Hello fellow Kyberians,

After 6 months of coffee-fueled hard work, weekly zoom meetings, and late night coding here we are on the eve of Katalyst’s launch. The excitement we’re feeling right now reminds us of our Kyber Network launch back in February 2018. We trusted the potential of our ideas, we knew we had a great team that could build our vision, and we couldn’t wait to execute on this vision. Two years on, we are ready to repeat this process once again and take Kyber to the next level of decentralization and growth.

So what happens next? As of tomorrow, with the deployment of the new Kyber smart contracts and the start of epoch 0 any KNC holder can stake their KNC in the KyberDAO. Governance voting will start a week later with epoch 1 and rewards to voters will be distributed two weeks after that with the start of epoch 2. Don’t worry if you’re not familiar with the various terms used here or are unsure of the timelines, we’ve written a guide to walk you through everything that’s happening in the next few days and months.

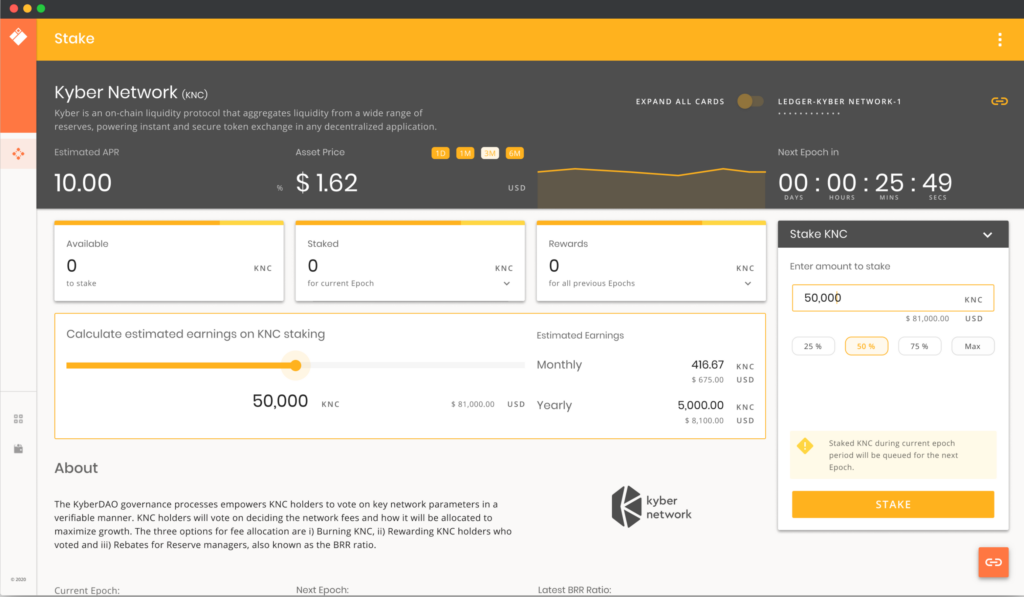

Great, so where do I stake?

Making the KyberDAO as easy as possible for you to participate in has always been a priority for us and over the last few months we’ve been working together with various teams to make this happen. We now have multiple ways to participate based on what flavour of participation a KNC holder would like to go for. Options range from simple and direct staking on Kyber.org, to using community-led pool masters who vote on your behalf and distribute the rewards to you, to using professional staking-as-a-service providers.

We’ve summarized the various options below (note: this is not an exhaustive list and we will announce new participation methods as they are released in the coming weeks and months)

Official Dashboard:

Kyber.org —A simple-to-use dashboard to stake, vote, and receive ETH rewards (goes live on 7th July, 7am GMT).

Pool Masters:

Unagii by StakeWithUs — Professional Staking-as-a-Service dashboard

Kyber Community Pool — Community-led pool (more below)

StakeDAO — Decentralized staking DAO launched by Stake Capital

xToken’s xKNC — Uses an xTtoken that accrues the KNC staking reward.

RockX — Professional Staking-as-a-Service company

Wallets:

Trust, imToken, Status, Alpha Wallet, Opera, Enjin, HTC Exodus and all other crypto wallets with in-built dapp browsers will provide access to Kyber’s staking DApp.

