Add liquidity to the eligible pools KyberSwap Elastic on Avalanche and earn liquidity mining rewards!

KyberSwap x BENQI x Yeti Finance

BENQI and Yeti Finance have chosen to partner with the highly capital efficient KyberSwap in a joint initiative to enhance liquidity and provide the best rates for sAVAX and YUSD tokens on Avalanche.

This first phase of this joint initiative is set to bring liquidity providers over $200,000 in liquidity mining rewards, with more incentives to come in the near future!

With our newest protocol KyberSwap Elastic, liquidity providers can enjoy even better earnings and flexibility to plan individual earning strategies!

BENQI is a decentralized non-custodial liquidity market and liquid staking protocol built on Avalanche. The BENQI Protocol consists of:

- The BENQI Liquidity Market (BLM) protocol enables users to effortlessly lend, borrow, and earn interest with their digital assets. Depositors providing liquidity to the protocol earn yield, while borrowers are able to borrow in an over-collateralized manner.

- The BENQI Liquid Staking (BLS) protocol is a liquid staking solution that tokenizes staked AVAX to grant users the ability to utilize the yield-bearing asset within Decentralized Finance applications.

The QI token is a native asset on Avalanche and oversees the entire ecosystem of the BENQI protocol including future iterations of the protocol. QI is required to vote and decide on the outcome of proposals through BENQI Improvement Proposals (BIPs).

BENQI Liquid Staked AVAX (sAVAX) is the token that users receive when staking their AVAX on BLS. It is the tokenized version of staked AVAX and accrues interest through Avalanche staking rewards. Users are able to exchange sAVAX for AVAX + staking rewards through the Unstake. AVAX holders can get $sAVAX by staking $AVAX on BENQI here.

This is not the first time BENQI has partnered with KyberSwap for its capital efficiency benefits. Check out our previous article to learn about BENQI’s first joint initiative with KyberSwap!

Yeti Finance is a cross-margin lending protocol on Avalanche that allows users to borrow up to 21x against their portfolio of LP tokens, staked assets such as sAVAX, and yield-bearing stablecoins in a single debt position for 0% interest.

Farming and staking rewards are auto-compounded when interest-bearing token such as staked assets or LP tokens are deposited onto Yeti Finance’s platform, opening up numerous leveraged farming strategies.

Borrowers receive YUSD, an overcollateralized stablecoin which can be swapped for additional assets and subsequently re-deposited into Yeti Finance to build a leverage position.

Liquidity Mining with BENQI and Yeti Finance on KyberSwap Elastic

From 17th Aug, liquidity providers can add liquidity to the eligible sAVAX and YUSD pools on KyberSwap Elastic on Avalanche and earn KNC, QI and YETI rewards!

Don’t forget, with the Elastic protocol LPs can enjoy concentrated liquidity and compounding fees, giving you higher capital efficiency and maximizing rewards!

Learn more about KyberSwap Elastic here.

Important Details: Eligible Pools (Fee Tier)

KyberSwap x BENQI x Yeti Farms List

- sAVAX-AVAX (0.01%)

- sAVAX-YUSD (0.04%)

- USDC-YUSD (0.01%)

*Full list of eligible pools for Yield Farming on Avalanche can be viewed here.

**Eligible pools for yield farming will be marked with a money bag icon.

Summary of Farming Process

- Get the tokens you want to add liquidity for on Avalanche (sAVAX, AVAX, YUSD, USDC)

- Add liquidity for the eligible Elastic pools and you will receive an NFT that represents your liquidity position

- Deposit your liquidity position NFT to the farming contracts

- IMPORTANT Last Step: Stake the deposited liquidity position NFT in the farm to start getting rewards

KyberSwap: Benefits for the BENQI, Yeti Finance and Avalanche Ecosystem

1. For Traders

- Best swap rates for sAVAX and YUSD through DEX aggregation, while letting traders identify other tokens even before they trend/moon via on-chain metrics

2. For Liquidity Providers

- Concentrated liquidity for sAVAX, YUSD and any other token, stables and non-stables

- Auto-compounded LP (liquidity provider) fees

- Bonus liquidity incentives through yield farming

- Sniping/Just-in-time attack protection to protect the earnings for BENQI and Yeti LPs

3. For Developers

- Dapps can integrate with KyberSwap’s pools and aggregation API to provide the best rates for their own users, saving time and resources.

