Add liquidity to earn KNC and MATIC rewards on Ethereum and Polygon

UPDATE: DMM has now rebranded to KyberSwap.com! Learn more.

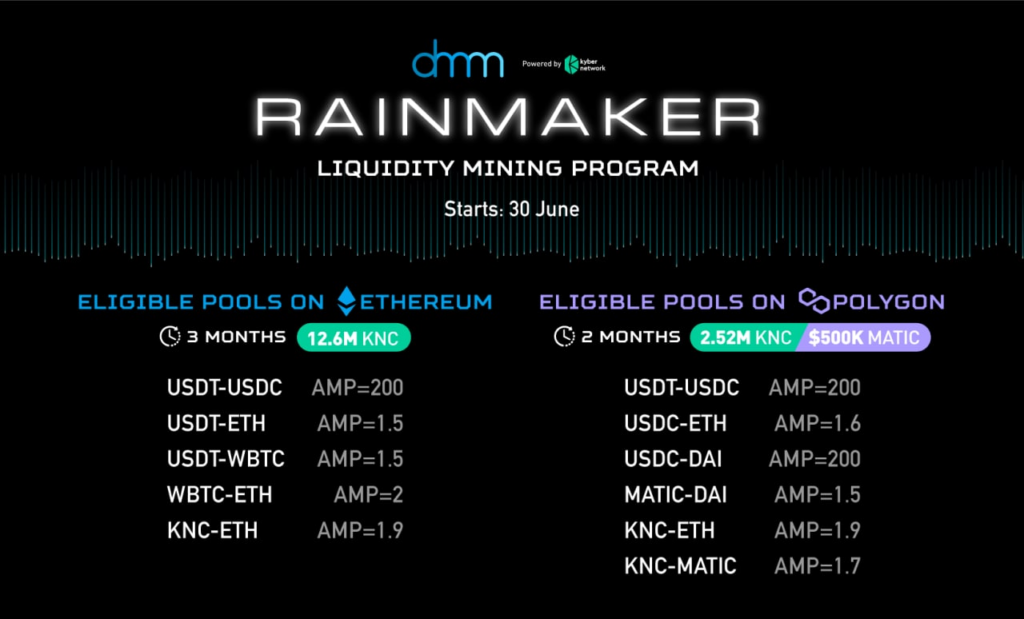

After much anticipation, Rainmaker, KyberDMM’s very first liquidity mining program, has officially begun! KyberDMM is also being deployed on the Polygon Network for the first time.

Kyber Dynamic Market Maker (DMM) is a next-gen, multi-chain AMM protocol that maximises the use of capital for liquidity providers with its amplified pools that provide high capital efficiency and dynamic fees that optimise returns. Currently in its beta phase, KyberDMM has already surpassed $300M in volume, $300M in TVL, and $30B in total amplified liquidity (equivalent TVL when compared to typical AMMs).

With the Rainmaker liquidity mining program, KyberDMM will help boost liquidity even further, provide important benefits to liquidity providers, as well as bring more DeFi participants and value into the Kyber and Polygon ecosystems.

On 30th June, at approximately 3.30pm GMT+8, the Rainmaker program will start distributing~$25M in rewards over the course of 3 months to eligible liquidity providers (LPs) on KyberDMM.

Rainmaker: Important Details

Starting time

- Ethereum block 12734250 and Polygon block 16318000 (~3.30pm GMT+8)

Liquidity Mining Program Duration

- Duration on Ethereum: 600k blocks (3 months)

- Duration on Polygon: 2.4M blocks (2 months)

KNC Token Smart Contract Address

- On Ethereum: 0xdeFA4e8a7bcBA345F687a2f1456F5Edd9CE97202

- On Polygon: 0x1C954E8fe737F99f68Fa1CCda3e51ebDB291948C

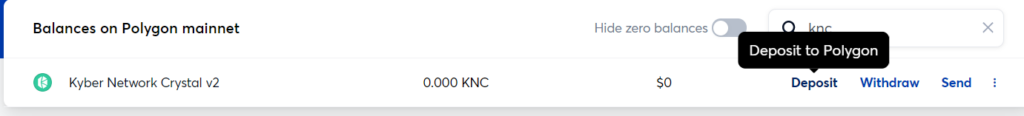

How do I bridge assets between the Ethereum and Polygon networks?