Other stakeholders and custodians:

Between the 19th of June and 26th of June we held the very important Pre-DAO poll where you, our community, voted on what the initial parameters for the Burn/Rebate/Reward (BRR) ratio as set by the KyberDAO should be. After over 400 votes the parameters decided on were:

- 65% Staking Rewards (ie. the share of the fees that is distributed to KNC stakers who voted in the previous epoch)

- 30% to Reserve Rebates for Fed Price Reserves (FPRs)

- 5% to be used for purchasing KNC tokens and subsequently burning them

It is now in the KyberDAO’s hands to steer these rates to their most optimal levels where Kyber Network’s growth is maximized. To join the debate please join our discord channel.

New Katalyst Participants

ParaFi Capital — We are really excited to announce that ParaFi Capital has taken a KNC position and aims to actively participate in the KyberDAO. Already active in both the MakerDAO and Compound governance processes, ParaFi are a highly experienced alternative investment firm with backgrounds from companies like JP Morgan, KKR & Co and TPG Capital.

We welcome the knowledge and experience they bring to the KyberDAO and look forward to their involvement. You can read the full details of our partnership here.

Kyber Community Pool — We had teased this in last month’s ecosystem update but we can finally unveil what DeFiDude and co have been up to these last few months. This new Kyber Community Pool does two things:

- Collects the pulse of what the Kyber community is thinking about in terms of protocol parameters and upcoming improvement proposals. It collects this pulse through discussions and polls on discord, twitter, telegram and reddit and comes to a consensus view.

- Votes in the KyberDAO based on this consensus view and allows any KNC holder to delegate their vote to this pool. This gives KNC holders who do not wish to actively participate in governance votes every two weeks the option to stake-and-forget while continuing to receive their ETH rewards.

You can read more details here and we would like to thank DeFiDude, Wayne, and Sasha for building this.

