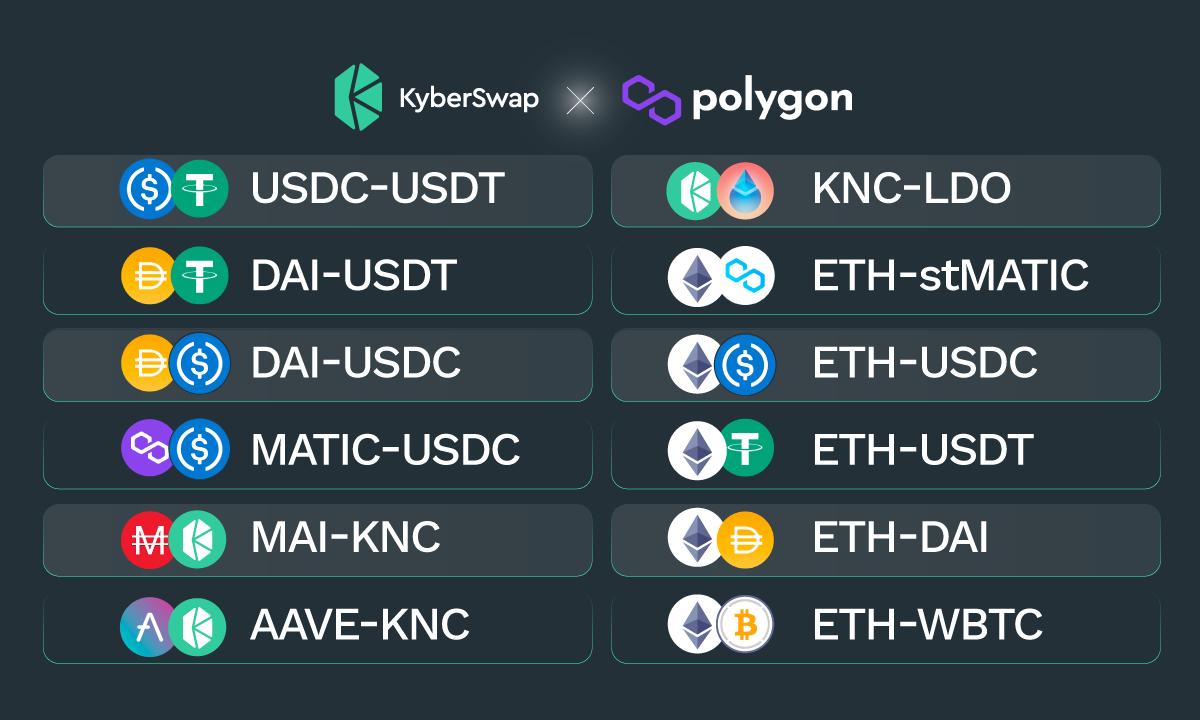

Important Details: Eligible Pools (Fee Tier):

- USDC-USDT (0.008%)

- DAI-USDT (0.008%)

- DAI-USDC (0.008%)

- MATIC-USDC (1%)

- ETH-stMATIC (0.04%)

- ETH-USDC(0.04%)

- ETH-USDT (0.04%)

- ETH-DAI (1%)

- ETH-WBTC (0.04%)

- MAI-KNC (0.04%)

- AAVE-KNC (1%)

- KNC-LDO (1%)

*Full list of eligible pools for Yield Farming on Polygon can be viewed here.

**Eligible pools for yield farming will be marked with a money bag icon.

KyberSwap: Benefits for Polygon Ecosystem

1. For Traders

- Best swap rates for USDC, USDT, ETH, DAI, MAI, AAVE, LDO, StMATIC, WBTC, KNC tokens through DEX aggregation, while letting users identify other tokens even before they trend/moon via on-chain metrics

2. For Liquidity Providers

- Concentrated liquidity for any token pair, stables and non-stables

- Auto-compounded LP (liquidity provider) fees

- Bonus liquidity incentives through yield farming

- Sniping/Just-in-time attack protection to protect the earnings for Polygon LPs

3. For Developers

- Dapps can integrate with KyberSwap’s pools and aggregation API to provide the best rates for their own users, saving time and resources.

Summary of Farming Process

- Get the tokens you want to add liquidity for on Polygon (USDC, USDT, ETH, DAI, MAI, AAVE, LDO, StMATIC, WBTC, KNC)

- Add liquidity for the eligible Elastic pools and you will receive an NFT that represents your liquidity position

- Deposit your liquidity position NFT to the farming contracts

- IMPORTANT: Stake the deposited liquidity position NFT in the farm to start getting rewards

Full Details on How to Farm on KyberSwap Elastic

Deposit Liquidity

- On KyberSwap, under “Earn -> Pools”, select [Elastic Pools]

- Add liquidity to the eligible pools at the fee tiers mentioned above.

- Key in your deposit amount for the token pair. Approve the tokens if you have not done so earlier.

- Input a custom price range in which you would like to provide liquidity by indicating the min price and the max price of that range. A narrower range gives your higher concentrated liquidity and more fees, while a bigger range would give a higher chance of the pool always being active (and get yield farming rewards).

- After adding liquidity, you will receive an NFT (non-fungible token) that represents your liquidity position. (You can view your liquidity positions on the “Earn -> My Pools” page.)

Note: While you can deposit both ‘Out of range’ and ‘In range’ liquidity positions, only your ‘In range’ liquidity positions will earn you farming rewards.

If your ‘Out of range’ liquidity position becomes active again, and you’ve already deposited it into the farming contract, you’ll start earning rewards for this liquidity position as well.

So make sure when you add liquidity, input a min and max price for your chosen token pair that would not go out of range!

Staking

- On the “Farm” page, select the same farm you added liquidity for. Click [Deposit] and select your liquidity position NFT (ID number). Click [Deposit Selected], approve and wait for your transaction to be confirmed.

- *IMPORTANT* After depositing your liquidity position NFT, click the [+] button to stake your deposited NFT.

- Note: If the [+] button is disabled, it means that you haven’t deposited your NFT liquidity positions into the farming smart contract yet. You MUST stake your liquidity position NFT in the farm to start accumulating rewards (depositing the liquidity position NFT earlier is not enough).

Harvesting & Claiming Rewards

- On the “Farm” page, click the “axe” icon button on the far right of the farm you want to harvest from, or the “Harvest All” button.

- A “Harvest” popup will be displayed and you can see the rewards you have accumulated so far in terms of total dollar value and in terms of individual tokens. Click on “Harvest”.

- To claim rewards, click on [Vesting] on the Farm page and click on [Claim] button under [Vesting Schedules] to claim the harvested rewards that have been unlocked. If there is no vesting period, your rewards are unlocked immediately after harvesting them.

Unstaking

- To unstake your NFT, simply click on the [-] button on the Farm.

- You will see a popup prompting you to select the liquidity position NFT you wish to unstake. Make your selection and click [Unstake Selected]. Confirm and wait for your transaction to go through.

For more detailed instructions on farming with Elastic pools, please visit: https://docs.kyberswap.com/guides/how-to-farm

You can also view farming tutorials directly on KyberSwap or watch our tutorial video here:

KyberSwap — Trade & Earn at the best rates

Bullish on Lido Finance and/or L2 chains? Then stayed tuned to our announcements cos we got some news coming your way 😉