To move Ether or ERC20 token assets from Ethereum to Polygon, you can simply use the Polygon Bridge.

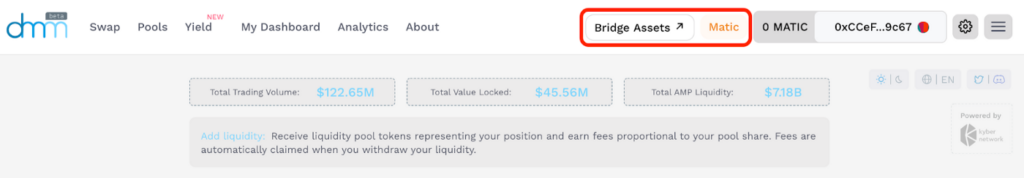

When you are on the Polygon (Matic) network on KyberDMM, click the ‘Bridge Assets’ button at the top of the page to access the bridge. Note that this button is not displayed if you are on the Ethereum network; change your network to ‘Matic’ on your Metamask first.

The entire process is fast and simple. Please read this handy guide from the Polygon team to learn how to use the bridge!

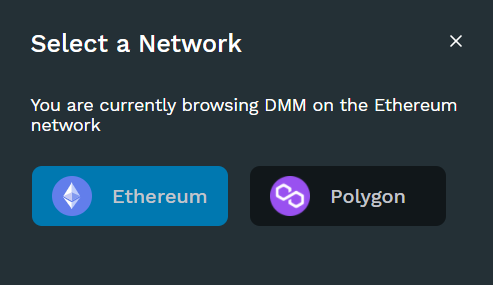

Switching from the Ethereum to Polygon Network: On KyberDMM, click the Ethereum button at the top to switch your network to Polygon (Matic) or change your network to ‘Matic’ on your Metamask directly.

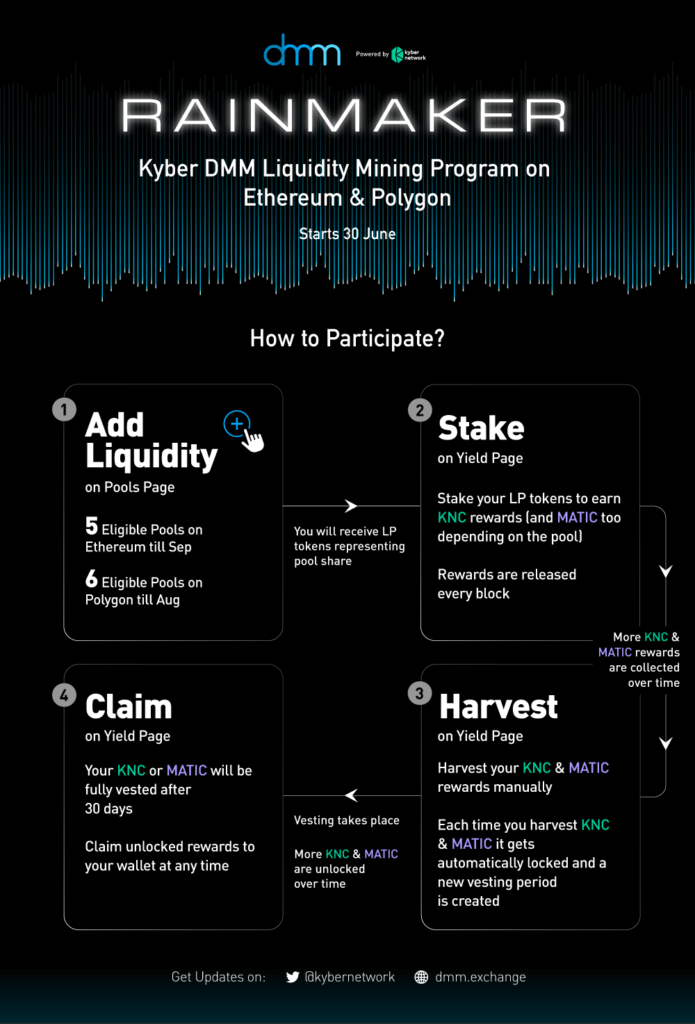

How to participate in Rainmaker?

Step 1: Add Liquidity

First, enter the ‘Pools’ page. Connect your wallet e.g. Metamask, Ledger (only works on Ethereum), WalletConnect, or Coinbase wallet, and add liquidity by depositing the required tokens into one (or more) of the eligible pools below. In return, you will immediately receive DMM LP pool tokens in your wallet representing your pool share and start earning standard protocol fees for that pool.