Kyber Network Stats

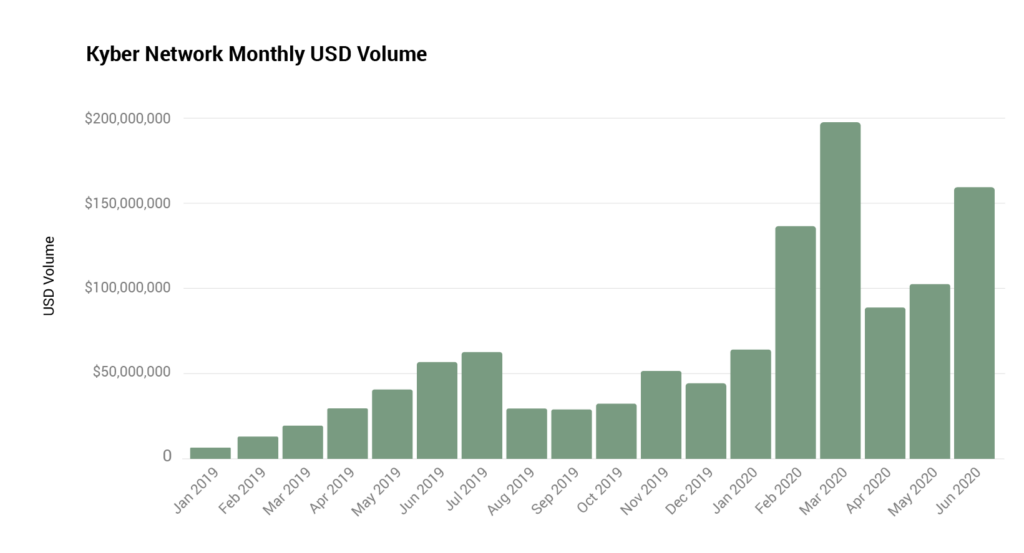

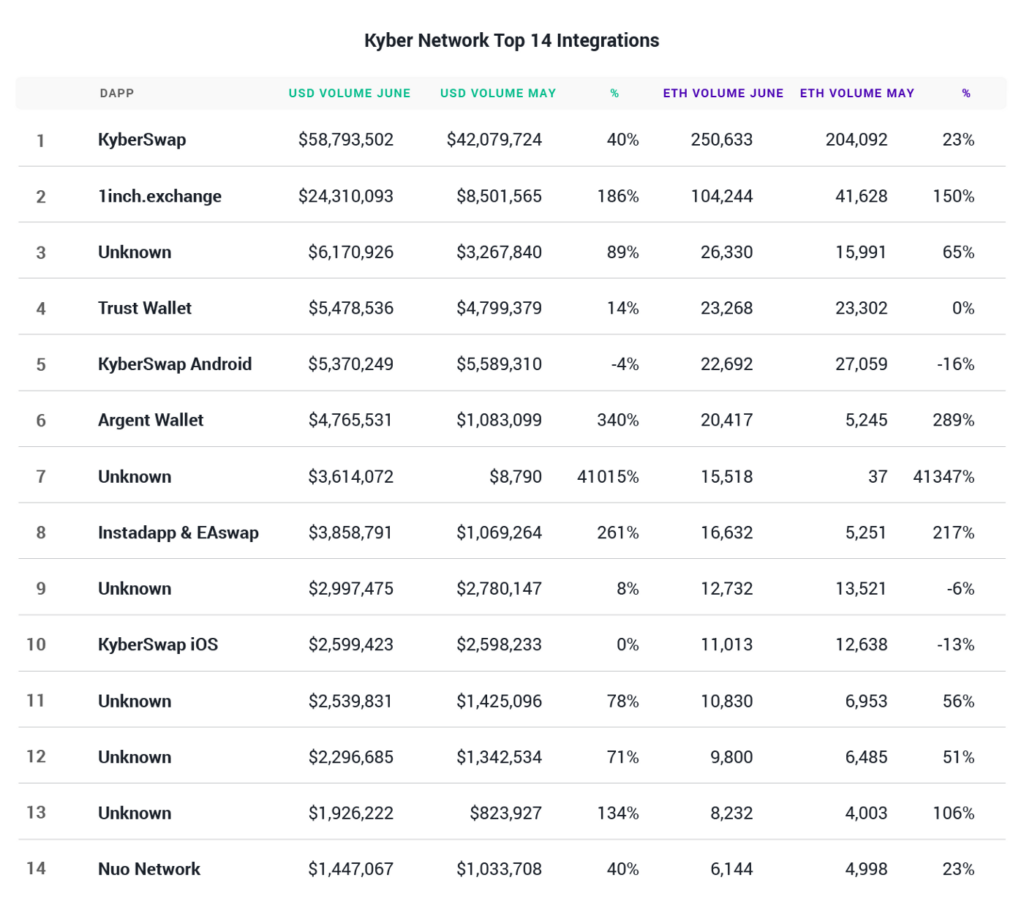

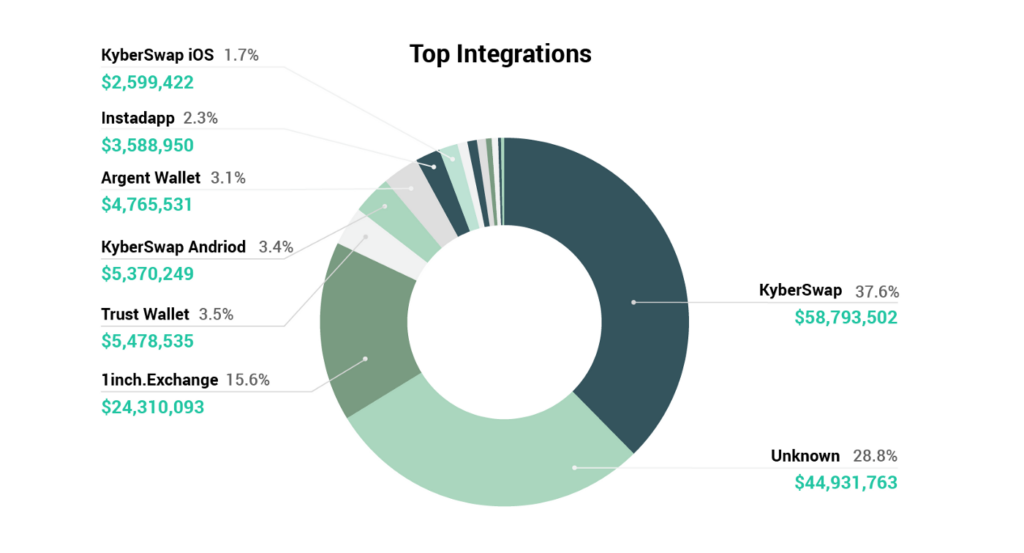

As has been the story every consecutive month for the last year, it was another month of new all time highs for the number of unique addresses trading on Kyber (which can be used as a proxy for number of users) and number of first trades (proxy for number of new users). Volumes and number of total trades were also the second highest on record with USD volume up 51% over May and total trades up 12%.

