Ethereum-based liquid staking giant Lido Finance has chosen KyberSwap Elastic to enhance liquidity on Polygon!

Lido Finance is a state of the art liquid staking protocol, powering DeFi and CeFi applications alike in their vibrant ecosystem. Lido empowers stakers to put their staked assets to use on their supported networks: Ethereum, Solana, Polygon and Polkadot. As one of the biggest liquid staking protocols in DeFi, we are proud that Lido Finance has chosen KyberSwap to enhance liquidity for the benefit of all three ecosystems.

From 16th Aug, liquidity providers can choose from 5 stMATIC eligible pools on KyberSwap Elastic to deepen liquidity and earn $LDO & $KNC rewards!

With KyberSwap’s Elastic protocol, LPs can enjoy concentrated liquidity and compounding fees, giving you higher capital efficiency and maximizing rewards!

*Learn more about KyberSwap Elastic here.

Important Details:

KyberSwap x Lido stMATIC Farms

Eligible Pools (Fee Tier):

- stMATIC-WMATIC (0.01%)

- USDC-stMATIC (0.04%)

- stMATIC-USDT (0.04%)

- stMATIC-DAI (0.04%)

- stMATIC-MAI (0.04%)

*Full list of eligible pools for Yield Farming can be viewed here.

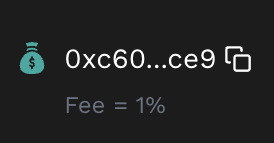

**Eligible pools for yield farming will be marked with a money bag icon.

How to get stMATIC?

Users can get stMATIC or Lido Staked Matic by staking MATIC on Lido and receive stMATIC while staking.

Alternatively, the easiest way to get stMATIC would be to buy directly on KyberSwap Polygon. Buying on KyberSwap gets you the best rates too!

KyberSwap: Benefits for Lido Ecosystem

1. For Traders

- Best swap rates for stMATIC through DEX aggregation, while letting you identify other tokens even before they trend/moon via on-chain metrics

2. For Liquidity Providers

- Concentrated liquidity for stMATIC pairs and any other token, stables and non-stables

- Auto-compounded LP (liquidity provider) fees

- Bonus liquidity incentives through yield farming

- Sniping/Just-in-time attack protection to protect the earnings for Lido LPs

3. For Developers

- Dapps can integrate with KyberSwap’s pools and aggregation API to provide the best rates for their own users, saving time and resources.

Summary of Farming Process

- Get the tokens you want to add liquidity for on Polygon (stMATIC, MATIC, USDC, USDT, DAI, MAI).

- Add liquidity for the eligible Elastic pools and you will receive an NFT that represents your liquidity position

- Deposit your liquidity position NFT to the farming contracts

- IMPORTANT Last Step: Stake the deposited liquidity position NFT in the farm to start getting rewards

Adding liquidity to Lido Elastic pools

- Under “Earn -> Pools” on Polygon, select Elastic Pools

- Add liquidity to the eligible pools at the fee tiers mentioned above.

- Key in your deposit amount for the token pair. Approve the tokens if you have not done so earlier.

- Input a custom price range in which you would like to provide liquidity by indicating the min price and the max price of that range. A narrower range gives your higher concentrated liquidity and more fees, while a bigger range would give a higher chance of the pool always being active (and get yield farming rewards).

- After adding liquidity, you will receive an NFT (non-fungible token) that represents your liquidity position.

- You can view your liquidity positions on the “Earn -> My Pools” page.

