Introduction

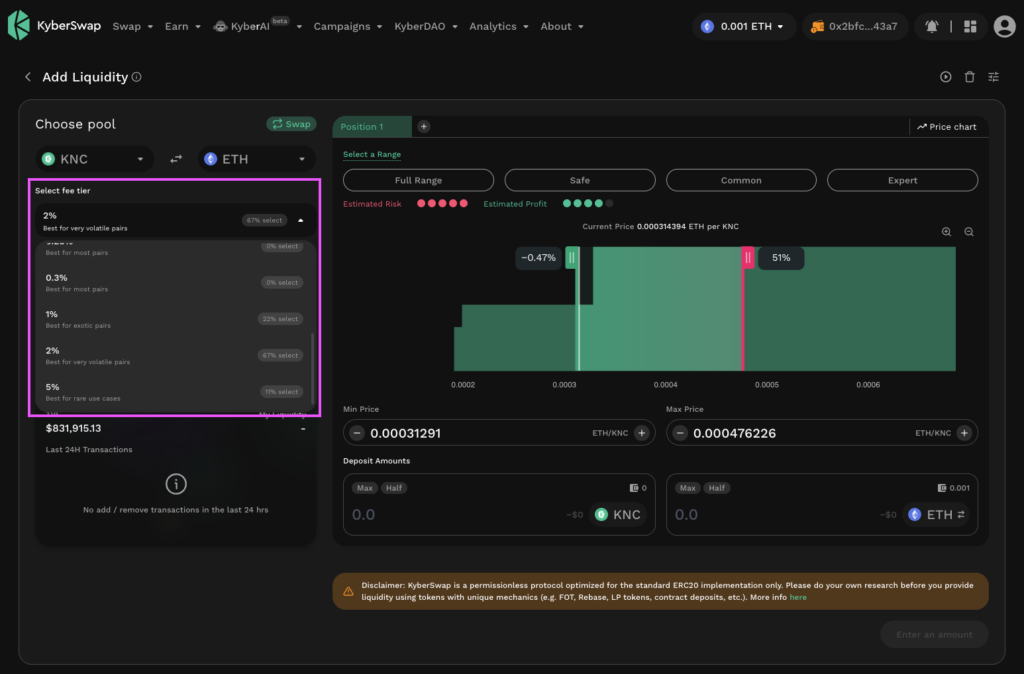

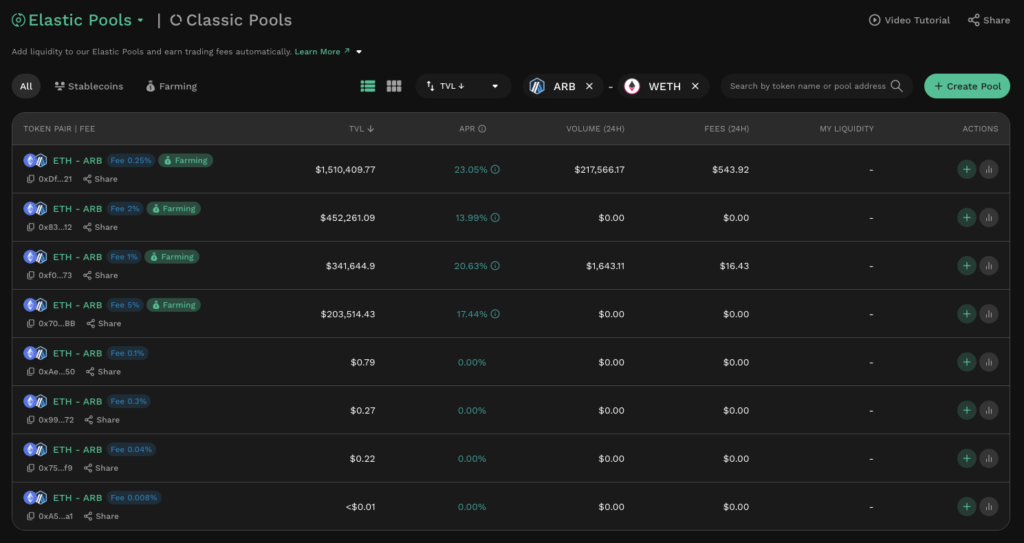

As DeFi becomes increasingly more sophisticated, liquidity providers (LPs) are also demanding more fine-grained control over the levers that impact their yield. In keeping up with this demand, protocols such as KyberSwap Elastic now enable LPs to select from 10 fee tier options ranging from the miniscule 0.008% to the eye-watering 5%. With the former requiring 625 times the trade volume of the latter to achieve the same fee amount, fee tier selection is not only a matter of personal preferences but also of market dynamics.