Almost all Kyber integrations saw strong growth with 1inch exchange especially standing out with $24M monthly volume which is a new record for a non-KyberSwap integration.

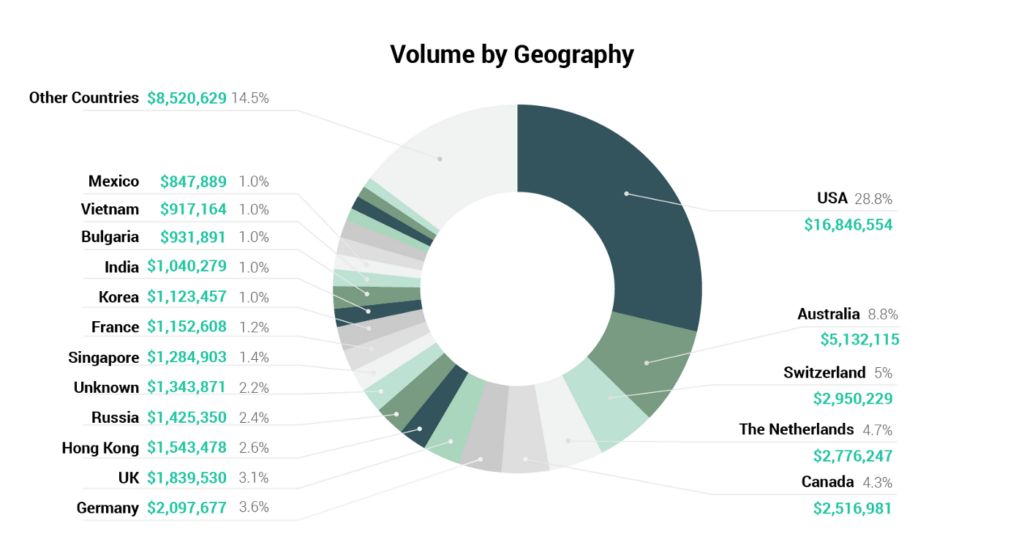

Crypto’s growing adoption across the world reflects in KyberSwap’s geographic data and we see users from over 100 countries swap tokens while more than 50 of these countries carry out monthly traders in excess of six and seven digits. The US continues to be the largest market accounting for almost 30% of all volumes while European countries make up half of the top 10.

DeFi Updates

As previously mentioned, 1inch.exchange’s $24M monthly volume stood out to us as this is just a fraction of 1inch’s total volume and is surely a sign the DeFi cake is getting bigger and bigger as most DeFi dapps expand their volumes.

We’re also looking forward to BZX’s just announced new BZRX token model which adds new value capture mechanisms to their protocol including fee sharing, Balancer fees, BAL rewards and a new insurance fund.

New Dapp integrations

Digifox

Our latest Kyber integration is Digifox, an iOS and Android finance app that gives users the ability to earn and save money, buy and trade cryptocurrencies, streamline taxes, budget, and spend money across the world. It was created by Nicholas Merten of DataDash fame, the largest cryptocurrency YouTube channel in the world with over 340,000 subscribers and a direct Kyber smart contract integration allows users to easily exchange one cryptocurrency to another.

Matcha — Our second integration is Matcha, an easy to use decentralized exchange built on top of 0x. Matcha pulls liquidity from Kyber, Uniswap, 0x, Curve, and Oasis and single order can be spread across multiple liquidity sources to get the best price for the end user.