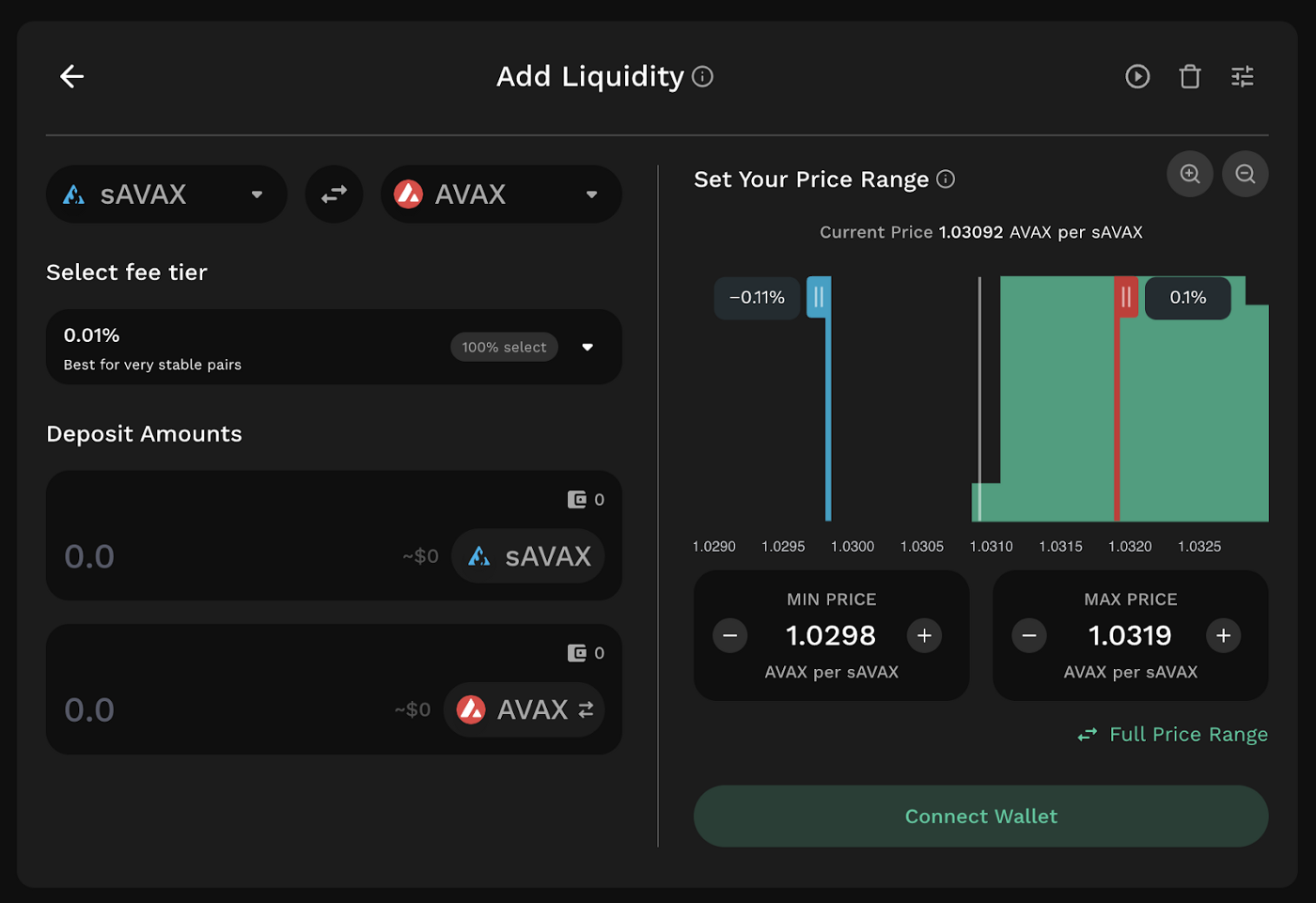

Adding liquidity to BENQI / Yeti Elastic pools

- Under “Earn -> Pools” on Avalanche, select Elastic Pools

- Add liquidity to the eligible pools at the fee tiers mentioned above.

- Key in your deposit amount for the token pair. Approve the tokens if you have not done so earlier.

- Input a custom price range in which you would like to provide liquidity by indicating the min price and the max price of that range. A narrower range gives your higher concentrated liquidity and more fees, while a wider range would give a higher chance of the pool always being active (and get yield farming rewards).

- After adding liquidity, you will receive an NFT (non-fungible token) that represents your liquidity position.

- You can view your liquidity positions on the “Earn -> My Pools” page.