View Liquidity Positions: On the ‘My Pools’ page, you can view all your liquidity positions and remove or add liquidity there. Your LP tokens need to be in your wallet. If you cannot see your liquidity position, click ‘Don’t see a pool you joined? Import it’ to add it manually.

Note: To view the liquidity pools on the Polygon (Matic) Network, go to your Metamask and change your network to ‘Matic’ first.

Eligible Liquidity Pools

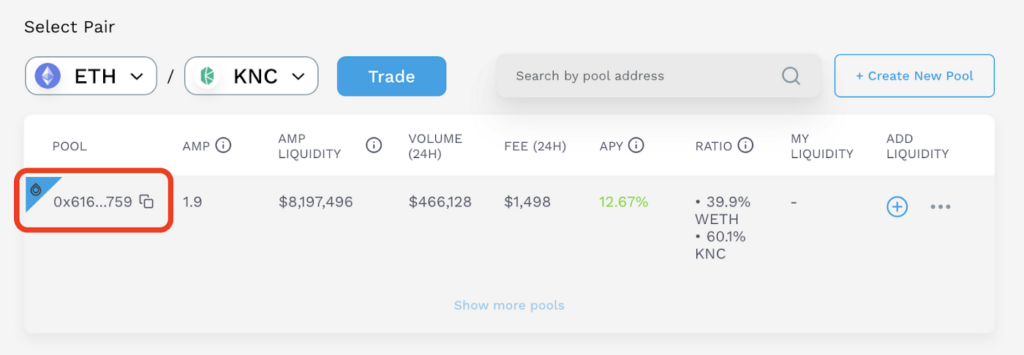

Eligible Rainmaker pools are labelled with the 💧 raindrop icon next to it on the left. These pools are eligible for yield farming.

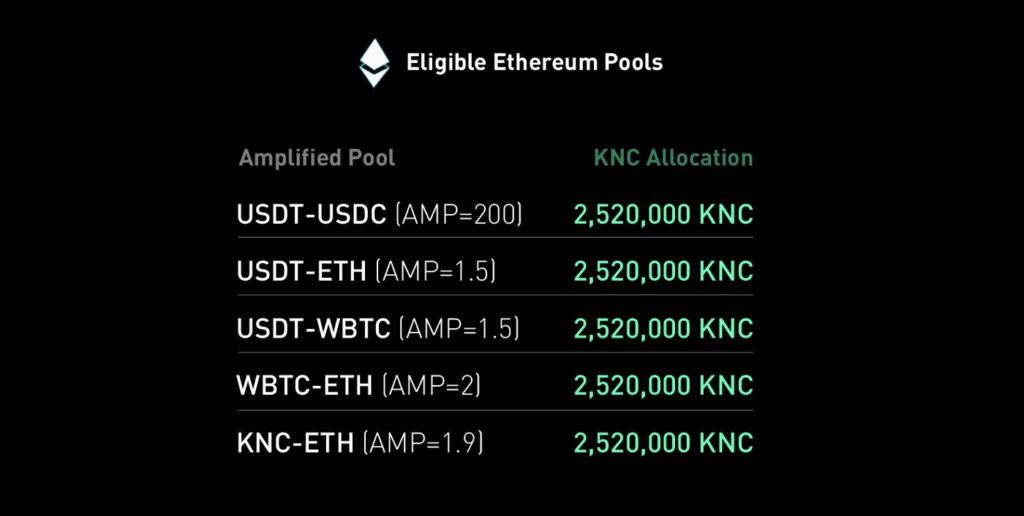

A) Rainmaker on Ethereum

Duration: 600k blocks (3 months)

Rewards: 12.6M KNC (~$20M) distributed equally across five eligible liquidity pools.