Reserve and Token Metrics

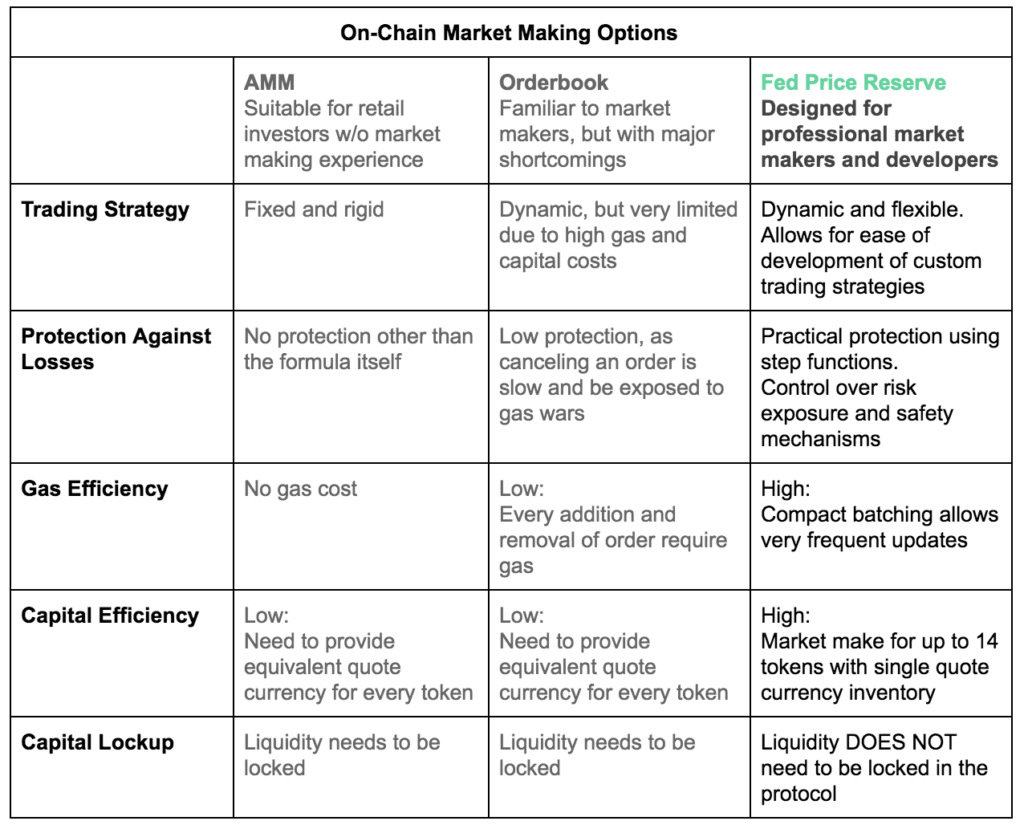

In June we published an important blog post that dives deep into Kyber’s Fed Price Reserves and explains how they are designed to allow professional market makers and advanced developers to market make effectively and generate on-chain profits. We highly recommend reading the blog post if this is your domain and you’d be interested in providing liquidity on Kyber or even if you’re just curious and would like to further your understanding of different market maker types in decentralized systems.