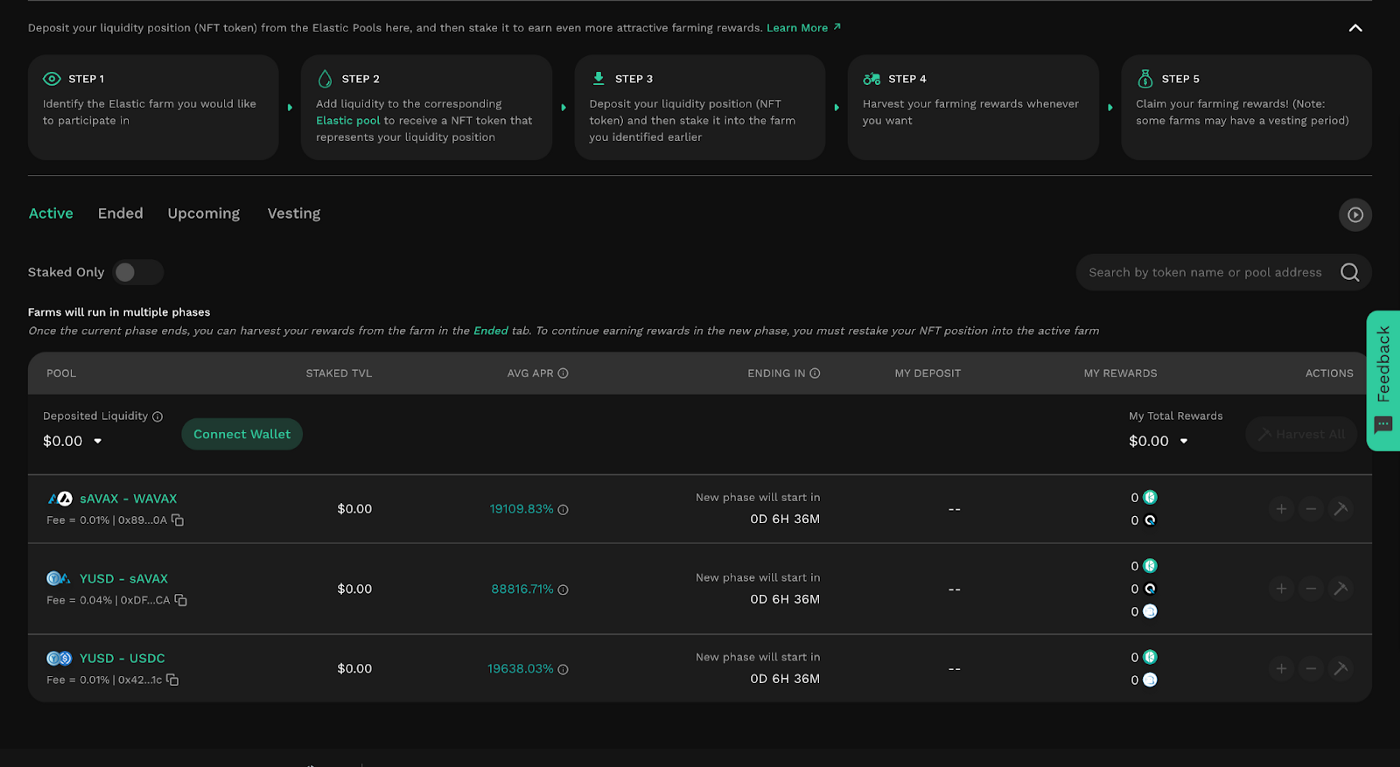

Farming on the BENQI / Yeti Elastic pool

BENQI x Yeti Farms on KyberSwap Elastic

- On the “Farm” page on the Avalanche network, choose the pool you wish to farm. Connect Wallet and click the “Approve” button to authorize your liquidity position NFTs to be accessed by the farming smart contract.

- Deposit liquidity position NFT: On the same Farm page, click the “Deposit” button to deposit your liquidity position NFT (ID number) into the farming smart contract so you can eventually stake them into the farms.

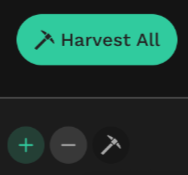

3. *IMPORTANT* Stake your deposited liquidity position NFT: After depositing your liquidity position NFT, click the “+” button on the right of the farm to stake your deposited NFT.

Note: If the “+” button is disabled, it means that you haven’t deposited your NFT liquidity positions into the farming smart contract yet.

Upon clicking the “+” button, a “Stake your liquidity” popup is displayed and you will be able to see all your liquidity position NFTs (shown as ID numbers) deposited in the earlier steps. The “Available Balance” against each liquidity position represents the liquidity that is available for staking into the farm.

Select the liquidity positions you want to stake into the farm, and click on “Stake Selected”. You MUST stake your liquidity position NFT in the farm to start accumulating rewards (depositing the liquidity position NFT earlier is not enough).

Your rewards will be calculated based on the value of your liquidity position staked in the farm relative to other farmers and how long your liquidity position has been active in the pool (i.e. in range).

