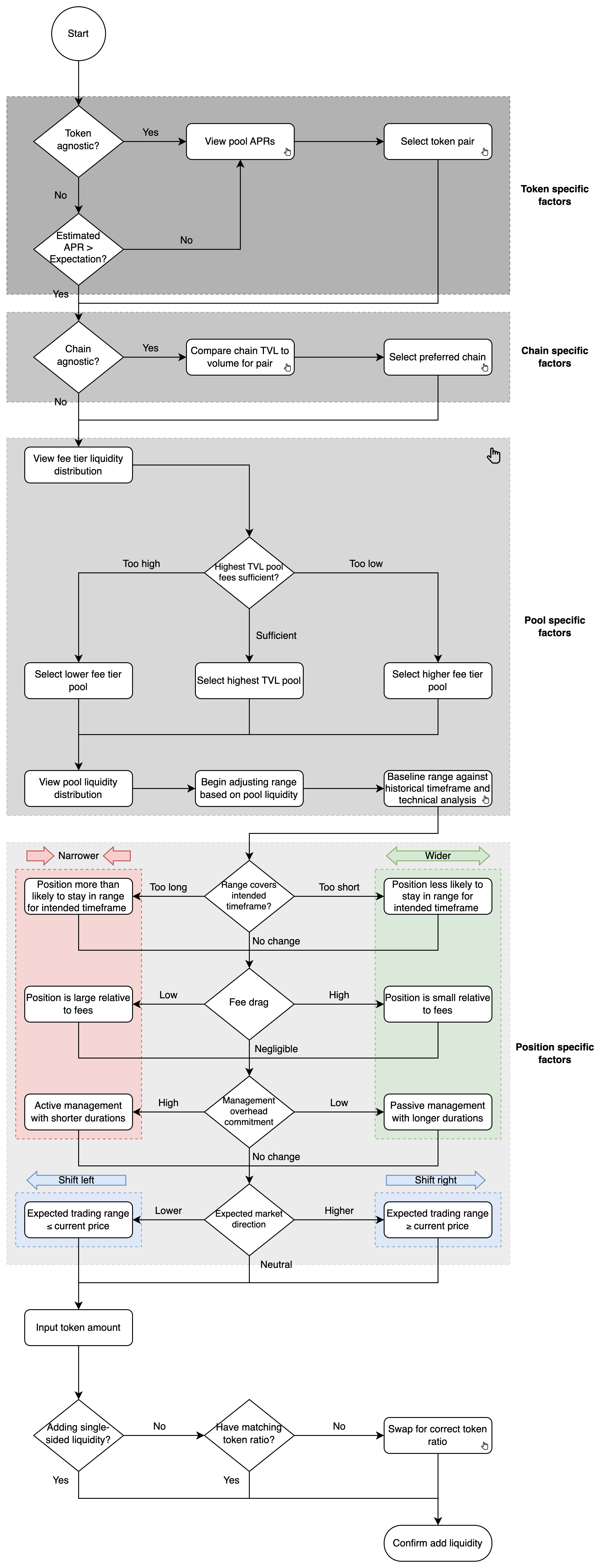

Demystifying Range Selection Through Simple Steps

Having previously covered the concepts as well as practical effects of position range choices on LP returns, this post summarizes all the learnings into an easily accessible flow chart. Through progressively stepping through this process flow, LPs can gain a better appreciation of each of the factors that goes into determining the best position range based on their personal preferences.

If in doubt, readers can always refer back to Part 1 to view the trading fee mechanism as well as the various decision factors and their corresponding risks. Additionally, the multiple real-world examples in Part 2 should enable readers to fine-tune their selected position ranges based on their risk profile.

Step-by-step Guide To Choosing The Best Range

Click Me!

Hover your mouse over steps with this icon and view quick links to the relevant KyberSwap products