Top Reserves

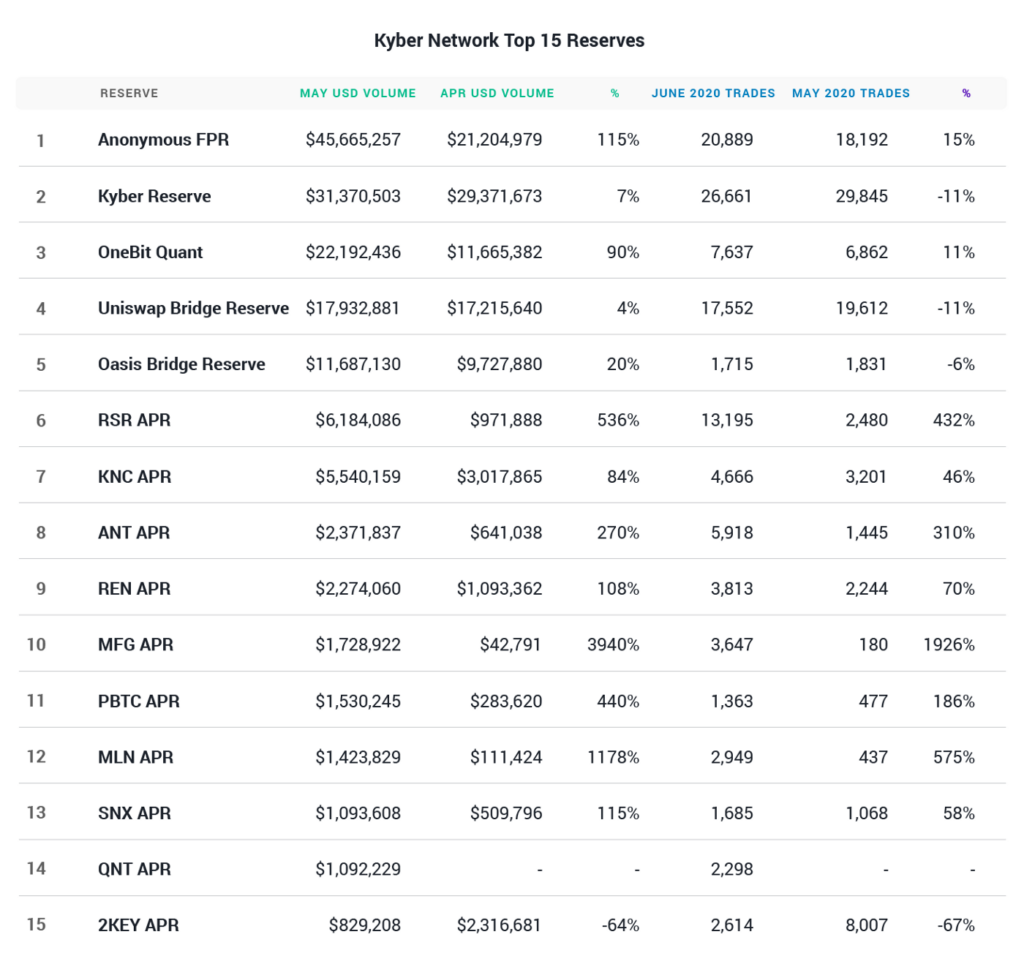

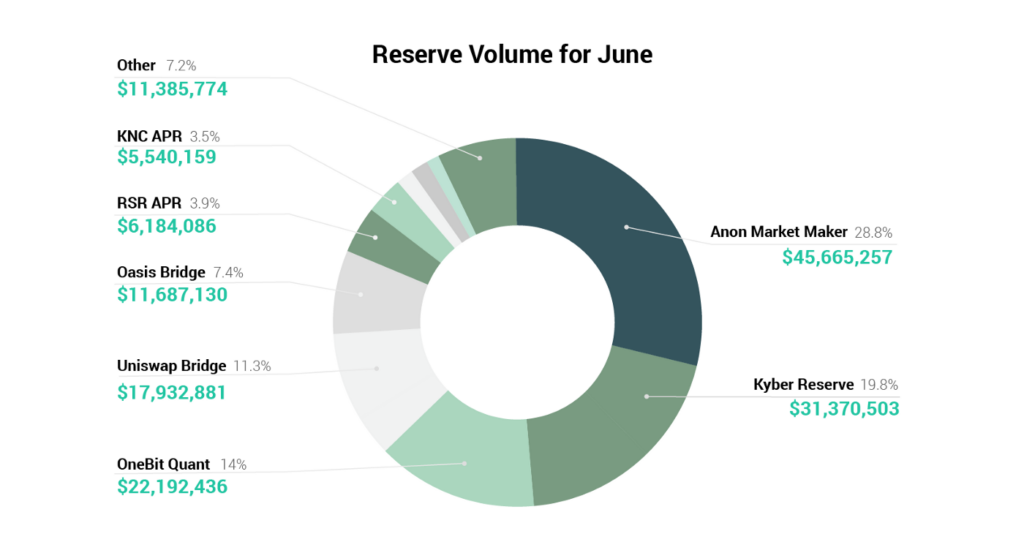

Kyber Network has a new no. 1 reserve. This anonymous professional market maker carried out $45.7M in transactions in May and provides liquidity to a dozen tokens ranging from stablecoins to popular ERC20 tokens like BAT, LINK, and KNC.