Farming on the Lido Elastic pools

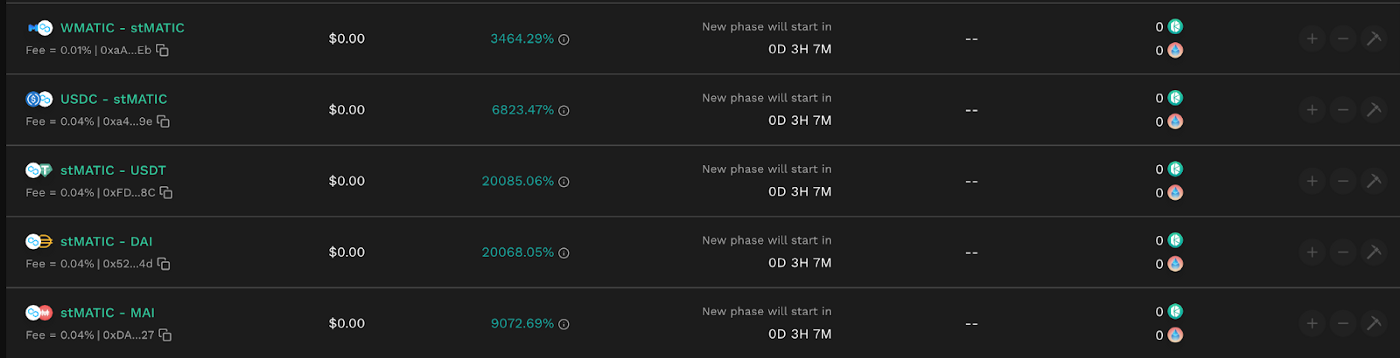

KyberSwap x Lido stMATIC Farms

- On the “Farm” page on the Polygon network, choose the Lido farm. Connect Wallet and click the “Approve” button to authorize your liquidity position NFTs to be accessed by the farming smart contract.

- Deposit liquidity position NFT: On the same Farm page, click the “Deposit” button to deposit your liquidity position NFT (ID number) into the farming smart contract so you can eventually stake them into the farms.

- *IMPORTANT* Stake your deposited liquidity position NFT: After depositing your liquidity position NFT, click the “+” button on the right of the Lido farm to stake your deposited NFT.

Note: If the “+” button is disabled, it means that you haven’t deposited your NFT liquidity positions into the farming smart contract yet.

Upon clicking the “+” button, a “Stake your liquidity” popup is displayed and you will be able to see all your liquidity position NFTs (shown as ID numbers) deposited in the earlier steps. The “Available Balance” against each liquidity position represents the liquidity that is available for staking into the farm.

Select the liquidity positions you want to stake into the farm, and click on “Stake Selected”. You MUST stake your liquidity position NFT in the farm to start accumulating rewards (depositing the liquidity position NFT earlier is not enough).

Your rewards will be calculated based on the value of your liquidity position staked in the farm relative to other farmers and how long your liquidity position has been active in the pool (i.e. in range).

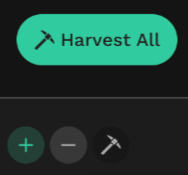

4. Harvest rewards: You can harvest your accumulated rewards whenever you want. To do so, in the “Farm” page, click the “axe” icon button on the far right of the farm you want to harvest from, or the “Harvest All” button.

A “Harvest” popup is displayed in which you can see the rewards you have accumulated so far in terms of total dollar value and in terms of individual tokens. Click on “Harvest”.

Harvest on KyberSwap Farm

5. Claim Rewards: Go to the ‘Vesting’ tab of the “Farm” page and click on the “Claim” button under the Vesting Schedules to claim the harvested KNC rewards that have been unlocked. There is no vesting period, so your rewards are unlocked immediately after harvesting them.

6. Once you have claimed successfully, you will see that the KNC reward tokens have been credited to your wallet!

Note: While you can deposit both ‘Out of range’ and ‘In range’ liquidity positions, only your ‘In range’ liquidity positions will earn you farming rewards.

If your ‘Out of range’ liquidity position becomes active again, and you’ve already deposited it into the farming contract, you’ll start earning rewards for this liquidity position as well.

So make sure when you add liquidity, input a min and max price for your chosen token pair that would not go out of range!

For more detailed instructions on farming with Elastic pools, please visit: https://docs.kyberswap.com/guides/how-to-farm

You can also watch the farming tutorial here:

KyberSwap Elastic Farming Tutorial

And for Polygon Bulls looking for more ways to earn, check out our KyberSwap x Polygon Trading Contest!

From 16th to 30th Aug, trade any token on KyberSwap on Polygon and stand to win a share of the $28,000 USDC rewards pool! Further details can be found on the KyberSwap Campaigns page.

That’s not all! If you haven’t heard, Lido Finance has announced that it will begin its expansion onto various L2 scaling services.

And isn’t KyberSwap deployed on several L2 chains….?

Stay tuned for further big news coming soon!

KyberSwap — Trade & Earn at the best rates