This article is the first half of a series exploring the impacts of fee tiers on potential LP returns:

- Part 1: Fee tiers and market dynamics

- Part 2: A practical look at selecting the best fee tier

Choosing The Best Fee Tier Walkthrough

The Liquidity Premium

As a liquidity provider (LP), one of the key decisions that you will face when contributing liquidity towards an AMM DEX is how much to charge a trader for trading against your liquidity. By providing liquidity to a pool, LPs ensure sufficient market depth (i.e. number of tokens) that traders can immediately trade against. Unlike the traditional order book model whereby market makers are able to specify the exact price at which their tokens will be sold, LPs in the AMM model specify a price range within which trades against their tokens are automated. Consequently, LPs will need to charge a liquidity premium in the form of trading fees to offset their market making risks.

The majority of DEXs provide LPs the option to select a fee tier at the point of pool creation. The fee tier specifies a percentage fee for every swap that takes place against the pool and hence acts as a trade premium which is paid to the LP. For example, a USD1,000 trade against a 1% fee tier pool means that USD10 goes to the LP as a market maker fee for facilitating the trade. Remember that for AMM swaps, the trade is always immediate (i.e. a market order) and hence the trading fee is effectively also a convenience fee which many traders are willing to incur. Nonetheless, the higher the trading fees, the less likely that trades will be routed via that pool if traders are able to source better rates (i.e. via aggregators like KyberSwap Aggregator).

Note that multiple pools with varying fee tiers can coexist for the same token pair. While a specific fee tier might command the bulk of a token pair’s liquidity, there might be specific reasons why individual LPs might want to select differing fee tiers. This might range from a belief that their selected fee tier will outperform the majority or as an alternative strategy such as earning fees while performing gradual buy/sells with positions (i.e. DCA positions).

