World’s 1st Dynamic Market Maker: Automated market making with greater flexibility and extremely high capital efficiency

UPDATE: DMM has now rebranded to KyberSwap.com! Learn more.

After months of extensive research, we are very excited to unveil the mainnet beta release of the long-awaited Kyber Dynamic Market Maker (DMM) protocol! Starting from today, any liquidity provider can make optimal use of idle tokens by adding them to KyberDMM pools, while any taker (e.g. Dapp, aggregator, or end user) can access this liquidity.

Kyber previously established the first liquidity aggregation protocol and on-chain endpoint in DeFi, as well as the KyberPRO framework catered to professional market makers. KyberDMM is a novel liquidity protocol specially designed for retail liquidity providers and token teams, and is the first of many new protocols that will be launched on the Kyber 3.0 liquidity hub

This launch marks a new era for DeFi, where open, permissionless liquidity contribution is coupled with extremely high capital efficiency and flexibilityfor the very first time. Advantages of the KyberDMM include:

1. Amplified pools with extremely high, if not the highest capital efficiency possible when compared to AMMs.

2. Lower trade slippage due to high capital efficiency.

3. Dynamic fees to optimize returns for liquidity providers and reduce the impact of impermanent loss.

4. No third-party or centralized oracle risks.

If this is your first time hearing about KyberDMM DEX, this video will bring you up to speed:

Visit the KyberDMM DEX beta at dmm.exchange

Using the KyberDMM beta

When developing the KyberDMM beta, we were inspired by the intuitive and user-friendly interface of the popular AMM Uniswap, so users should find certain operations such as swapping tokens and the protocol analytics page very familiar. However, there are a few important differences that we will highlight below. We also plan to further innovate on the UI in the near future so that it is tailored-made for the new, unique features of KyberDMM.

For Liquidity Providers

1. Adding Liquidity to an Existing Pool

As a liquidity provider, depositing assets into KyberDMM allows you to maximize the utilization of your capital.

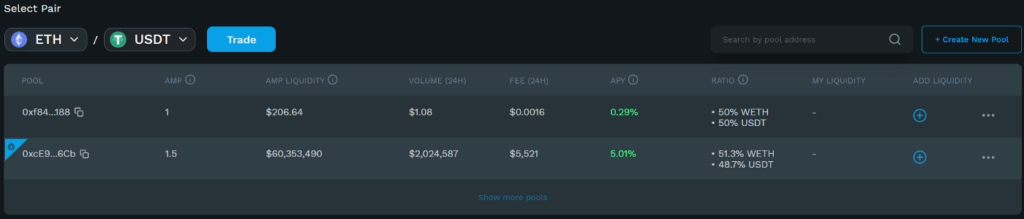

You can add liquidity by first entering the ‘Pools’ tab before selecting the token pair that you want to add liquidity for. The list of available pools for that pair will be displayed and each pool has important information categorized by Pool, Ratio, Liquidity, Volume, Fee, AMP, 1Y F/L, My Liquidity etc. If there are no available pools for that token pair, you are able to create a new pool.

- AMP: Amplification Factor. Higher AMP, higher capital efficiency within a specific price range. This means that given the same liquidity pool and trade size, Kyber DMM can provide much better liquidity and slippage compared to AMMs. Slippage can potentially be 100–200X better than AMMs for more stable pairs! Higher AMP is recommended for more stable pairs (e.g. USDC/USDT, sETH/ETH), lower AMP for more volatile pairs. AMP=1 pools are basic pools with dynamic fees but no amplification. For most non-stable token pairs, an AMP of 1.15–1.3 is recommended .Pool creators have to set the AMP factor for each pool in advance, and liquidity providers can then choose which pool they want to deposit tokens in based on the AMP.

- AMP Liquidity: Amplified Liquidity = AMP factor x Token inventory available in the pool. Equivalent TVL compared to typical AMMs.

- Volume (24H): 24H Trade volume executed through the selected pool.

- Fee (24H): Fees collected in 24H for liquidity providers from trades executed through the selected pool.

- APY: 1 Year Collected Fees divided by Pool liquidity, based on 24H volume annualised. This metric can also be viewed as the pool’s return on liquidity.

- Ratio: Current ratio for the token pair in the selected pool. Liquidity providers have to add liquidity according to this ratio. This ratio starts at 50–50 but will change over time as trades are performed through the pool.