Eligible Pools on Ethereum

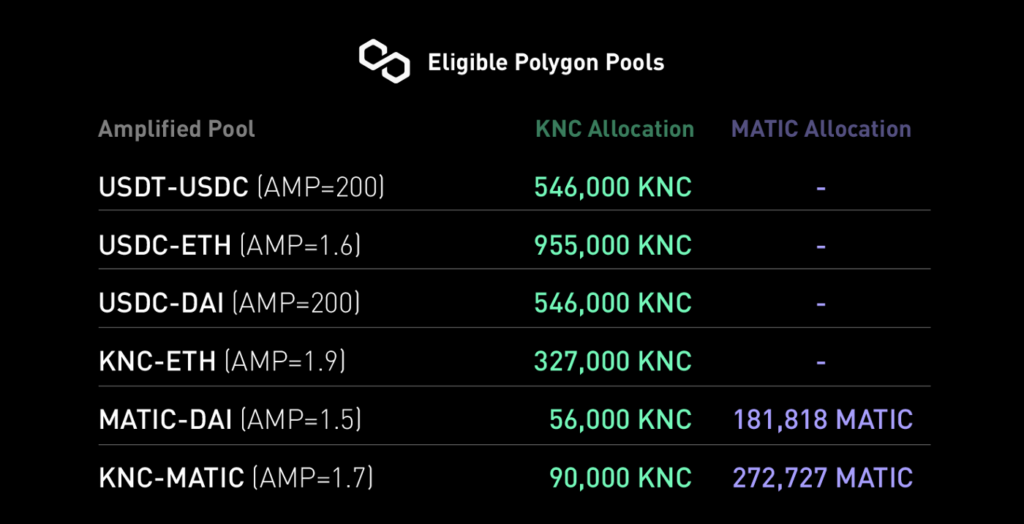

B) Rainmaker on Polygon

Duration: 2.4M blocks (2 months)

Rewards: 2.52M KNC tokens (~$5M) and 454,545 MATIC tokens (~$520,000) distributed based on the following allocation.

Eligible Pools on Polygon

- USDT-USDC (AMP=200)

- USDC-ETH (AMP=1.6)

- USDC-DAI (AMP=200)

- KNC-ETH (AMP=1.9)

- MATIC-DAI (AMP=1.5)

- KNC-MATIC (AMP=1.7)

*AMP = Amplification factor. Amplified pools have higher capital efficiency; achieving better rates with less capital when compared to other protocols. Higher AMP, higher capital efficiency within a price range.

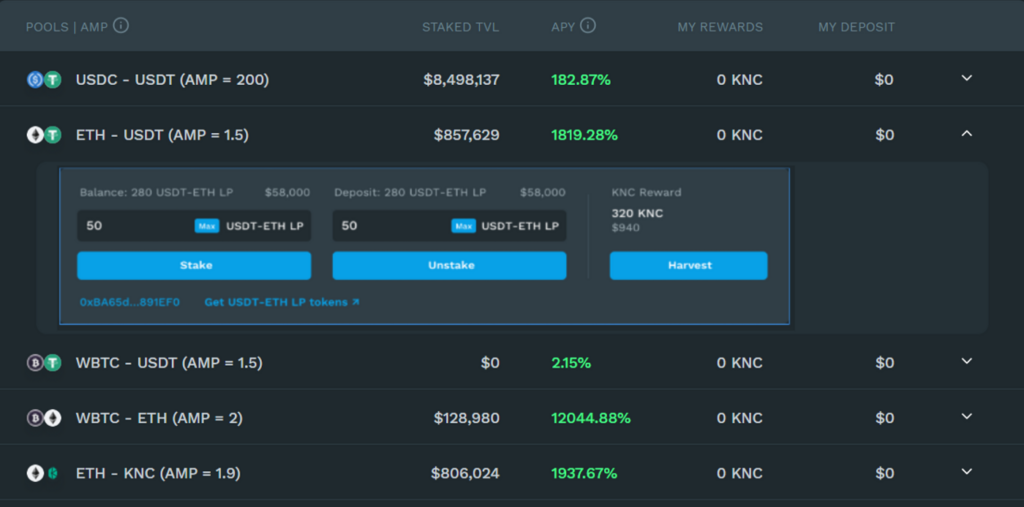

Step 2: Stake DMM LP tokens and start receiving liquidity incentives

Next, enter the ‘Farm’ page. You can view the eligible pools here and add liquidity for the pool you want if you haven’t done so.

Next, stake your DMM LP tokens in the corresponding farming pool contract. You need to approve the tokens if this is your first time here. After staking, you can view the amount you staked under ‘My Deposit’.

Once you have successfully staked your DMM LP tokens, you will start receiving KNC (and MATIC, depending on the pool) liquidity rewards on top of protocol fees. APY here refers to the annualized percentage yield based on pool fees + rewards.

