KyberSwap Elastic inherits all the powerful features of KyberSwap Classic, while giving you concentrated liquidity and the flexibility to take your earning strategy to the next level.

To keep up with the ever-changing landscape of DeFi, KyberSwap has been working tirelessly to evolve to meet the relevant needs of Traders and Liquidity Providers.

As such, we are proud to announce KyberSwap’s new protocol: KyberSwap Elastic!

KyberSwap’s existing protocol known as KyberDMM will henceforth be renamed to KyberSwap Classic. KyberSwap Classic, the world’s first Dynamic Market Maker, was able to reflect market conditions to dynamically adjust the fees and optimize returns for Liquidity Providers with its extremely capital efficient model.

Concentrated Liquidity on KyberSwap Elastic

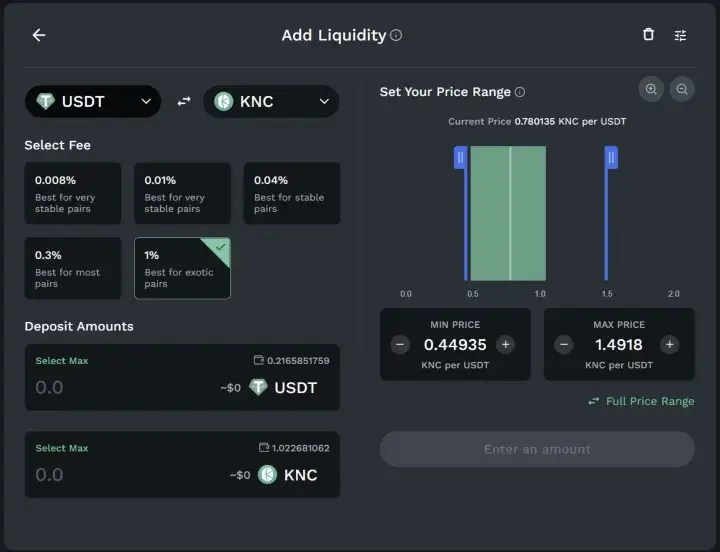

KyberSwap Elastic takes things a step further with its concentrated liquidity! Liquidity Providers (LPs) now have the flexibility to supply liquidity to an Elastic pool using a custom price range of their choice to determine how ‘concentrated’ the liquidity is. LPs can concentrate liquidity by using a narrow price range for the token pair. This way, liquidity in the pool is used more efficiently, mimicking much higher levels of liquidity and achieving better slippage, volume, and earnings for LPs. This is especially effective for stablecoins and correlated pairs (e.g. USDC-DAI) which have little movement in price.

Of course, LPs also have the option to set a wider price range or even a full price range (0 to infinity). This ensures that liquidity for uncorrelated token pairs such as USDC-ETH remains active even with big price swings during high market volatility.

Overall, the customizable price range of Elastic pools provides LPs with greater flexibility to achieve capital efficiency and manage risks, while rewarding them for having a sound liquidity strategy. Elastic pool fees also auto-compound so LPs earn higher APY!

Designed to provide unparalleled flexibility, security, and returns, KyberSwap Elastic provides a diverse set of features primarily for LPs with distinct liquidity needs and risk appetites. Ultimately, with this innovative protocol, we can expect the overall liquidity on KyberSwap to increase, thereby benefiting the KyberDAO and KNC holders as well.

*KyberSwap Elastic has been audited by Chainsecurity. Download the audit report here and the KyberSwap Elastic Whitepaper here.

To sum up, the key improvements KyberSwap Elastic has over KyberSwap Classic are as follows:

Customisable Concentrated Liquidity:

Instead of adding liquidity to a determined price range (like in KyberSwap Classic), Kyberswap Elastic allows LPs to get granular with their strategy by adding liquidity to a specific price range of their choice. LPs get an NFT that represents their liquidity position and their share of the pool.

Flexible Strategies:

With greater customizability options, you will be able to better plan investment/exit strategies depending on your risk tolerance with greater control.

Risk Control:

With KyberSwap Elastic’s customizability, you will also be able to retain closer control over the tokens’ buy/sell range. This increased control would allow you to mitigate losses brought about by Impermanent Loss.

But that’s not all! Check out the other cool advantages KyberSwap Elastic brings:

- 5 Fee Tiers: 0.008%, 0.01%, 0.04%, 0.3% and 1%. Liquidity providers can select the fee tier they want after considering how correlated the token pair is. The 5 different tiers bring about superior flexibility for liquidity providers compared to other DEXes. We plan on adjusting these fee tiers with time.

- Auto-Compounding of Fees: We automatically reinvest the fee earnings of our liquidity providers by adding it back into a full range reinvestment curve that’s tied to the same liquidity pool, so they earn more due to compounding. Liquidity providers can withdraw their tokens and collect the trading fees they have earned anytime.