- My Liquidity: If you have added liquidity earlier, it will be shown here.

- Add Liquidity: Click the + button next to the pool of choice to begin adding liquidity to earn dynamic fees. After adding liquidity, you will receive transferrable DMM-LP pool tokens representing your pool share. Fees earned as a liquidity provider can be automatically claimed when you withdraw your liquidity later.

- Migrate Liquidity: There is a simple liquidity migration page if you wish to quickly migrate your liquidity residing in external platforms (e.g. Uniswap, Sushiswap) to the KyberDMM.

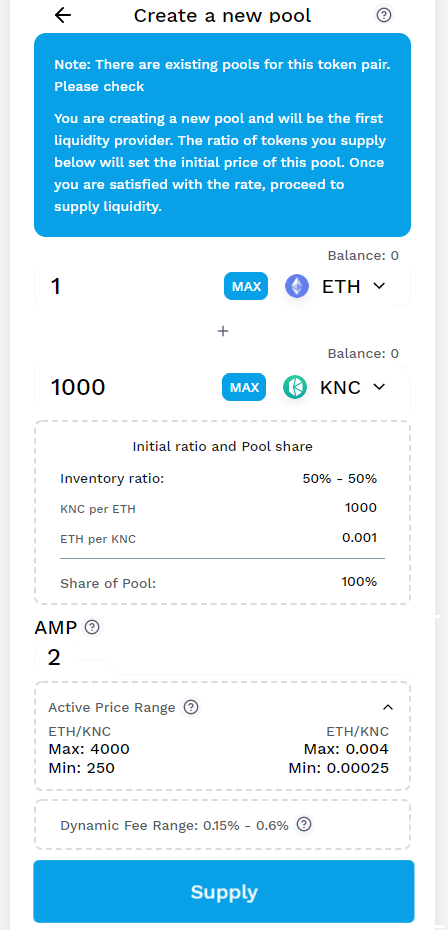

2. Creating a New Pool

Multiple pools with different AMPs can be created for the same token pair. To create a new pool in less than 5 minutes, click Create New Pool. As a pool creator, you can customize your programmable pricing curve with a specific amplification (AMP) factor to create amplified pools that support highly capital-efficient liquidity contributions for any token pair. Higher AMP, higher capital efficiency within a tighter price range.

The ratio of the tokens you add will set the initial price for this pool, so make sure you add an appropriate ratio of tokens while keeping in mind the market price for the token pair.

Active Price Range: This is the active/tradable price range of the token pair in that particular liquidity pool. When you increase the AMP to a factor >1, capital efficiency for the pool increases, but the active/tradable price range will also change and this can be seen on the UI. For most non-stable token pairs, an AMP of 1.15–1.3 is recommended .If the pool has AMP=1, it is a basic pool with dynamic fees but no amplification. Active price range for AMP=1 pools has no limit (0 to infinity). If the price goes above or below the range, the pool may become inactive.

Dynamic Fees: Each liquidity pool will earn dynamic fees. Fees increase during high market volatility and decrease during low market volatility to encourage trading and volume. Overall, this optimizes potential returns for liquidity providers and bears similarities to how some professional market makers operate to get the most returns out of their trades. The dynamic fee range (dynamic fees given to liquidity providers) will change depending on the AMP used for pool creation.

After different pools are created, additional liquidity providers can then choose which pool they want to deposit tokens into after looking at the AMP and other important details.