Every liquidity provider that adds liquidity to eligible pools and stakes their DMM LP tokens will receive KNC or MATIC rewards over time, with the reward amount dependent on their share of the total staked DMM LP tokens in the pool. Reward distribution will be linear, with a fixed amount released every block. The longer you provide liquidity, the more rewards you receive.

Your total rewards collected from adding liquidity and staking is also displayed and you can either harvest your rewards all at once or from individual pools.

No Lock-up for Liquidity: You can unstake your DMM LP tokens and withdraw liquidity at any time without a penalty to existing rewards received. If you unstake your LP tokens, your rewards are automatically harvested.

Important: Please use the official KyberDMM user interface to stake LP tokens. Direct transfers to the liquidity mining pool address will result in the loss of your deposited tokens to KyberDMM.

Step 3: Harvest and Claim Rewards

After being allocated KNC or MATIC rewards, you will have to harvest your rewards. When you harvest rewards, it activates a new 30-day vesting period.

Harvested rewards are locked at the start and vested linearly over 30 days (~200,000 blocks at 12–15s per block on Ethereum), with some rewards being unlocked every block. This linear vesting mechanism is an essential governance safeguard and ensures a more robust incentive system for Kyber Network.

- Ethereum Lock Duration (Linear vesting): 200k blocks (30 days)

- Polygon Lock Duration (Linear vesting): 1.2M blocks (30 days)

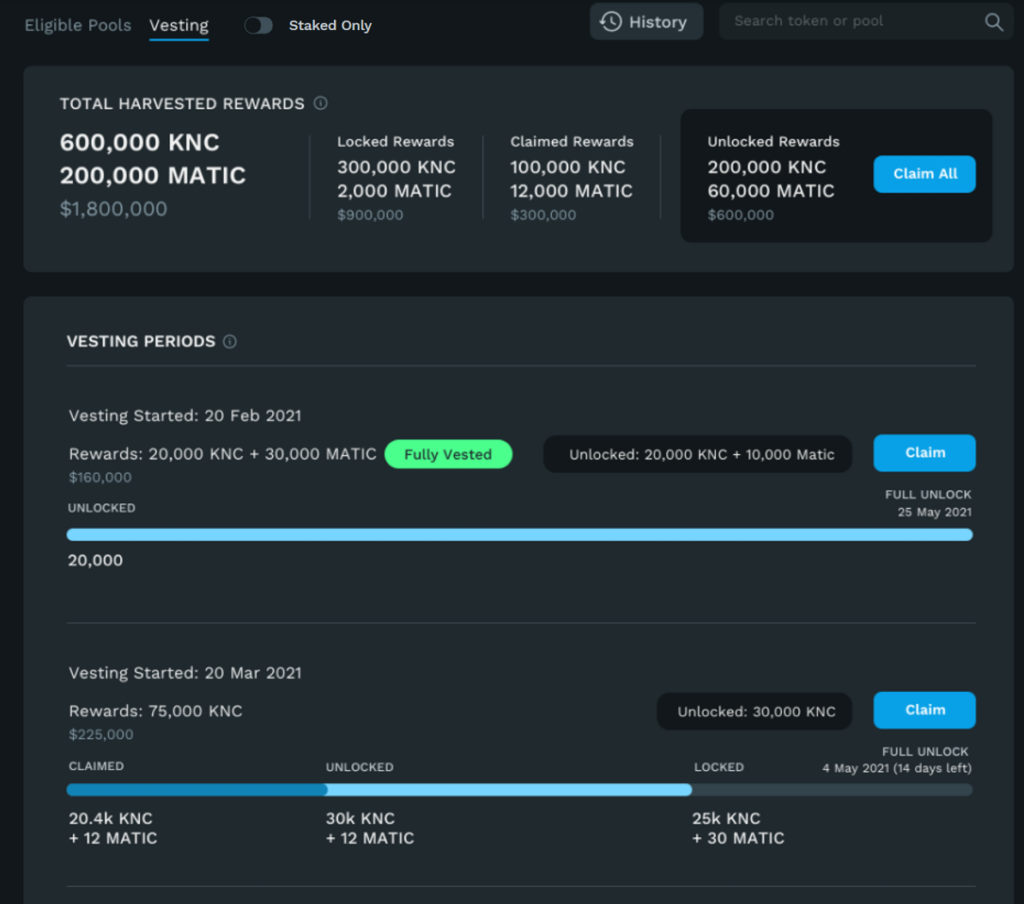

Navigating to the ‘Vesting’ tab, you can view how much of your KNC or MATIC rewards have been claimed, locked, and unlocked since the beginning. You can also view your current and past vesting periods.