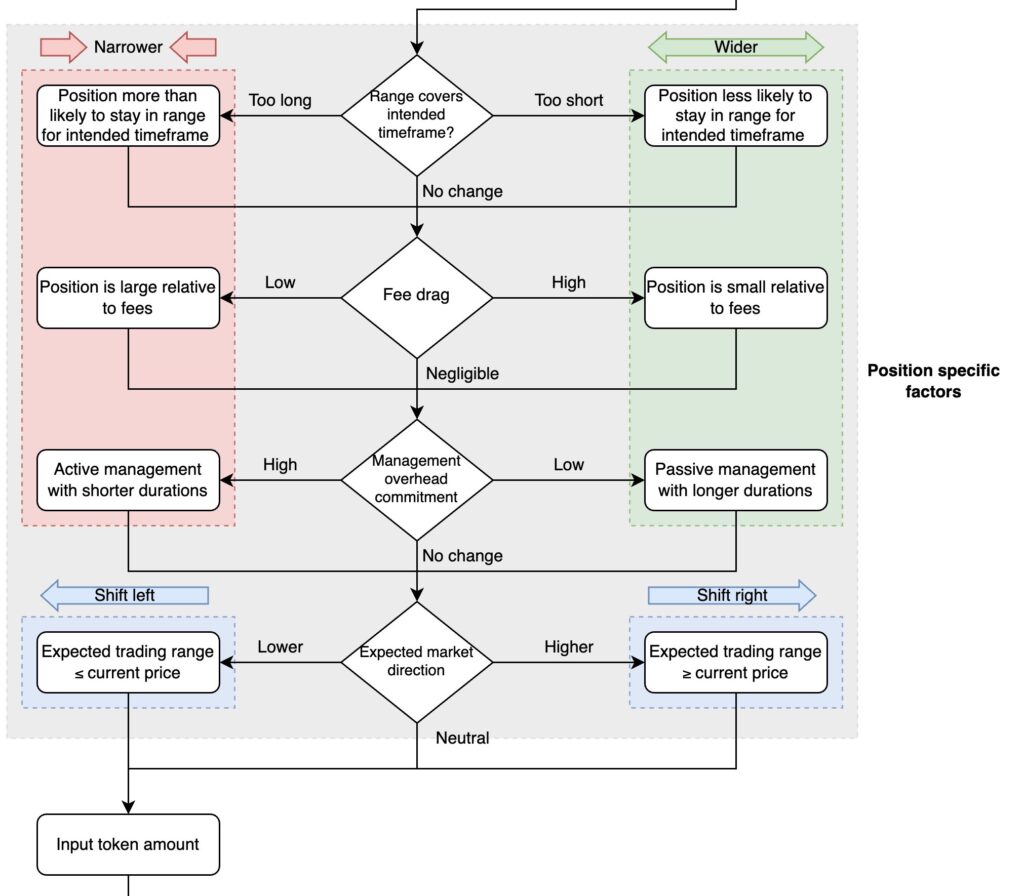

Having covered how to select an optimal price range previously, this article focuses on selecting the right fee tier to complement the selected price range. For the purposes of this article, we will ignore how trading fees are proportionally distributed between LPs and instead concentrate on the fees earned for every dollar of liquidity contributed. You can refer to the previous article on the Trading Fees Distribution for further details on the mechanics of how AMM distribute fees.

Additionally, although a minority of protocols such as KyberSwap Classic implement dynamic fees, we will assume that trading fees are fixed upon pool creation to simplify the concepts covered.

The Trading Fee Market

The fee tier is the most straightforward configuration which directly impacts a LP’s returns. For every trade that utilizes the LP’s tokens, the LP will receive a percentage cut of the trade volume as per the fee tier configured for the pool. With all else being equal, traders will always want to trade against the pools with the lowest fee tier to minimize the trading fees incurred. As such, pools with lower fee tiers will likely experience higher trade counts as compared to pools with higher fee tiers.

As a result of this trading fee dynamics, LPs must therefore find the sweet spot between fee tiers and trade volume. A LP’s returns is a function of the total trade volume facilitated multiplied by the fee tier. Hence, LPs are more concerned about trade volume rather than facilitating the most number of trades. The two examples below highlights this fact:

- A 0.1% fee tier pool which facilitates ten USD100 trades, would result in the LP earning USD1 in trading fees. That is, USD1,000 of trade volume went through the pool and 0.1% of the trade volume went to the LP.

- A 1% fee tier pool which experienced a single USD1,000 trade, would result in the LP earning USD10 in trading fees. That is, USD1,000 of trade volume went through the pool and 1% of the trade volume went to the LP.

To select the best fee tier, LPs must therefore also be aware of how the trading fees will affect the distribution of trade volume.

Trading Fees & Bid-Ask Spread: A Trader’s Perspective

While trading fees are definitely a major factor for traders, what is undeniably more important is the availability of tokens when executing a trade. It doesn’t matter if a lower trading fee is charged if there is insufficient liquidity for the trade. This, in a nutshell, is also why more exotic pairs are able to command higher liquidity premiums as their market depth is significantly more constrained.

Traders using market orders via AMM DEXs are therefore exposed to both the following risks:

- Price impact: The more tokens demanded by a trade, the higher the average price per token as tokens will have to be sourced further and further from the market price.

- Slippage: Changing market conditions during the execution of the trade could result in a difference between the expected and final price of a trade.

Price impact is particularly important in this context as such trades must be compared against their order book counterparts. In the traditional limit order model, there always exists a bid-ask spread whereby there is a difference between the highest price a buyer is willing to pay versus the lowest price a seller is willing to accept. For traders who require the token immediately, they have the option to execute a limit order at the asking price or conduct an AMM swap at the pool’s current price. If the price deviation between the pool price and the limit order asking price is greater than the trading fees, traders will get more tokens from swapping with the pool.

Critically, in the AMM model, liquidity is proportionally distributed across a price range according to the pool’s pricing curve. This means that tokens can be sourced across the whole price range with no liquidity gaps as per the order book model. For every additional token required for a trade, the AMM model is able to incrementally source tokens while limit order asks tend to grow exponentially and in a staggered manner from the lowest ask price.