For Traders

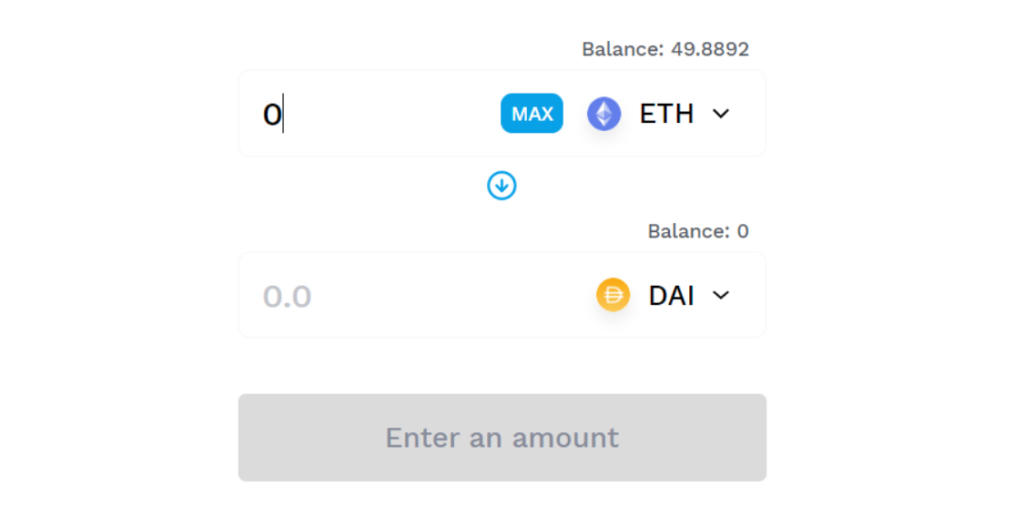

Drawing liquidity from its pools, the KyberDMM DEX allows anyone to swap between tokens on the ‘Swap’ tab.

KyberDMM will automatically go through all the liquidity pools available and find the pool with the best price (that can also support the trade size). It is possible for traders to enjoy lower slippage due to much higher capital efficiency when trades go through amplified pools.

KyberDMM Analytics Page

We have also prepared a protocol analytics and tracker page for users to easily track the available token pairs, present liquidity, trading volume, and other important statistics.

Read about KyberDMM’s role in Kyber 3.0 here.

Building with Kyber DMM

Developers can start building on KyberDMM right away! Any taker can access the liquidity available on the various pools. Due to KyberDMM’s programmable curves and dynamic fees, liquidity providers automatically enjoy greater flexibility, higher earnings potential, and extremely high capital efficiencynot possible in typical AMMs.

We encourage all DeFi wallets, Dapps, aggregators, and end users to integrate the DMM for their liquidity needs given its immediate and potential benefits. Integrating directly with the KyberDMM instead of the main Kyber Network liquidity endpoint also enables Dapps to potentially save a substantial amount of gas.

All the necessary documentation can be found here http://docs.dmm.exchange/and you can ask questions on our Discord or forum.

Commitment to Security

Kyber has always maintained a high standard of smart contract security for all of its protocols and initiatives, and its liquidity infrastructure has facilitated close to $5 Billion worth of trading volume for thousands of users since 2018. The new KyberDMM protocol will likewise enjoy the same level of security and reliability.

The codebase has been reviewed and audited multiple times by both the team and external auditors such as Chain Security with no critical issues found, and the codebase remains open source on Github for community developers to review.

As an additional safeguard and a sign of our commitment towards security, KyberDMM is covered up to $20 Million by decentralized insurance provider Unslashed Finance and we have an ongoing DMM Bug Bounty program.

What’s Next?

We are very grateful to our passionate community for their support for the KyberDMM protocol launch! Please note that the protocol is still in beta and the number of tokens available will still be low at launch. We welcome more feedback to further optimize the UI and operations to ensure a seamless swapping, liquidity contribution, and liquidity sourcing experience.

Everyone in the Kyber community is encouraged to join our governance forum at gov.kyber.org to share their feedback as well as ideas on how to boost liquidity on the KyberDMM.

Given the KyberDMM’s enhanced flexibility and capital efficiency, we believe it will soon be a critical liquidity source for a wide variety of DeFi use cases. We look forward to watching the KyberDMM flourish as a key component of Kyber Network’s path towards being a sustainable liquidity infrastructure for DeFi.

UPDATE: DMM has now rebranded to KyberSwap.com! Learn more.

About Kyber Network

Kyber Network is building a world where any token is usable anywhere. KyberSwap.com, our flagship Decentralized Exchange (DEX), provides the best rates for traders in DeFi and maximizes returns for liquidity providers.

KyberSwap powers 100+ integrated projects and has facilitated over US$7 billion worth of transactions for thousands of users since its inception. Currently deployed across 11 chains including Ethereum, BNB Chain, Polygon, Avalanche, Fantom, Cronos, Arbitrum, Velas, Aurora, Oasis and BitTorrent.

KyberSwap | Discord | Website | Twitter | Forum | Blog | Reddit | Facebook |Developer Portal | Github |KyberSwap| KyberSwap Docs