4. Harvest rewards: You can harvest your accumulated rewards whenever you want. To do so, in the “Farm” page, click the “axe” icon button on the far right of the farm you want to harvest from, or the “Harvest All” button.

A “Harvest” popup is displayed in which you can see the rewards you have accumulated so far in terms of total dollar value and in terms of individual tokens. Click on “Harvest”.

5. Claim Rewards: Go to the ‘Vesting’ tab of the “Farm” page and click on the “Claim” button under the Vesting Schedules to claim the harvested KNC rewards that have been unlocked. There is no vesting period, so your rewards are unlocked immediately after harvesting them.

6. Once you have claimed successfully, you will see that the KNC reward tokens have been credited to your wallet!

Note: While you can deposit both ‘Out of range’ and ‘In range’ liquidity positions, only your ‘In range’ liquidity positions will earn you farming rewards.

If your ‘Out of range’ liquidity position becomes active again, and you’ve already deposited it into the farming contract, you’ll start earning rewards for this liquidity position as well.

So make sure when you add liquidity, input a min and max price for your chosen token pair that would not go out of range!

For more detailed instructions on farming with Elastic pools, please visit: https://docs.kyberswap.com/guides/how-to-farm

You can also watch the farming tutorial here:

KyberSwap Elastic Farming Tutorial

Happy farming!

But wait, that’s not all! Remember Avalanche Phase 2? Could Phase 3 be coming up soon?

Stay tuned for big news KyberSwappers!

KyberSwap — Trade & Earn at the best rates