Professional market makers in general continue to dominate Kyber Network’s liquidity provision and account for 2/3rd of all volume. They are followed by DEX bridge reserves connected to Uniswap and Oasis which make up another 20%, followed by a long tail of 40+ automated market maker reserves deployed by token teams providing liquidity to their respective tokens.

Token Volumes

Stablecoins continue to see great demand on Kyber and were especially prominent in June’s yield-farming narrative that swept over DeFi, while unsurprisingly given the strong attention on Kyber’s growth and the Katalyst launch, KNC is leading the ERC20 token volumes with WBTC a close second.

New Tokens on Kyber Network

Cindicator [CND] — Cindicator is an intelligence platform for traders and analysts with CND tokens unlocking various levels of access to the data. Link

Compound [COMP] — Compound is an algorithmic interest rate protocol where users can lend and borrow assets, and COMP serves as its governance token. COMP liquidity is served through a Uniswap Bridge Reserve. Link

Origin[OGN] — Origin is a platform to create peer-to-peer markets and e-commerce apps. OGN is used for governance and boosting listings. Link

pNetwork Token[PNT] — Eidoo is a multi-currency crypto platform and wallet with PNT used to various features including Eidoo Card cashback program and in-app Atomic Swaps. Link

Quant Network[QNT] — Quant are the developers of Overledge, the world’s first blockchain operating system while QNT is used to sign and verify transactions and access the ecosystem. Link

KNC Updates

KNC Added to MCD

With the passing of a final Executive Vote on the 28th of June, we successfully concluded our KNC Multi-collateral DAI application and Maker Vaults can now be opened by locking up KNC. We’d like to thank the Maker team and its community for its thoughtful consideration of our application and we gained valuable insight into their decentralized governance process. Read More

KNC Added to FTX, Binance Futures, and Binance Margin Trading

With demand for KNC growing steadily over the last year, we’re also seeing it added to more and more large derivatives trading venues and June saw its addition to Binance Futures, Binance Margin Trading, and FTX. This opens up KNC to Spot, Futures, and Leveraged trading on both platforms.

5 million KNC burnt

Amidst all these developments, June was also the month we saw the 5 millionth KNC burnt. The KNC amount collected from swapping fees and burnt puts Kyber amongst the highest value-accruing decentralized networks not just in Ethereum but in crypto in general.[1]

Kyber Network has hit another milestone before our Katalyst and @KyberDAO launch!