Depending on how many times you harvest rewards, there could be multiple vesting periods running concurrently. Note that gas is required for every harvest so you might want to accumulate a reasonable amount of rewards before harvesting them. View past transactions by clicking the ‘History’ button.

Once unlocked, rewards can be claimed at any time. You can choose to claim all the unlocked rewards at once or only claim for certain vesting periods.

Have more questions? Visit our Rainmaker FAQ and watch this video.

To recap, here is a simple infographic summarizing the Rainmaker Liquidity Mining Program:

What can I do with my KNC or MATIC rewards?

KNC is an ERC20 utility token that plays a valuable and central role in the Kyber and DeFi ecosystem. You may use your KNC token rewards to add liquidity into the eligible KNC pools to earn even more liquidity mining rewards, or stake KNC on KyberDAO to participate in governance and earn voting rewards.

MATIC is an ERC20 token that is used to power Polygon, the gateway to a Multi-Chain Ethereum. The MATIC token serves dual purposes: securing the network via staking and being used for the payment of transaction fees. You may use your MATIC rewards to add liquidity into the eligible MATIC pools for more rewards.

Why add liquidity on KyberDMM?

Apart from the liquidity mining rewards, KyberDMM liquidity providers enjoy a host of important benefits that are not available on typical AMMs.

- Amplified Pools: Liquidity providers have the flexibility to select amplified liquidity pools that greatly improve capital efficiency and help reduce trade slippage. With the same pool and trade size, stable token pairs with low variability in the price range (e.g. USDC/USDT) can be 100–400 times better compared to other platforms. Liquidity providers can provide better prices and earn more fees with less capital.

- Dynamic Fees: Protocol fees are adjusted dynamically based on market conditions to maximise returns and reduce the impact of impermanent loss for liquidity providers, with fees automatically accruing in the pool.

- Fully permissionless: Anyone can create a liquidity pool or add liquidity to existing pools; while any Dapp, aggregator, or end user can access this liquidity. KyberDMM is already integrated with 1inch and Matcha, with more aggregators and Dapps on the way.

- No 3rd-party oracles: Not vulnerable to external oracle risks.

Our Commitment to Security

KyberDMM’s codebase has been reviewed and audited multiple times by both the team and external auditors such as Chain Security with no critical issues found, and remains open source on Github for community developers to review. KyberDMM is also covered up to $20 Million by decentralized insurance provider Unslashed Finance. However, all DeFi platforms and smart contracts carry risks. Please be wary of scams and phishing attempts.

Delivering Enhanced Liquidity for Kyber and DeFi

KyberDMM is the first major protocol on Kyber 3.0’s new liquidity hub architecture. The Rainmaker liquidity mining program is an important step towards greatly boosting liquidity and adoption of the KyberDMM, while bringing in many more KNC and MATIC holders to help grow the Kyber and Polygon ecosystems.

We welcome all DeFi participants to add liquidity on the KyberDMM to enjoy dynamic fees, higher capital efficiency, and additional KNC and MATIC yield.

For developers looking to build with KyberDMM, please check out our developer documentation. We also have bounties for the ongoing ETHGlobal HackMoney online hackathon.

Rainmaker is the first of many incentive programs to come. Follow us on Twitterand Discord to stay updated!

Onward, Kyber Network!

About Kyber Network

Kyber Network is building a world where any token is usable anywhere. KyberSwap.com, our flagship Decentralized Exchange (DEX), provides the best rates for traders in DeFi and maximizes returns for liquidity providers.

KyberSwap powers 100+ integrated projects and has facilitated over US$7 billion worth of transactions for thousands of users since its inception. Currently deployed across 11 chains including Ethereum, BNB Chain, Polygon, Avalanche, Fantom, Cronos, Arbitrum, Velas, Aurora, Oasis and BitTorrent.

KyberSwap | Discord | Website | Twitter | Forum | Blog | Reddit | Facebook |Developer Portal | Github |KyberSwap| KyberSwap Docs