- New Farming Mechanisms: We’ve created an innovative liquidity mining (i.e. farming) system for KyberSwap Elastic which distributes farming rewards to users according to:

a) Active liquidity contribution: According to the liquidity provider’s contribution to the corresponding pool’s active liquidity (liquidity that is within the active price range).

b) Active liquidity contribution + trade volume supported: We take it a step further, and can also distribute farming rewards based on the total trade volume that is supported by the liquidity position(s) of our users. The more trading volume you support, the more farming rewards you will earn.

These farming mechanisms complement the price range flexibility since it depicts different liquidity positions as well as the risk that liquidity providers take.

- Just-in-Time (JIT) Attack Protection Feature: We’ve implemented an anti-sniping feature where the trading fee earnings of liquidity providers are locked and quickly vested based on the duration of their liquidity contribution. This feature is implemented to stop attackers from putting in and pulling out their liquidity ‘just in time’ to earn huge trading fees without having to deal with impermanent loss, which would reduce the earnings of other honest liquidity providers. This means LP earnings are better protected on KyberSwap compared to other platforms!

Combining advanced features of our new Elastic protocol with KyberSwap’s ever-present signature tools, we now have a full picture on how KyberSwap is the only DEX / DEX aggregator you’ll ever need to complete your trading and earning user journeys

- Quick token research with Discover — the world’s first tool to discover tokens before they trend.

- Analyze charts accurately with Pro Live Charts.

- Swap 20,000+ tokens on one single platform without feeling FOMO about better rates somewhere else. Thanks to KyberSwap’s non-stop integration with 63+ DEXes on 12 chains, making it the most integrated DEX aggregator out there.

- Provide liquidity with high capital efficiency due to concentrated liquidity.

- Farm and earn rewards that better reflect your position and effort.

- Enjoy automatic and compounding reinvestment that saves you time while earning higher fees.

- Feel secured and protected with multiple security measures taken by KyberSwap such as Unslashed insurance, anti-JIT feature and so on.

Overall, the main advantage KyberSwap Elastic has over the Classic version is customization. While Classic does provide high capital efficiency and is a well-rounded trading and earning protocol itself, KyberSwap Elastic empowers you with more flexibility to create and implement your own liquidity strategy.

For a deeper dive into the technical overview of KyberSwap Elastic, check out the KyberSwap documentation or continue to read below.

5 Fee Tiers

The flexible fee tiers enable LPs to select the best-suited rates for them with token’s volatility, risk levels… all taken in consideration.

Here’s what we recommend:

Option 1 — 0.008% fee tier: Best for very stable pairs

The 0.008% fee tier is ideal for token pairs that typically trade at a fixed or extremely high correlated rate, such as pairs of stablecoins (e.g. USDC-USDT). Liquidity providers take on minimal price risk in these pools, and traders expect to pay minimal fees.

Option 2 — 0.01% fee tier: Best for very stable pairs

The 0.01% fee tier is ideal for token pairs that typically trade at a fixed or extremely high correlated rate, such as pairs of stablecoins (e.g. USDC-USDT). Liquidity providers take on minimal price risk in these pools, and traders expect to pay minimal fees.

Option 3 — 0.04% fee tier: Best for stable pairs

The 0.04% fee tier is ideal for token pairs that typically trade at a fixed or highly correlated rate, such as pairs of stablecoins (e.g. DAI-USDC). Liquidity providers take on minimal price risk in these pools, and traders expect to pay minimal fees.

Option 4 — 0.3% fee tier: Best for most pairs

The 0.30% fee tier is best suited for less correlated token pairs such as the ETH-DAI token pair, which are subject to significant price movements to either upside or downside. This higher fee is more likely to compensate liquidity providers for the greater price risk that they take on relative to stablecoin LPs.

Option 5–1% fee tier: Best for exotic pairs

The 1% fee tier is best suited for even less correlated token pairs such as the ETH-KNC token pair, which are subject to significant price movements to either upside or downside. This higher fee is more likely to compensate liquidity providers for the greater price risk that they take on relative to stablecoin liquidity providers.

Concentrated Liquidity

Liquidity providers can specify which price range they want to add liquidity to which leads to concentrated liquidity.

Be advised that the min price and max price you select will automatically be adjusted by the system to the nearest lower values which are called lower and upper “ticks” that are used in our new mechanism to prevent high gas costs resulting from the scenario where multiple price ranges are crossed during a trade. Users will have to acknowledge the adjusted rate before adding liquidity. This way, you will have the final say, not the system.

The price range you’ve selected represents the degree to which you think the current price will fluctuate in the future. The liquidity you provide will be evenly distributed over this price range. You will get a fee for any swap to be processed at a specific price (or in other words, at a specific active tick) in your selected range, proportional to the liquidity you provide at that price (or at that active tick).

A full price range allows tokens to be traded at any price, but may bring you less fees than a concentrated price range due to the liquidity allocation on inactive price ticks.