Given the above, traders with high volume trades with a correspondingly large price impact might benefit from choosing the AMM route for a trade. The trading fees in this case will be compared against the relatively higher price impact which the trade would have incurred from a limit order trade. Note that limit orders also implement their own form of trading fees which might further skew the decision.

Market Volatility And Impermanent Loss

As volatility is a well-known aspect of the crypto space, the fixed trading fees must also take into account the bid-ask spread during times of extreme volatility. Put simply, LPs are unable to modify the trading fee premium in times of increased volatility where the risks of impermanent loss are higher. When markets are relatively volatile, makers tend to adjust their limit order asks accordingly and therefore the bid-ask spread tends to widen. Seen from a taker’s point of view, this makes AMM swaps an even better proposition which comes at the expense of the LP.

By providing liquidity to a pool, LPs consent to their tokens being automatically traded by the smart contract whenever a trader initiates a trade. Note that LPs are always on the short-end of the trade whereby a trader will swap the less valuable token in exchange for the LP’s more valuable tokens. For example, in an ETH to USDC swap, the trader provides ETH to the LP (via the smart contract) in exchange for the LP’s USDC. The final outcome of the trade results in ETH being worth less after the trade (i.e. that is why selling a token results in a price decrease). As LPs are unable to control this aspect of the trade, the trading fees charged must also cover the increased impermanent loss risks during times of extreme volatility.

Trading Fees, Pool Price, And Market Price

One easily overlooked aspect of trading fees is how it tends to affect the pool price relative to the market price. The estimated price which a trader pays for a trade is equivalent to the pool price plus the trading fee. As such, the fee tier directly affects the extent to which the estimated final price will exceed the current market price. For example, if the pool price for ETH-USDC 1% fee tier pool is 1ETH:2,000USDC, the trader will have to pay 2,020USDC to purchase ETH from the pool (assuming fees are charged from amountIn). Whether this trade makes sense depends on the market price relative to the estimated final price.

Based on the above, we can safely assume that the pool price for higher fee tier pools will tend to lag lower fee tier pools which in turn lags the market price. That is, traders will not trade against higher fee tier pools until all the other cheaper options have run out. This dynamic significantly affects a pool’s trade volume because the pool will fail to attract any trades as long as the pool’s price plus trading fees continue to be outside the actively traded price. Taking the same example above, if the ETH market continues to trade sideways between the ranges of 1,990-2,010USDC, the 1% ETH-USDC pool would not have seen any trades while a 0.1% ETH-USDC pool would have experienced a significant number of trades (the ~2USDC trading fee is more than covered by the changes in market price).

The best fee tier is therefore also dependent on the relative volatility of the selected token pair. A 1% fee tier for stable or highly-correlated pairs (i.e. USDC-USDT, ETH-stETH) would result in the LP just incurring gas fees without any returns. However, the same 1% fee tier for highly volatile pairs (i.e. stables against exotic tokens) might result in significant returns during periods of elevated volatility.

Conclusion

Having covered the relationship between fee tiers and market dynamics, you should now have a greater appreciation as to the outsized impact fee tier selection has on potential LP returns. DEXs are giving LPs more autonomy over fee configurations but without proper context, selecting a higher fee tier will only result in wasted gas fees. The higher the fee tier, the higher the liquidity premium which traders must be willing to incur to execute a market order against the pool. Such willingness will be dependent on the market depth with more exotic tokens commanding higher premiums.

Token specific factors aside, a LP’s yield will be directly proportional to the trading volume facilitated by the selected pool. Trades will only be directed to the pool when the market price deviates from the pool price by more than the configured fee percentage. This means that for less volatile pairs, trades will rarely be routed via higher fee tier pools. Trades will always be executed against lower fee tier pools first but LPs will adjust their expected premiums according to the expected impermanent loss risks.

The next half of this series will put these concepts into practice by creating positions of similar widths across pools with varying fee tiers. Through tracking these positions over the course of a week, you will be able to see how the aforementioned concepts materializes into real yield. This will hopefully provide you a stronger foundation when deciding on an appropriate fee tier for your position.