— Kyber Network (@KyberNetwork) June 19, 2020

Over 5 Million KNC tokens have been burned! 🥳🎉🚀

Tracker: https://t.co/Y6O9XiDKVq

Join our discord: https://t.co/GATUjxaPzt pic.twitter.com/r8Nko9mqtE

KyberWorld

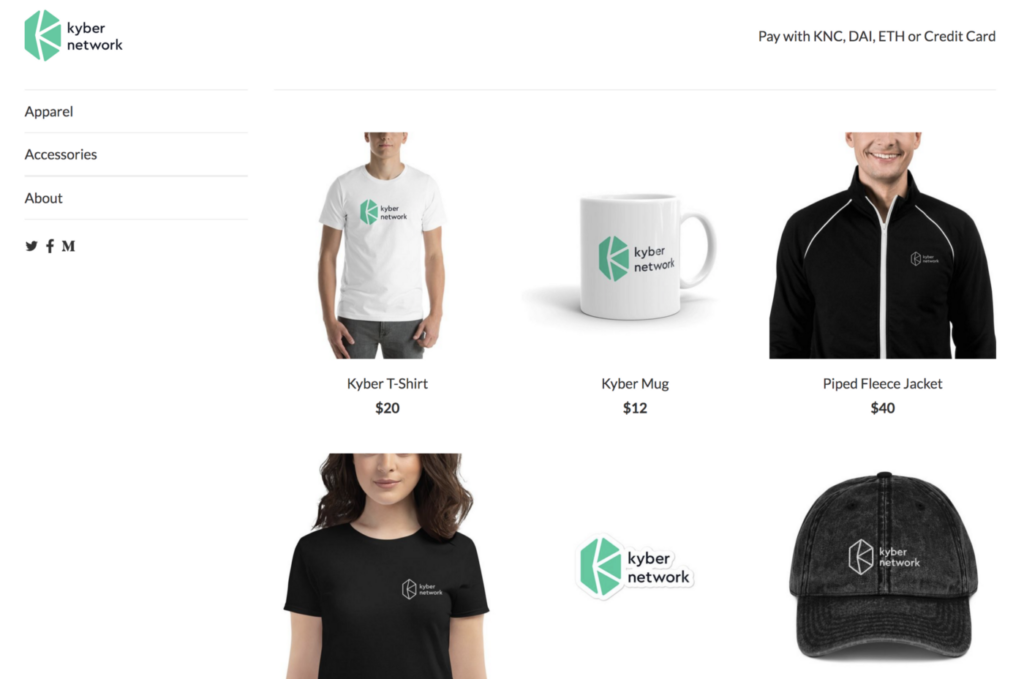

Kyber DShop

T-shirts, caps, socks, flip-flops, we’ve got them! Judging from how quickly they run out at hackathons and your online queries, we know Kyber swag are highly sought after and that’s why we’ve teamed up with Origin Protocol to launch a Kyber DShop. This Dshop is a decentralized e-commerce platform built on Ethereum, IPFS, PGP and Origin Protocol, and merchandise can be purchased with KNC, DAI, ETH or credit card. You can visit the store here and read more here and of course tweet us photos of yourselves wearing Kyber merch!

Online Appearances

It was another month of online conferences and panels and we had the pleasure of joining Matic on their InBlox Blockchain eWeekend series to talk about decentralized payment systems, participate in pToken’s Destination DeFi panel, and be part of the Virtual Blockchain Summity Scalability and Interoperability panel.

We were also guests of Jason Choi on the Blockcrunch Podcast which you can listen to here.

On July 9th DeFiDude will be hosting a virtual meetup together with Chicago DeFi and Bloxroute Labs. The agenda includes an intro to Kyber and Katalyst, and how both Kyber Governance and the Community Pool works. You can register for free here and tune in through Zoom on Thursday 10pm GMT.

In The Media

With the Katalyst launch upon us media coverage has ramped up to cover the latest developments and timelines and we’ve picked a select few for you:

Coindesk — Kyber Unveils Date for Planned Katalyst Protocol Upgrade

Cointelegraph — Kyber Sets Date for Launch of Katalyst Protocol Upgrade

Decrypt — ParaFi invests in DeFi protocol Kyber as industry boom

Huobi — A Coin To Keep An Eye On

Multi.io — Kyber Network Monthly Report

Tokenmetrics — The Best Decentralized Exchanges of 2020

The Defiant — Kyber announces KNC makeover launch date

Other Articles and Videos: AltcoinBuzz, BraveNewCoin, Coincodex, Crypto Tapas, CryptoJamm, Cryptonewsz, Crypto Mastermind, Decrypt 2, DeFi Rate, Every Bit Helps, Kavi, Magno Crypto, PaySpace Magazine, , Quora,

Foreign Language Articles: Dutch, Italian, French, Japanese, Japanese 2, Spanish, Spanish 2, Spanish 3, Tassini Media, Turkish (by our very own Ece!) Turkish 2, Turkish 3, Vietnamese

Conclusion

This week we celebrate the birth of the KyberDAO and see Kyber Network upgrade to the contracts that will serve its next million users. We look forward to serving these million users with one of the best liquidity protocols in the space and one that is backed by a decentralized autonomous organization that gives each on of them a voice in Kyber’s future. We hope you will join us and be part of this future.

About Kyber Network

Kyber Network is delivering a sustainable liquidity infrastructure for DeFi. As a liquidity hub, Kyber connects liquidity from various protocols and sources to provide the best token rates to Dapps, aggregators, DeFi platforms, and traders.

Through Kyber, anyone can provide or access liquidity, and developers can build innovative applications, including token swap services, decentralized payments, and financial Dapps — helping to build a world where any token is usable anywhere. Kyber is powering more than 100 integrated projects and has facilitated over US$7 billion worth of transactions for thousands of users since its inception.

KyberSwap, the latest protocol in the liquidity hub, provides the best rates for traders and maximizes returns for liquidity providers.

Discord | Website | Twitter | Telegram | Forum | Blog | Reddit | Facebook | Github | KyberSwap | KyberSwap Docs