Compounding of Fees

KyberSwap Elastic inherits the liquidity concentration of the Classic version in order to preserve the compound feature while still achieving customizability. Eventually, the protocol pours the collected fee into a Reinvestment Curve, which is aggregated with the pool.

The reinvestment curve is a compoundable constant product curve that supports the full price range, from 0 to infinity. The reinvestment curve is aggregated with the pool so that they maintain a common price while behaving differently. Price ranges of the pool have different amounts of liquidity, which are not affected by exchange activities. Meanwhile, the reinvestment curve’s liquidity remains the same on all ticks and increases based on the accumulating fee after each swap.

New Farming Mechanisms

As a tick-based automated market maker (AMM), KyberSwap Elastic protocol will allow you to provide liquidity to a pool within a custom price range so liquidity can be used more efficiently, mimicking much higher levels of liquidity. This also means that you will no longer share the same position in a pool as LPs can customize the price-range of their positions.

This customizability makes the traditional liquidity mining mechanism (i.e. distributing farming rewards to all staking users in a pro-rata way) no longer reasonable as users’ contributions to the total liquidity of the pool will be different depending on their position. The risk taken by each user also varies greatly.

To tackle these challenges, we created an innovative liquidity mining (aka farming) system for KyberSwap Elastic that is able to distribute farming rewards to users according to their contribution to the pool’s active liquidity. We’ve implemented 2 farming mechanisms, and all farms will be set up based on either of these farming mechanisms.

Let’s look into these 2 types of farming, as it will be important for liquidity providers (and farmers) to monitor their liquidity positions and adjust when needed to maximize their earnings through farming:

- Farming Type 1 — Active Time of your Liquidity

This type of Farm relies on 1 factor: Total time your liquidity position has been active (aka in range) in the pool and supporting the current price of the pool

Once you stake your liquidity position(s) into a farm, we will start calculating your farming rewards based on whether your liquidity position(s) is currently active and supporting the current price of the pool. You will continue to accumulate farming rewards as long as your position is active. You will of course accumulate rewards in proportion to the liquidity of your position relative to other farmers.

If your liquidity position goes out of range (aka becomes inactive), you will stop accumulating farming rewards. This can happen if the current price of the pool moves significantly due to market changes. You will have to adjust the price range of your liquidity position so that it is again in range (aka active) and is supporting the current price of the pool. - Farming Type 2 — Active Time of your Liquidity & Target Volume

This type of Farm relies on 2 factors:

– Total time your liquidity position has been active (aka in range) in the pool and supporting the current price of the pool

– Trade volume supported by your liquidity position (indicated by the target Fee earned from the pool). The objective of Target Trade Volume is for the project that is giving out farming incentives to indicate the trading volume they would like each liquidity position to support before they receive farming rewards.

Once you stake your liquidity position(s) into a farm, we will start calculating your farming rewards based on (1) whether your liquidity position(s) is currently active and supporting the current price of the pool (2) whether your liquidity position(s) has supported the required target volume by supporting the trading volume in the pool.

You will accumulate farming rewards even if your liquidity position hasn’t hit the full Target Volume. As soon as your position hits the full Target Volume, from thereafter, you will continue receiving 100% of the rewards for that liquidity position. You will of course accumulate rewards in proportion to the dollar value of your liquidity position relative to other farmers.

If your liquidity position goes out of price range (aka becomes inactive), you will stop accumulating farming rewards. This can happen if the current price of the pool moves significantly due to market changes. You will have to adjust the price range of your liquidity position so that it is again in range (aka active) and is supporting the current price of the pool.

In order to hit your full Target Volume faster, you may also have to adjust the price range of your liquidity position so that it’s concentrated enough and consequently more trading volume of the pool is supported by your liquidity position.

Anti-Sniping/Just-In-Time Feature

An AMM which compounds different positions, such as Uniswap v3, provides tools for liquidity providers to add and remove liquidity easily in specific ranges. The feature leads to a novel attack called Just-In-Time (JIT), where the attacker tries to jump in front of normal liquidity providers by adding and removing liquidity just before and right after a huge swap.

The sandwich attack can be effectively restrained on the taker’s (trader’s) side thanks to parameters limiting how much slippage can be tolerated. However, there is no similar anti-JIT attack mechanism for liquidity providers. Hence, KyberSwap’s Elastic protocol introduces a feature that protects liquidity providers from this type of attack thus protecting their potential earnings.

The difference between attacks and normal activities of liquidity providers is their contributing duration. When liquidity providers supply their funds to the protocol, they take the risk of impermanent loss. However, in the case of an attacker who withdraws their fund immediately, the impermanent loss can be pre-calculated so that their profit is guaranteed.

Kyberswap Elastic’s Anti-JIT Feature is designed as a quick lock-up of reward, which is vested based on the duration of liquidity contribution as an attempt to prevent this kind of attack.

To get involved and updated on important news and various campaigns, follow and/or contact us via official channels below!